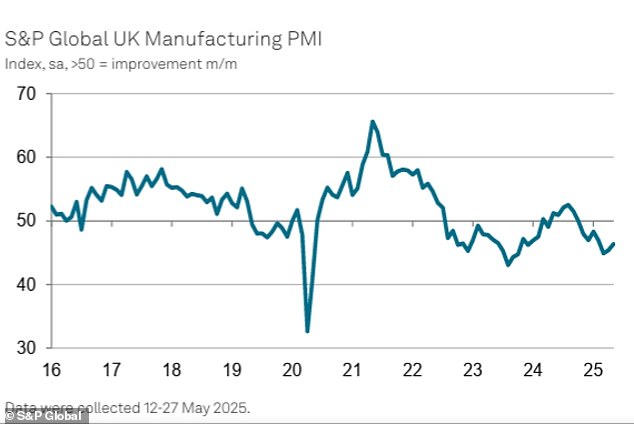

Britain’s manufacturing industry continued to shrink in May, although the rate of contraction improved.

The closely watched S&P Global UK Manufacturing Purchasing Managers’ Index (PMI) gave a reading of 46.4 for May.

While this was higher than the 45.4 recorded in April and the provisional estimate of 45.1, it was below the neutral 50 threshold for the eighth consecutive month.

S&P Global said the British manufacturing industry was affected by a mix of subdued global demand, volatile trading conditions, and rising cost pressures, which hit output, new orders, new export business, and employment.

Manufacturing production shrank for the seventh consecutive month amidst reduced new work volumes from both domestic and overseas clients.

At the same time, new business fell for the eighth successive month due to a ‘general reluctance among clients to commit to new contracts’.

Improvement: The S&P Global UK Manufacturing Purchasing Managers’ Index (PMI) gave a reading of 46.4 in May, higher than the 45.4 recorded in April

S&P said clients were partly reluctant to spend money following the UK Government’s recent hikes in National Insurance contributions and minimum wages.

In early April, employers’ NI contributions rose from 13.8 per cent on salaries above £9,000 to 15 per cent on annual salaries exceeding £5,100.

The National Living Wage also increased by 6.7 per cent to £12.21 per hour, while the hourly National Minimum Wage for 18 to 20-year-olds jumped by 16.3 per cent to £10.

Rob Dobson, director at S&P Global Market Intelligence, said: ‘May PMI data indicate that UK manufacturing faces major challenges, including turbulent market conditions, trade uncertainties, low client confidence and rising tax-related wage costs.

Dobson noted ‘some signs of manufacturing turning a corner’ and highlighted PMI indices on output and new orders growing over the past two months.

Yet he added: ‘Trading conditions remain turbulent both at home and abroad, making either a return to stabilisation or a sink back into deeper contraction likely during the coming months.’

President Donald Trump has upended the global trading order and caused significant uncertainty in recent months by imposing tariffs on goods entering the US.

He has put a 10 per cent universal tariff on US goods imports, a 25 per cent duty on imported steel and aluminium, and a 30 per cent levy on most products from China.

S&P said manufacturers affected by higher costs blamed tariffs, as well as freight prices, rising energy bills, and suppliers passing on costs.

It also claimed tariff uncertainty continued contributing to a decrease in new export orders while average vendor lead times expanded to their ‘greatest extent’ so far this year.

However, input price inflation still eased to a five-month low, and good weather provided a sales uplift for some manufacturers.

Mike Thornton, Head of Industrials at RSM UK, remarked: ‘While uncertainty and disruption are easing, we’re yet to see genuine signs of a rebound in activity and long-term growth.

‘With the government’s spending review and industrial strategy due this month, we’re expecting policy will clarify manufacturing’s role as a key growth-driving industry, giving businesses the clarity and confidence to make long-term investment decisions.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.