All investors have an opinion on the best strategy to grow your wealth, but who is right? Are you better off buying investments that appear to be bargains, following the latest trend, or even going against the crowd?

We asked investment platform AJ Bell to crunch the numbers to find out who is really correct.

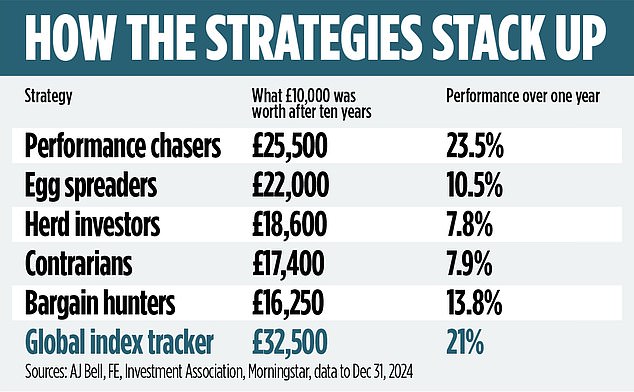

We looked at what would have happened if you invested £10,000 in each of the six most popular strategies.

We calculated how much money you would have if you’d invested a decade ago and one year ago to see if the best strategies fall in and out of favour over the long term or are consistent.

Here, we share the results of the winners and losers – but with one caveat. Investing experts suggest that although the top strategy has achieved great results recently, most investors should not follow it.

Performance chasers came top of the table with £10,000 being worth £25,000 after ten years

The winner… performance chasing

Performance chasing came out on top for the second year running, both over a one and ten-year period.

This strategy involves putting your money into the best-performing investment sector from the previous year.

Those who followed it would have ended up with £25,500 over a decade on an initial £10,000 and would have seen a 23.5 per cent increase over a year.

Laith Khalaf, head of investment analysis at AJ Bell, says this approach meant moving all your money into the technology and telecoms sector in 2024, which has continued to perform well this year.

However, over the long-term, following the strategy would have led you into many niche investment areas and on a stomach-lurching rollercoaster ride.

You would have invested in what Khalaf calls ‘high octane’ sectors such as healthcare, India, China and commodities funds. At some points over ten years, you would have lost 14.2 per cent in a calendar year and in others gained 44.4 per cent.

‘Performance chasing comes with large risk warnings,’ he says. ‘An area that has performed well in one year has probably become a crowded trade and vulnerable to over-valuation and profit-taking.’

Jason Hollands, managing director of investment platform Bestinvest agrees that buying what is popular is a flawed strategy.

‘Financial services firms carry risk warnings that ‘past performance is not a guide to the future’ for a reason,’ he says.

‘No one in their right mind would drive a car solely staring in the rear-view mirror, without keeping an eye on the road ahead, and building a portfolio solely on 12-month performance periods would effectively be doing this.’

Tom Hopkins, senior portfolio manager at BRI Wealth Management, said that performance chasing ‘might seem like a smart move but it often leads to an unbalanced portfolio, sector-specific risk and increased volatility of returns.

‘Instead, investors should focus on creating a diversified, resilient portfolio that aligns with long-term goals and risk tolerance.’

In second place… egg spreading

AJ Bell pitted performance chasing against five other popular strategies.

These are contrarian investing – putting your money in the least popular fund sector of the previous 12 months; herd investing – putting your money into the most popular sector; bargain hunting – investing in the worst-performing sector of the previous 12 months; and putting your eggs into many baskets by splitting your money equally across the US, UK, Europe, Japan and Emerging Markets.

Over ten years those who followed a sensible ‘egg spreading’ strategy would have come second to performance chasers, with a total return of 120 per cent.

The third most successful was herd investing.

Herd investors would now be buying into corporate bonds – last year’s most loved sector – while contrarian investors would, once again, be buying UK All Companies, the least loved sector in six out of the ten years in the study.

Bargain hunters would be buying into Latin America, where stocks have slid due to fears following the US election. Outperforming performance chasers would be buying into financial and financial technology funds, which performed the best last year.

Why top performance is not always wise

While it may be tempting to follow a strategy, the numbers revealed that all five were beaten by one simple plan – putting all of your money into a global tracker fund and leaving it there.

This would have delivered 21 per cent in 2024 and 225 per cent over a ten-year period – so if you’d put in £10,000 ten years ago, you’d have £32,500, and if you’d put it in last year, you’d have £12,100.

Over 2024, only performance chasers would have beaten those invested in a simple tracker. Those in the tracker fund would have saved on fees and charges too.

Rob Burgeman, senior investment manager at wealth manager RBC Brewin Dolphin, adds holding a portfolio with different types of investments is much more likely to lead to success.

‘You are more than twice as likely to win the EuroMillions jackpot – at odds of one in 140 million – than to select the best-performing asset class from a choice of seven over ten years,’ he says.

He adds that over the past decade, seven different asset classes have been the top performer – North American equities have done best in three of those years and commodities twice. But commodities have also been the worst performer for four years. So picking the best from one year doesn’t necessarily translate into success the following one.

A compromise can come to the rescue

If you like the idea of testing your own investment thesis, one option is to build a core and satellite approach, where you put most of your portfolio into low-cost tracker funds or multi-asset funds and a small fraction into the area you believe is set to outperform.

Burgeman says a good portfolio should be invested globally, with a bias to the US because that is where the largest companies are.

‘What is in favour today can be unpopular tomorrow. The right spread of exposure to different assets will make sure you focus on long-term goals and shield you from short-term noise,’ he says.

So, whether you’re a believer last year’s darling will become next year’s dud or think the US fintech bubble will run and run, remember to shield the bulk of your portfolio from the pain of fads. It’s easy to get carried away by market excitement, but boring diversification usually wins the day.