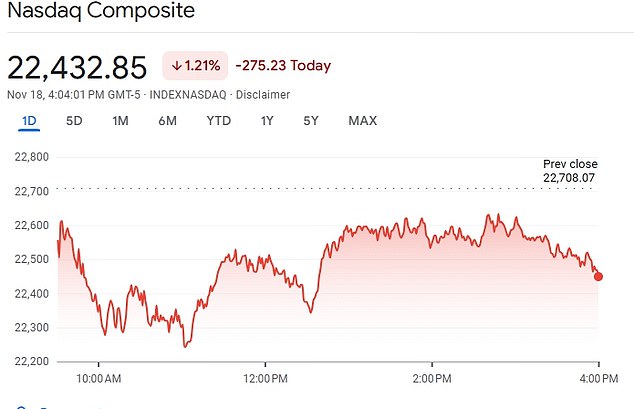

Wall Street has extended its rut into a fourth straight day.

On Tuesday, all three major indexes were about one percent in the red, as traders with significant stakes in tech and consumer stocks clenched their jaws ahead of this week’s pivotal earnings calls.

Nvidia, the world’s only $5trillion company, reports its financial results on Wednesday. Target and Walmart will also post their numbers this week, after The Home Depot disappointed on Tuesday.

The scuttlebutt in New York is that companies are seeing earnings reduced by high interest rates, tariffs and a slowdown in consumer spending. Those rumors have tipped the market into ‘extreme fear.’

And the whispers are turning into serious warnings. Big-name investors like Warren Buffett, Masayoshi Son and Michael Burry are already making defensive moves to protect their gains.

But should less plugged-in consumers follow their lead and sell off investments and their 401(k)s?

To answer that, the Daily Mail reached out to dozens of investment analysts to get a finger on the pulse of today’s market and figure out what worried, casual traders should do to protect their earnings.

Here is what they told us.

Stocks dipped again early morning Tuesday as investors continued to worry about an AI bubble and consumer spending

Investor worries turned up after The Home Depot posted lower-than-expected sales growth and said customers are slashing spending instead of renovating their homes

‘Do nothing’

Analysts say it’s best to leave your investments alone, even when they dive into the red.

‘A 401(k) investment is a long term strategy, so do nothing,’ Meredith Whitney, a financial analyst dubbed the ‘Oracle of Wall Street’ by Bloomberg, told the Daily Mail. ‘I take market dips as an opportunity to buy stocks you’ve been looking at for a long time when they’re weak.’

Take, for example, the Nasdaq this past April.

Following President Donald Trump’s larger-than-expected reciprocal tariff rates, companies across the US saw their stocks plummet while top executives calculated a massive new tax they’d have to pay.

The Nasdaq dropped nearly 10 percent in just four days.

But since the tumble – and as the federal government pared back the levies – the tech-heavy index has skyrocketed, adding more than 16 percent to its value. Anyone who sold their stock in April missed out on the record-setting gains.

‘Volatility is the price of admission when investing in stock markets,’ Isaac Stell, an investment manager at Wealth Club, told the Daily Mail.

‘The most effective strategy for long-term investors is usually to do nothing.’

Meredith Whitney (pictured), dubbed the Oracle of Wall Street, told the Daily Mail that long-term investors shouldn’t touch their stocks: ‘do nothing’

For the most part, investors are still largely optimistic about Wall Street’s months-long momentum, and view this week’s rough patch as a healthy correction.

‘Not all hope is lost,’ Bret Kenwell, an investment analyst at eToro, told the Daily Mail when assessing the tech stock drops.

‘After such a stellar run over the past two quarters, a breather not only makes sense but should be viewed as a welcomed dip for sidelined investors.’

The tricky question of AI

Still, even the most optimistic traders acknowledge that the market’s strength rests on a narrow foundation.

This year, major indexes have relied heavily on companies investing in AI. Nearly 30 percent of the S&P 500 index is concentrated in five companies: Google’s parent Alphabet, Nvidia, Microsoft, Apple and Amazon, according to CNBC.

Many of those companies are making enormous bets on firms with astounding amounts of debt and limited revenue – like OpenAI or CoreWeave – to build the cloud-computing infrastructure and large-language models that run AI.

The incredible debt and limited revenue have worried investors about a potential popping of the bubble, much like the dot-com bust in the early 2000s or the housing crash in 2008.

But few see those risks tipping the market toward an immediate crash.

Steve Eisman (pictured), a famed investors and part of the crew that inspired The Big Short, said talk about a tech bubble is overstated: ‘AI is already delivering’

The tech-heavy Nasdaq has shed another 1.2 percent on Tuesday, extending a four-day losing streak

Bret Kenwell (pictured), an investment analyst at eToro, said recent wobbles in the market are healthy

Advice to leave your stocks alone mirrors that of Steve Eisman, a former portfolio manager at Oppenheimer & Co and Neuberger Berman, who was made famous when Steve Carell portrayed him in The Big Short.

Eisman made millions after betting that the housing market would crash. He doesn’t see a similar crash coming to stocks today.

‘Look at the speed of adoption of ChatGPT, which reached 800 million users in only three years,’ he previously told the Daily Mail. ‘The internet took 13. AI is already delivering.’

If 401(k) holders need to make any moves at all, Georgia Lord, head of financial planning at Corbett Road Wealth Management, said dips are the perfect time to add diverse stocks to investment portfolios.

‘It’s a little harder for those that maybe have just retired and are getting hit with this downfall now,’ she said.

‘But for those that are looking to stop working in the next few years, I really encourage them if they are not already working with a professional, to at least have an introductory conversation and get some advice.’

The mirage of big-spender generations

But even as analysts debate strategy, Whitney flagged a deeper trend she believes is quietly dragging on the market: the so-called Avocado Toast generation.

Around 42 million younger millennials and older Gen-Z Americans owe more than $1.8trillion in student debt.

During the Covid pandemic, payments toward that debt were largely paused, giving that generation an extra $200 to spend at restaurants like Chipotle, Cava and Sweetgreen, she said.

‘I think that was a big driver of spending,’ she told the Daily Mail.

‘Businesses fell for the mirage in the desert that this cohort was a stronger spending group than they turned out to be.’

This year, all three companies have seen their stocks crater further than the rest of the economy. Since January, Chipotle is down nearly 27 percent, Cava has lost 61 percent, and Sweetgreen has shed about 82 percent.