Artificial intelligence (AI) is changing our lives in a 21st century industrial revolution powered by semiconductors.

The companies that supply these vital products – which are used to make microchips – may have seemed like a danger zone for investors of late.

This view has suddenly shifted, however. Much of the change in mood is thanks to better-than-expected results from the $3.45trillion titan Nvidia.

This Silicon Valley business, which was founded as recently a 1993, is the number one name in microchips and could overtake Microsoft as the world’s largest company.

It did grab the number one slot briefly a couple of times last year, but it has been a rollercoaster ride since. Investing in the AI revolution will involve spills as well as thrills.

But Nvidia’s performance provides a persuasive reason to continue to back the radical transformation it is bringing about.

Nvidia’s revenues for the first quarter of its financial year soared by 69pc to $44bn.

The numbers suggest that geopolitical tensions and alarm around investors over Donald Trump’s trade war are being outweighed by the global clamour for microchips.

Nvidia’s revenues for the first quarter of its financial year have soared by 69pc to $44bn

These are the miniature electronic circuits used in ATMs, cars, laptops, phones and much, much else. They are also key to the development of generative AI (GenAI), which can create new content.

The shock US court ruling that President Trump’s tariffs may be illegal only adds to the renewed excitement surrounding Nvidia and the rest of the sector.

The opportunities in the microchip sector may be huge. There are, however, some clouds on the horizon.

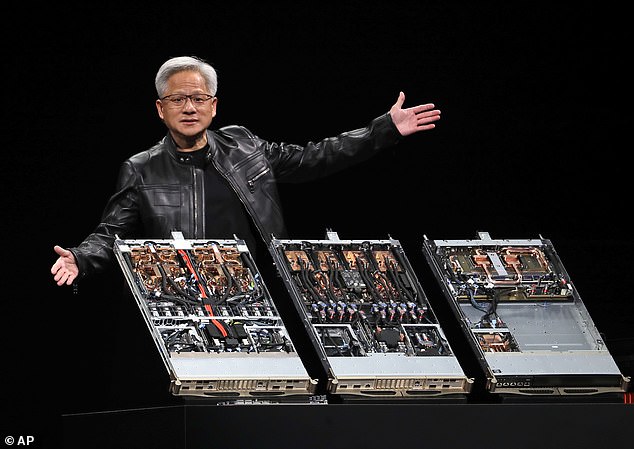

Unveiling the results, Jensen Huang, Nvidia’s chief executive – a man fond of a leather jacket and unafraid of being critical of Donald Trump – warned that curbs on exports to China may have the reverse of the desired effect and jeopardise America’s pre-eminent position in microchips.

As he remarked: ‘Export restrictions have spurred China’s innovation… and US global infrastructure leadership is at stake.’

American tech shares took a hammering earlier in the year when Chinese start-up DeepSeek stunned the AI world by taking on the US giants at what it said was a fraction of the cost. Its innovation, observers say, was hurried by being frozen out by the US: a modern version of the old proverb that necessity is the mother of invention.

This week, as Nvidia revealed its results, DeepSeek said it has upgraded its AI model to perform better.

Colette Kress, Nvidia’s chief financial officer, also pointed out that the US company has lost out to the tune of $5.5bn because of the restrictions on the sale to China of H20-type chips specifically evolved for that nation. Orders from the Middle East may compensate for some of this, however.

Huang was also upbeat about the prospect of a boom in ‘tokenisation’. A token is the unit of information that an AI programme takes in and then spews out.

Nvidia is facilitating a vast amount of this activity since it sells the GPU (graphic processing unit) chips that power Open AI’s ChatGPT – which has 800 million weekly users.

ChatGPT is routinely described as ‘game-changing’, and a statement from Nicolai Tangen – boss of the $1.8 trillion Norwegian sovereign wealth fund – explains why. This month Tangen told his staff: ‘It isn’t voluntary to use AI. If you don’t use it, you will never be promoted. You won’t get a job.’

Nvidia’s chief executive Jensen Huang is a man fond of a leather jacket and unafraid of being critical of Donald Trump

Little wonder then that David Coombs, head of multi-asset investment at Rathbones, argues: ‘Our view remains that we are only at the beginning of AI – and that demand for advanced chips will underpin growth.’

You may not have ventured yet into the microchip sector. But if you have an Isa or other savings funds, it is almost certain that you own a slice of Nivida.

This group is one of the Magnificent Seven of US tech (the others are: Alphabet, Amazon, Apple, Meta, Microsoft and Tesla) which form the basis of many such funds.

Other microchip stocks, such as AMD, ASML, Broadcom, Qualcomm and TSMC, are also widely held in popular funds.

This may be sufficient exposure to the AI revolution for you. Or you may be pondering your options. Whatever your personal portfolio, this is what you need to know now.

The companies leading the revolution

Alphabet, Amazon and the rest of the major players in tech are splashing out billions to triumph in the AI battle.

Companies in other fields are also loosening the purse strings. This spree is a compelling argument to commit some cash to the revolution.

Stephen Yiu, manager of the Blue Whale Growth fund, points out that no one knows who will triumph in this arms race – and that some of the money will be wasted.

But in the 19th century gold rush, the picks and shovels businesses were the most successful. Microchips companies are the latter-day equivalent.

Nvidia, Broadcom and TSMC are some of Blue Whale’s largest stakes. Yiu is excited by the potential of DeepSeek, the low-cost Chinese rival to ChatGPT. At the start of the year, this was seen as a threat to Nvidia.

Stephen Yiu of Blue Whale Capital is excited by the potential of DeepSeek – the low-cost Chinese rival to ChatGPT

But DeepSeek relies on Nvidia’s wares. As Yiu points out, the inexpensive Chinese system will enable many more start-ups to develop apps. This should boost Nvidia’s sales – though Trump’s protectionism will also encourage Chinese competitors, as Jensen Huang has noted.

Trump’s antics are providing buying opportunities for those brave enough to purchase on White House-induced price dips.

Coombs explains: ‘We find comfort in companies that are technology leaders, with dominant market positions and pricing power and we continue to buy more of these businesses on any Trump-related share price weakness.’

His choices include Nvidia and another Silicon Valley entity – Cadence Design Systems. Among the other holdings are two Dutch groups. First is ASM International, which is a specialist in atomic layer deposition (ALD) – a crucial process in chip making. He also holds ASML, which makes semiconductor manufacturing equipment. ASML is a top ‘WFE’ company. WFE stands for wafer-fab equipment. Apologies for the alphabet soup: acronyms abound in microchip world.

Coombs also favours the TSMC (Taiwan Semiconductor Manufacturing Company) which ‘fabricates’ the chips that Nvidia designs.

How to back the revolution

Nvidia shares have rallied from their 43pc slump in the wake of President Trump’s ‘Liberation Day’ announcement of a barrage of tariffs in April.

The shares now stand at $141.76 – 24,686pc above their level of a decade ago. Experts think they have further to go.

Brokers Morgan Stanley argue that the price could rise to $160. Wedbush, another broker, has a target of $175, arguing that forecasts for microchip market expansion are not yet reflected in the price.

AMD, a $186bn business, is regarded as a smaller version of Nvidia. The company is led by Lisa Su, who is Huang’s first cousin.

Around half of the 50 analysts that follow this stock rate it as a ‘buy’ with an average target price of $127, against the current $113.

The rest see the shares as a ‘hold’ or believe that they will outperform the market.

ASM, a company capitalised at €24bn, is considered to be a ‘buy’ by the experts. The average target price for the shares, which currently stand at €484, is €612.

As for ASML, a €262bn enterprise, it is ranked as another buy. The current price is €660, up 13pc over the past month, while the average target price is €770.

Broadcom, once better known for broadband chips, is moving fast into the AI area. Shares in the $1.1bn group have soared by 47pc over the past six months to $237, but analysts still believe Broadcom to be a ‘buy’, forecasting the shares could hit $300 if its company cloud computing division can attract more custom.

At the start of the year Bank of America said that Cadence Design Systems would be one of the AI winners in 2025. Other analysts continue to be of the same view, with one firm predicting the shares could increase from $310 today to $375.

San Diego-based Qualcomm has become better known in the UK in the past few months for its bid for Alphawave – one of the few British players in microchips.

Qualcomm shares have fallen by 30pc over the past 12 months to $148, depressed by tariff fears. Could the company’s new emphasis on data centres reverse this trend? Analysts are hedging their bets, rating the shares a ‘hold’.

TSMC’s geographic location in Taiwan places it at the heart of the trade wars. But the company is navigating its way through the turmoil by building fabrication plants in Arizona, Germany and Japan, for instance.

Thanks to this stance, analysts view the shares as a ‘buy’, reckoning that they could rise from the current 967 Taiwan dollars to 1,242 Taiwan dollars.

TSMC has been called the most important company in the world, since there would be no AI industrial revolution without its wares.

This suggests that it may merit a place in your portfolio, but only if you are ready for the twists and turns in this fast-paced revolution for which steady nerves will be required.