Crafty electric car drivers cost Rachel Reeves and the Treasury £30million in road tax this year by using a loophole – that we recommended – to scupper the Chancellor’s vehicle excise duty (VED) raid on EVs.

Under new rules ushered in by Reeves on 1 April, drivers of EVs registered after April 2017 were – for the very first time – required to pay VED at a standard rate of £195 a year.

With the vehicle tax system for years based on emissions, EVs until April had avoided the annual payment, which was seen as one of the big advantages of switching to battery cars.

But having confirmed that she would see through a Tory policy of ending VED exemptions way ahead of 1 April 2025, more than 300,000 EV drivers swerved Reeves’ raid by taking advantage of a loophole in the system.

VED rules state that drivers can tax their vehicles at any time. And, as This is Money instructed EV owners in February, by renewing VED before 31 March would mean they could delay their first annual payment by 12 months.

And according to the Driver and Vehicle Licensing Agency, almost a quarter of all EV owners in Britain – amounting to over 300,000 drivers – did just that.

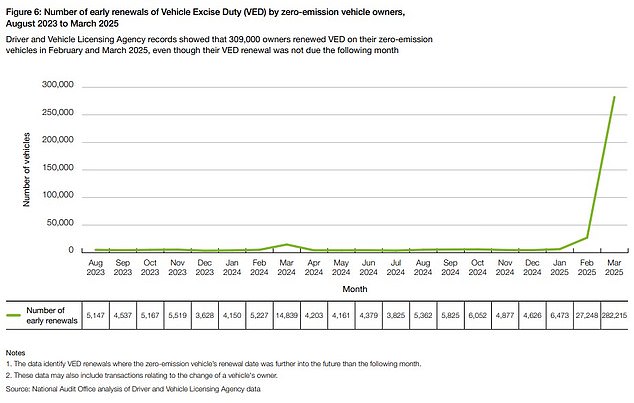

It revealed there had been a 1,400 per cent increase in early VED renewals before 1 April compared to the year previous, which equates to an estimated tax hole of £30million.

In February, This is Money recommended EV owners use a loophole in the vehicle excise duty system to evade an annual £195 payment for this year. And over 300,000 of them did, costing the Treasury an estimated £30million in lost revenue

In the DVLA’s Annual Report & Accounts published in the summer, the document revealed that almost a quarter of all zero-emission vehicles on the road had their VED renewed early to ‘delay paying the new rate’.

It added: ‘Owners of zero-emission vehicles with more than a month remaining on their existing VED period could renew their VED before 1 April 2025 at the existing nil rate.

‘Depending on when their VED was originally due, owners could pay no VED fees for up to an additional 10 months before they would need to renew at the new rate.

‘DVLA reported that 309,000 vehicles had VED renewed in February and March 2025 with more than a month remaining on their existing VED period – nearly a quarter of the UK’s population of zero-emission vehicles.

‘This equated to a 1,400 per cent increase in early renewals in February and March 2025 of zero-emission vehicles, compared with the previous year.

‘DVLA estimated that this increase could have equated to around £30million in lost VED revenue.’

It added that minsters had ‘not fully set out the risks of the likelihood and extent of the impact of behavioural change in response to the new VED rates for HM Treasury’.

Under new rules ushered in by Rachel Reeves on 1 April, drivers of EVs registered after April 2017 were – for the very first time – required to pay VED at a standard rate of £195 a year

The DVLA’s Annual Report & Accounts for 2024-25 shows the massive 1,400% surge in EV drivers renewing their tax before 1 April to delay the £195 annual payment by 12 months

Electric car owners face a fresh tax sting in the Chancellor’s upcoming Autumn Budget where Rachel Reeves is expected to announce that EV drivers will be hit with 3p-per-mile road pricing from 2028 to fill the Treasury black hole created by shrinking fuel duty revenue

Last week it emerged that the Chancellor is set to announce road pricing for electric cars in her speech delivered to the Commons on 26 November.

Reeves is expected to rubberstamp road pricing for 2028, pending a public consultation.

EV owners are expected to be charged 3p for every mile they travel, on top of the £195-a-year VED rate electric car drivers now have to pay since April this year under new measures that ended EV exemption from car tax.

Dubbed by government insiders as ‘VED+’, for EV owners covering an average of 10,000 miles per year, their total annual tax outlay will be £495; £300 in per-mile charges and £195 in standard rate VED.

Drivers of hybrid cars, which are powered by both a combustion engine and electric motors, will also have to pay the charge, but at a lower rate, it has been claimed.

It’s estimated that it would help the Treasury raise an estimated £1.8billion by 2031 to fill the billions in lost fuel duty revenue as the nation’s car parc transitions to electric cars.

In another blow to EV owners delivered yesterday, it was announced by Transport for London that electric car drivers will be required to pay the Congestion Charge in the capital from 2 January.