Nvidia, the world’s biggest company, has revealed its sales are soaring — a huge boost for the wider US economy, Wall Street and Americans’ retirement savings.

The chipmaker, which has been the engine of the AI boom and a key driver of the market’s rally, delivered another blockbuster quarter that reassured investors the tech surge is still intact.

The company reported $57billion in sales, when analysts expected $54.9billion.

Profit was $31.9billion, up 65 percent compared to the same quarter last year. It’s up 245 percent in the past two years.

Shares soared five percent in minutes, as CEO Jensen Huang boasted that ‘sales are off the charts,’ before after-market trading brought the stock price to around three percent.

Nvidia’s earnings had been touted as a market-moving event unlike almost anything else in recent corporate America.

The $5trillion chipmaker supplies about 90 percent of the physical tech that powers America’s artificial intelligence boom.

‘There’s been a lot of talk about an AI bubble,’ Huang said on Wednesday. ‘We see something very different.’

Nvidia boss Jensen Huang has promised explosive AI growth — but Wall Street is bracing for a violent reaction to Wednesday’s results

Its quarterly numbers routinely influence the direction of the entire US stock market.

This year, major indexes have relied heavily on companies investing in AI. Nearly 30 percent of the S&P 500 index is concentrated in five companies: Nvidia, Microsoft, Apple, Amazon and Google’s parent Alphabet, according to CNBC.

That reliance has worried some investors. The big swings could make the entire US market extremely volatile.

Before the earnings release, options markets predicted Nvidia’s share price would swing 6.4 percent — a move worth $280–$300billion, according to data cited by the Financial Times.

That would have been one of the biggest single-day reactions in corporate history.

But it doesn’t matter today: Nvidia’s earnings, buoyed by $500billion in chip orders in the next two years.

Data centers generated $51.2billion.

‘Blackwell sales are off the charts, and cloud GPUs are sold out,’ Huang said. ‘Compute demand keeps accelerating.’

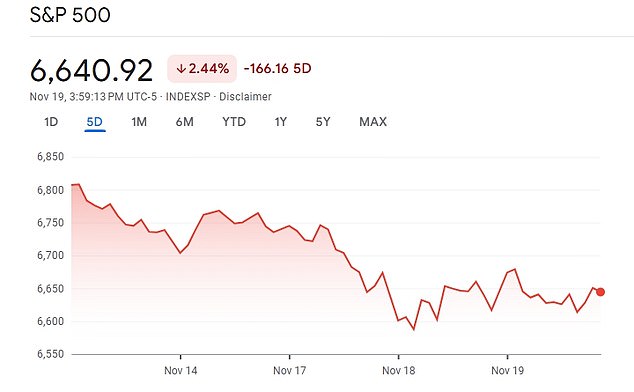

The S&P 500 has fallen over the past week. A falling S&P 500 matters: the index underpins most 401(k)s and pension funds, meaning this week’s slump directly affects Americans’ retirement savings – but Wednesday’s Nvidia earnings could turn the market around

Expectations have become a burden for the gigantic company. Nvidia has beaten estimates repeatedly over the past year, pushing investors to demand ‘perfect’ results every time.

Mike Zigmont, co-head of trading at Visdom Investment Group, warned the FT: ‘Prices went too high to justify. If Nvidia delivers disappointing guidance, the market is going to sink significantly.’

Despite its explosive growth, Nvidia’s stock has fallen around 11 percent in recent weeks as the broader AI rally cools.

Tech giants like Meta, down 19 percent this month, and Oracle, down 20 percent, have been hammered too, suggesting investors may be reassessing whether Silicon Valley’s AI spending spree is sustainable.

Nvidia isn’t just another tech company. It has been the single largest contributor to the stock market’s gains this year, part of the so-called ‘Magnificent Seven’ that lifted the S&P 500 to repeated highs.

Roughly half of the index’s rally in 2024 has come from a handful of AI giants — meaning if Nvidia stumbles, markets lose their main engine of momentum.

The Nasdaq has already fallen more than 4 percent over the past week, with traders warning that sentiment has shifted into what analysts call ‘extreme fear.’

Nvidia may take center stage today, but Walmart’s numbers and the jobs report tomorrow turn this into a triple whammy of crucial economic signals.

This is a breaking news story. Updates to come.