Skipton Building Society has launched a new savings product designed to encourage customers to use their tax-free ISA allowance at the start of the financial year rather than waiting until the weeks leading up to April.

The Annual Allowance Cash ISA, which became available today, pays four per cent tax-free pa/AER.

The account is intended for current-year subscriptions only, meaning savers cannot transfer funds from previous tax years or other providers.

Skipton is seeking to address a long-standing pattern among British savers who typically rush to utilise their ISA allowance near the end of the tax year.z

By contributing earlier, customers are able to build up tax-free interest for a longer period instead of potentially paying tax on interest generated in standard savings accounts.

The product offers flexible access, allowing withdrawals while maintaining eligibility for the competitive tax-free rate.

Customers can deposit up to the full annual ISA allowance, which is set at £20,000 for the 2025/26 tax year.

The account can be opened and managed via the building society’s mobile app, online services, telephone banking, branches, or by post.

Skipton Building Society has unveiled a savings product urging customers to use their ISA allowance early in the financial year, rather than waiting until April

|

GETTY

Skipton said the purpose of the new product is to highlight the immediate tax advantages available to those who act promptly.

Those who move their savings into an ISA earlier in the financial year receive tax-free interest straight away and avoid the possibility of paying tax on returns earned outside the ISA structure.

Alex Sitaras, head of savings and partnership products at Skipton Building Society, said: “We’re delighted to introduce the Annual Allowance Cash ISA to our range.

“This competitive rate gives customers a great opportunity to start benefiting from their tax-free savings now, rather than waiting until April.

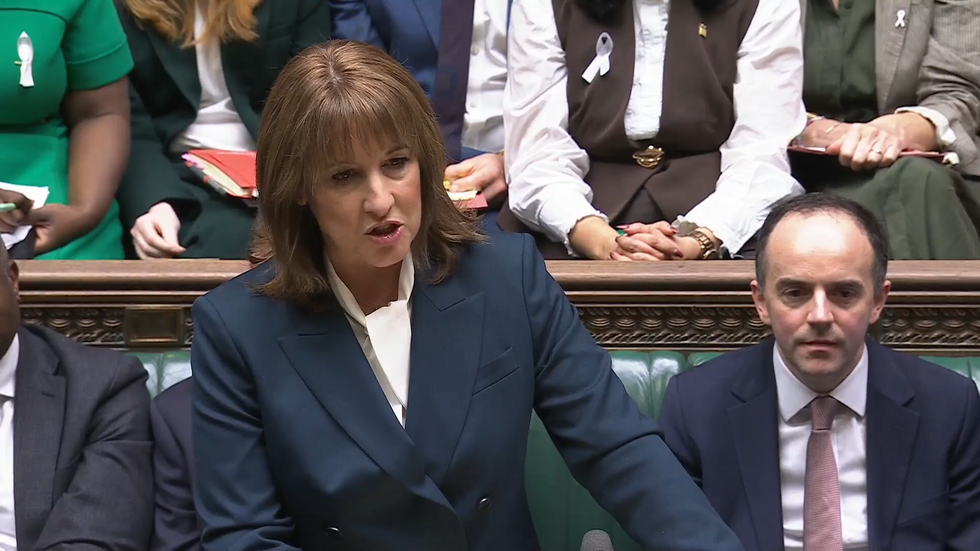

The move comes after the Budget announcement that the tax-free allowance would be cut

|

GB NEWS“With the recent Budget announcement and planned changes in April 2027, we’re encouraging savers to make full use of their full £20,000 cash ISA allowance in the current tax year and next, before the reductions come into force in April 2027”.

The building society is urging customers to take advantage of the existing £20,000 cash ISA limit while the current rules remain in place.

Planned changes to ISA regulations from April 2027 will reduce the amount that can be held in cash each year, prompting Skipton to encourage savers to maximise contributions during the current and following tax years.

Research commissioned by Skipton indicates widespread dissatisfaction with the Government’s planned ISA reforms.

The ISA cut has been met with frustration from savers

|

GETTYA snap poll of 563 Cash ISA holders found that 67 per cent responded negatively to the Chancellor’s announcement.

Almost three-quarters of respondents, at 73 per cent, believe the upcoming changes will lessen the benefits of holding a Cash ISA.

More than half, at 53 per cent, consider the planned reductions unfair to individuals who had structured their long-term financial planning around the existing £20,000 limit.

The findings highlight the level of concern among savers as the planned reforms approach.

Skipton said awareness of the changes remains limited among many ISA holders, with the building society intending to provide further guidance to customers in the coming months.

The organisation said the new product is aimed at helping savers make the most of the current rules before the April 2027 changes take effect.