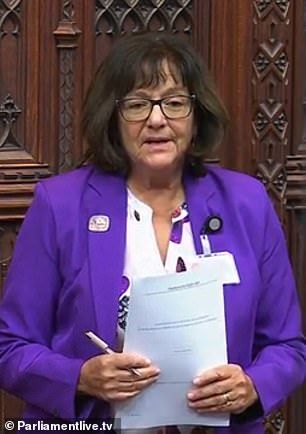

Pensions campaigner Ros Altmann led an attack this week against ‘unworkable’ proposals to levy inheritance tax on pensions and death benefits from April 2027.

During a House of Lords stand-off, she condemned the plans as damaging because they would encourage savers to access retirement pots early to avoid the tax, and undermine saving into pensions in the first place.

The former Pensions Minister has previously criticised the daunting new bureaucracy involved, pointing out it will be an impossible task for some families to find all past pensions, identify all beneficiaries, and work out and then pay any inheritance tax due within six months.

‘There have not been enough warnings about this coming catastrophe,’ she said regarding the looming admin headaches for families, including the risks of shelling out 8 per cent interest on late payments.

Responding to Baroness Altmann in the House of Lords, Financial Secretary to the Treasury Lord Livermore said: ‘The Government continue to incentivise pension savings for their intended purpose of funding retirement.

Lady Altmann: Nobody will want to be an executor to a will once they realise what these new rules mean

‘Most unused pension funds and death benefits payable from a pension will form part of a person’s estate for inheritance tax purposes from 6 April 2027.

‘This removes distortions resulting from changes made over the last decade, which have led to pensions being openly used and marketed as a tax planning vehicle to transfer wealth, rather than to fund retirement.’

Lord Livermore added that pension tax incentives cost taxpayers £78billion a year, and it was important to ensure these reliefs were used to encourage savings for retirement, not ‘ordinary taxpayers subsidising the wealthy to pass on their wealth free of inheritance tax’.

Chancellor Rachel Reeves announced at last year’s Budget that inheritance tax would start being levied on unspent pensions, as it is on other assets such as property, savings and investments, from spring 2027 – see more on the new rules below.

But Baroness Altmann has warned that mid level earners will have a strong incentive to empty their pension fund as soon as they can and pay just basic rate 20 per cent income tax on withdrawals.

‘Most people are more worried about dying soon rather than living too long,’ she said.

Huge burden for grieving families

Baroness Altmann has also argued the administrative burden on ‘personal representatives’ – executors or administrators of wills, often family members with no tax or pension experience – will be wholly disproportionate.

‘Nobody would want to be an executor or personal representative once they realise what these new rules mean.’

The personal representatives, alongside the beneficiaries inheriting the estate, will be jointly responsible for paying the bill, either as a group or individually – even though they might not control the pensions directly.

They will have to pay any inheritance tax inside six months, but potentially without any money from the pension funds available to them, or interest will be imposed.

It is already common for beneficiaries not to have the ready cash to pay inheritance tax bills.

There are various ways to get round this, but they often arrange for cash in the deceased person’s accounts to pay His Majesty’s Revenue & Customs direct, or borrow to cover the bill.

Lord Livermore: Distortions resulting from changes over the last decade led to pensions being openly used and marketed as a tax planning vehicle to transfer wealth, rather than fund retirement

Other peers weighed into this week’s exchanges on inheritance tax in the House of Lords, which were sparked by Baroness Altmann asking Lord Livermore what assessment the Government had made about the impact of its proposals on bereaved families, confidence in pensions and future levels of pensioner poverty.

Baroness Neville-Rolfe, a Conservative, said: ‘My Lords, I speak as someone whose relatives have struggled for years, rather than months, in coping with the probate system, partly because of the problems caused by the inefficiencies of the probate office.

‘Executors will not be able to deal with the extra complexity of adding pensions to inheritance tax, particularly those with lots of small pension pots.’

Liberal Democrat peer Baroness Kramer said: ‘My Lords, does the Minister agree that in real life, many people restricted their lifestyles, spending and gifting in order to build a sufficient defined contribution pension that could pay, if needed, for years in a care home, not knowing how long they would live or their health condition, and because they did not want to burden the state or their children?

‘They now see that they were being gullible in believing the assurances that anything unused could go to their loved ones free of inheritance tax, and that the Government simply regard their sense of responsibility as rather stupid.’

The Conservative Lord Massey of Hampstead said: ‘Interest charges for late payments of tax are charged at 8 per cent per annum and apply to estates after six months.

‘Does the Minister agree that, given potential complications in finalising and executing wills, six months is rather short and that a longer grace period of at least one year should apply before interest charges are levied?’

However, cross-bench peer Lord Macpherson of Earl’s Court asked whether, if the point of pension relief was to provide a pension in retirement, savers should therefore draw down their funds rather than using them as ‘a device to avoid inheritance tax and to improve the lot of their descendants, rather than themselves’.

Baroness Altmann has called for the Government to levy a flat-rate charge of 10 per cent, 15 per cent or 20 per cent on unused pensions when someone dies, paid direct by the pension firm regardless of the inheritance tax position of an estate.

But Lord Livermore said: ‘Currently, fewer than 10 per cent of estates will have an inheritance tax liability. If you put a flat tax on all pensions, you are asking 90 per cent of estates to pay more so that 10 per cent of estates can pay less. I do not consider that to be fair.’

> Read the full exchanges in the House of Lords here

People likely to shun the job of executor in future

Pension and legal experts have sounded the alarm about the plans to levy inheritance tax on pensions.

Step, an industry group for inheritance professionals, said the reforms will create chaos and put bereaved families and ordinary people who act as executors at financial risk.

It pointed out personal representatives, those legally responsible for gathering in the assets of estates and distributing them to beneficiaries, would be held liable for inheritance tax on pension funds they do not control.

Step said this was an ‘unwanted and unexpected’ change to the original proposals that could result in great unfairness, and families would be left struggling to find anyone willing to act as executor.

It added that if a professional was appointed as executor, they would not want to distribute the estate for years in case new pensions came to light on which they were personally liable to pay inheritance tax.

This would drive up professional indemnity insurance costs for advisers and therefore clients, while estates could be left undistributed for years as executors wait for valuations, pension fund details and HMRC decisions, the group warned.

Emma Chamberlain, a barrister and spokesperson for Step, said: ‘There is no reason why the executors should have to pay inheritance tax due on the pension fund from assets of the estate, such as the house or bank accounts, which may well pass to completely different people.

‘If they have distributed the estate before the pension fund inheritance liabilities have been settled, they are personally liable.’

Step has proposed giving executors protection against a new pension fund emerging long after the estate has been distributed.

It suggested that unless a fund was being passed to a beneficiary exempt from IHT, such as a spouse or charity, pension schemes should be required to keep 50 per cent back until directed otherwise by executors, so it could be used to pay inheritance tax if necessary.

SIPPS: INVEST TO BUILD YOUR PENSION

AJ Bell

AJ Bell

0.25% account fee. Full range of investments

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing, 40% off account fees

Interactive Investor

Interactive Investor

From £5.99 per month, £100 of free trades

InvestEngine

InvestEngine

Fee-free ETF investing, £100 welcome bonus

Prosper

Prosper

No account fee and 30 ETF fees refunded

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.