An electric carmaker is fighting to stay alive on the Nasdaq as Wall Street loses patience with the struggling EV sector.

On Wednesday, Swedish automaker Polestar announced plans for a reverse stock split in a bid to avoid being delisted from the exchange — a move that slashes the number of shares in circulation but boosts their per-share value.

For example, a one-for-ten split would turn ten shares trading at $1 into a single share worth $10.

Companies typically attempt these reverse splits when their stock has fallen so low that they risk losing their stock-market listing — it’s a cosmetic fix that can buy time, but rarely changes the underlying problems.

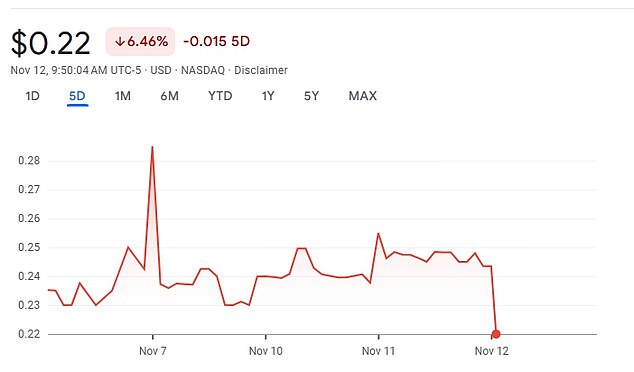

Wall Street wasn’t impressed. The stock plunged nearly 12 percent Wednesday to just $0.22 a share.

It extends a brutal slide that’s left the once-hyped Tesla rival below Nasdaq’s minimum listing threshold of $1.

Polestar, a spin off from Volvo, has been trading south of that threshold for weeks amid mounting debt, production delays, tariffs, and a suddenly shaky roadmap for electric vehicles.

The company’s troubles couldn’t have come at a worse time for electric automakers. In September, the industry lost a government-funded $7,500 consumer tax credit that propped up consumer interest.

And, the automaker is set to launch its next model, the Polestar 4, in the US by December.

Polestar is about to launch its next EV in the US, named the Polestar 4, in December

Polestar previously told the Daily Mail the vehicle will be their volume seller. It comes without a rear window.

The Polestar 4’s sales are crucial to the company, which discontinued its China-made Polestar 2, its previous best-seller, in April. The company had to withdraw the car from the US market due to massive tariffs on Chinese-built vehicles.

US sales have since relied on the high-end, $68,000 Polestar 3 SUV.

Sales of the new car are up, with revenue climbing 36 percent last quarter. Still, rising costs from quickly depreciating cars have led to a larger cash crunch.

The EV maker, which is majority-owned by China’s Geely Holding and a spin-off of luxury automaker Volvo, reported a $365million loss in the third quarter — worse than the $323million it lost during the same period last year.

CEO Michael Lohscheller said the reverse stock split is part of a broader effort to ‘make our organization and operations more efficient’ as market conditions worsen.

It’s also not his first time taking this risk.

Lohscheller attempted a similar split when he took over Nikola, the now-defunct electric truck startup.

Polestar’s stock dropped in early morning trading after the company’s CEO announced plans for a reverse stock split

Michael Lohscheller, Polestar’s CEO, made a similar stock move when he was the head of Nikola, a now defunct electric truck maker. Nikola had already gone bankrupt before the Wall Street shake-up, a fate that Polestar has avoided so far

It comes after weeks of major changes at the company. Polestar has been slashing costs, changing leadership, and pivoting to a dealer-focused sales model to energize its finances.

The company previously told the Daily Mail that it had received a fresh investment from its owner, but declined to disclose the amount.

It’s also doubling down on Europe as US demand fades, skipping an American and China launch for its upcoming sport sedan, the Polestar 5 GT.

Polestar’s stock first hit the open market in 2022 at $13 per share following a SPAC merger.

A Polestar representative didn’t immediately respond to the Daily Mail’s request for comment.