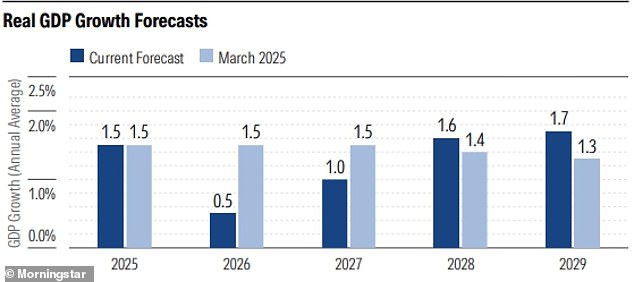

- Morningstar slashes 2026 growth forecast from 1.5% to just 0.5%

Britain could be set for a sharp slowdown in economic growth next year as the country braces for another bruising Budget in two weeks’ time.

Rachel Reeves is expected to unleash another round of tax hikes as part of wider efforts to reign in Britain’s public finances on 26 November and close a ‘fiscal blackhole’ estimated to be as large as £40billion.

While no changes have been confirmed as yet, National Insurance and income tax hikes are thought to be among Reeves’ targets.

Now, analysts at Morningstar have slashed growth forecasts for next year in response to the growing likelihood of income tax hikes.

Having previously expected the British economy to expand by 1.5 per cent in 2026, in line with growth this year, Morningstar now says the UK economy will eke out growth of just 0.5 per cent.

National Insurance and income tax hikes could be on the way in Rachel Reeves’ upcoming budget

Morningstar UK economist Grant Slade said: ‘A strong contribution from Government expenditures is offsetting weak business investment and consumer spending in 2025.

‘However, as the fiscal stance tightens in 2026, Government spending and an expected income tax hike is set to weigh on economic growth.’

Morningstar thinks GDP growth will not meaningfully improve until 2027 when the economy is set to benefit from a sharp turnaround in UK productivity.

The most recently published data compiled by HM Treasury shows City forecasters on average expect GDP growth of 1.1 per cent next year, down from 1.3 per cent forecast in March.

Natwest Markets has the most conservative outlook on 2026 growth, which it expects to hit just 0.8 per cent, while Barclays Capital is the most positive with a forecast of 1.3 per cent.

Thomas Pugh, chief economist at RSM UK, thinks the Chancellor will look to boost her ‘fiscal headroom’ by £15billion to £20billion with the ‘heavy lifting’ done by tax hikes.

He said: ‘[The Government] is going to have to raise revenue in the least damaging way possible. So that really means focusing on disinflation in taxes – things like income reform, property taxes, and staying away from measures which really push up inflation or have big distortionary impacts on the economy.’

‘I suspect significant pro-growth reforms [are] probably a step too far this time.’

However, chief economist at WPI Strategy Martin Beck thinks UK growth fears are overdone in some quarters and the economy will show similar strength next year.

He said: ‘If taxes go up a lot, the Bank of England would probably cut interest rates by more than it would have done otherwise. That’s its job.

‘Inflation is going to be lower, interest rates are going to be lower – both here and overseas. Overseas fiscal stimulus, in Germany and the US for example, will also benefit the UK.

‘Households have a lot of firepower at the moment, relatively speaking, household debt is low and savings rates are still historically strong.

‘I think we’ll get 1.5 to 1.6 per cent growth for next year. The outlook at the beginning of 2025 was gloomy and it improved – the same will happen again next year.

‘There seems to be an in-built institutional pessimism among UK economists since the Brexit vote.’

Morningstar slashes growth outlook for next year – but says outlook will improve from 2027

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Freetrade

Freetrade

Investing Isa now free on basic plan

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.