Finally, after long delays, an unnecessary bidding competition and division inside government, Rolls-Royce has received the go-ahead to build a new generation of small modular reactors (SMRs).

Almost a decade has passed since a team of Rolls’ engineers visited the Daily Mail’s City office to make the case for a new generation of smaller, British-made nuclear reactors.

It planned to use the tried-and-tested turbines which power UK submarines.

The Rolls-Royce design was innovative, would be infinitely cheaper than the super-reactor being built at Hinkley in Somerset and now destined for Sizewell C in Suffolk, and would be flexible.

The reactor could be constructed on, or near, the sites of Britain’s fading nuclear fleet or close to where reliable baseload power would be needed.

No one quite knew at the time that the climate change agenda and demand for data centres to power AI and the digital economy would catapult SMR technology to prominence.

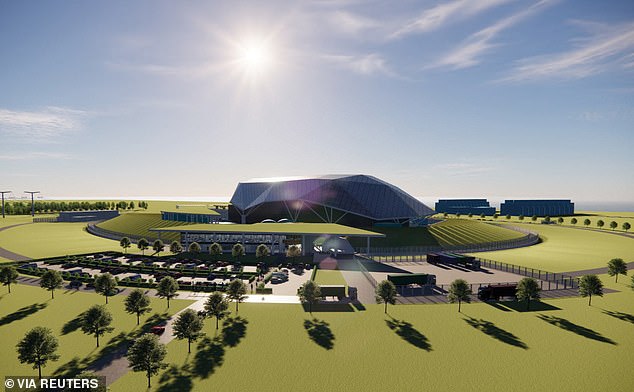

Powering up: A Rolls-Royce design for a small nuclear reactor. The company has been given the go-ahead to build the devices, which are based on its submarine technology, for the UK

Rolls has been straining at the leash to pursue a technology that could transform British industrial capability and exports with a potential market of $250billion to $400billion by 2035 to 2040.

As the sand slipped through the egg-timer over the last several years, the world’s other big electrical engineers woke up to the potential. Westinghouse of Canada (sold off by Gordon Brown), GE-Hitachi and British rival Holtec moved into the territory.

Bizarrely, Rolls-Royce was kept waiting while the UK conducted an open auction, giving rivals the opportunity to play catch-up.

While Britain sat on its hands, the Czech Republic became the first major customer for SMRs made by a Rolls-Royce consortium.

Only now have licences and some £2.5billion of support been provided for three pioneering modular reactors in the UK. Since Labour came to office, the Energy Secretary Ed Miliband and Great British Energy have been focused on windfarms and solar power, to the detriment of everything else.

Britain’s fading nuclear capability meant we were stuck with a power system dependent on the wind blowing, the sun shining and still undeveloped fuel cell storage capacity.

It is to the credit of the Government, and one suspects Keir Starmer’s obsession with big tech, that SMRs are being embraced along with a second super-reactor to be built by France’s state-owned EDF.

The opportunity for Rolls in the UK and overseas to create a new business to sit alongside its Trent family of aerospace engines and defence capabilities is enormous.

The thirst for electric power by Google, Amazon, Apple and Bitcoin miners, among others, is unrelenting. Several contracts, with UK makers, have already been signed by the Silicon Valley giants.

New nuclear has zero carbon emissions but decommissioning and waste are still big unresolved issues.

Nevertheless, the volumes of spent fuel from new generation modern reactors is a fraction of their late 20th century forbearers.

Rolls-Royce shares (which I hold) have been on a tear since chief executive Tufan ‘Turbo’ Erginbilgic has been at the helm.

The shares are up 690 per cent over the last five years placing a value on the group of £75.6billion defying dissonance with London listings. Wow.

Comeback kid

The long haul back for Marks & Spencer after the cyber-attack has taken a significant step. Shoppers will again be able to access fashion items such as clothing for home delivery.

They will have to be a little more patient if they want beauty products or homeware. Food has been less of a problem as deliveries are already in the hands of Ocado through what, until now, has been a fraught joint venture.

There can be few causes for cheer in something so disruptive which has cost an estimated £300million, undermined consumer confidence in the security of personal data and asserted downward pressure on the shares. Before the attack, M&S was on an upward trajectory.

The cyber shock should assist chief executive Stuart Machin in overcoming executive complacency about progress. Having taken the opportunity to update sclerotic systems, it is quite possible that with a following wind it will come back stronger.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.