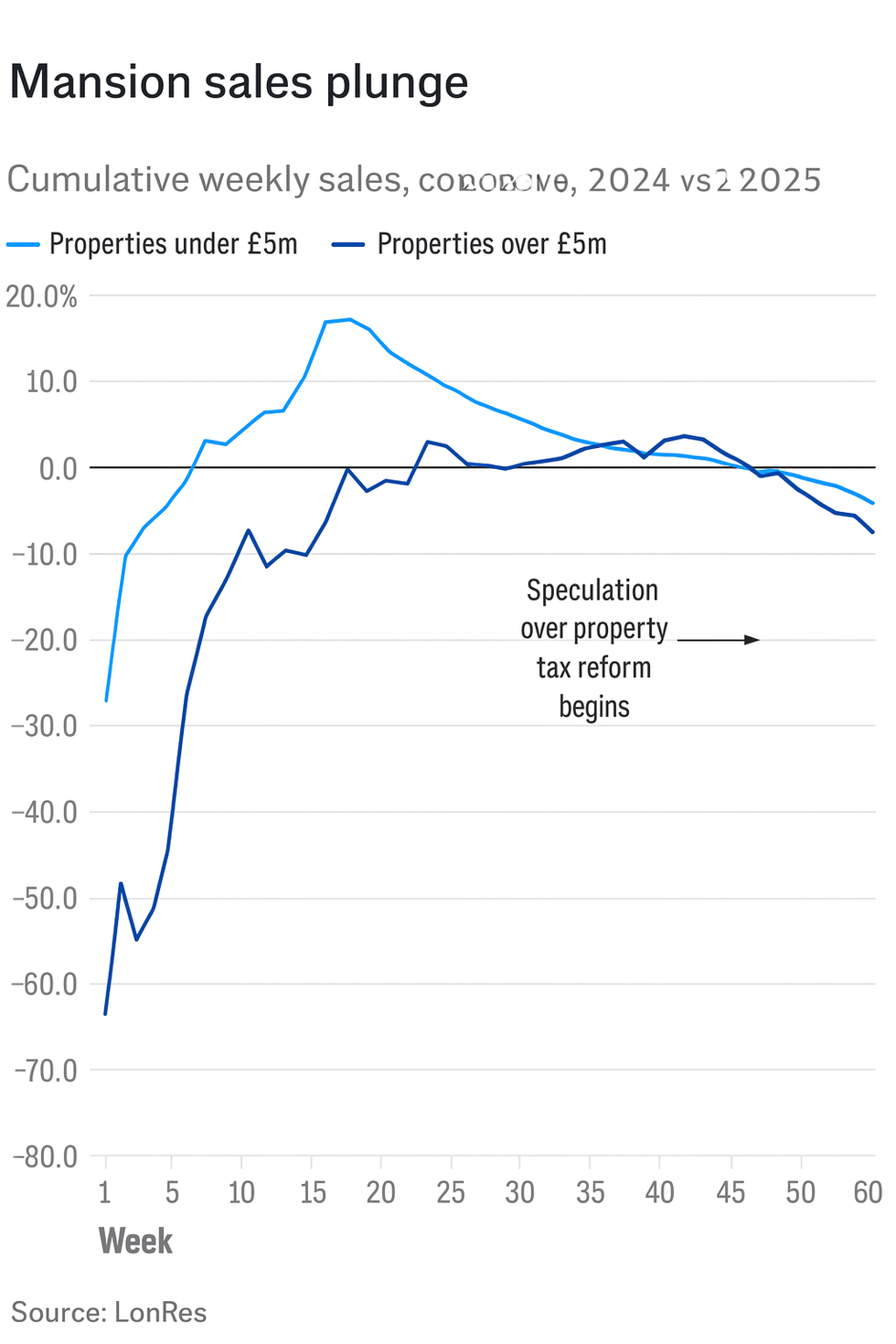

London’s premium property sector has experienced a dramatic downturn, with transactions for residences valued above £5million tumbling by 65 per cent during October.

Property analytics firm LonRes revealed the stark figures while warning of broader market weakness.

Fears Chancellor Rachel Reeves is set to impose strict new property taxes in the Budget are to blame, according to experts.

It is thought the Treasury is contemplating a mansion tax targeting residences valued above £1.5million, alongside proposals to double council tax charges for properties in the highest valuation bands.

The capital’s residential values have declined significantly, recording a 5.8 per cent decrease compared with October 2024.

This represents the steepest yearly fall observed since early last year.

Market activity has frozen across multiple indicators.

Fresh property listings contracted by nearly a fifth, while available inventory expanded by 15.6 per cent as potential purchasers remained hesitant.

Luxury property sales slump amid speculation over incoming mansion tax, triggering a sharp market freeze

|

GETTY

Anthony Payne, LonRes chief executive, offered pointed criticism of the Chancellor’s approach.

“I grew up with the old adage that ‘sticks and stones may break my bones, but words never hurt me’,” he said.

“But somebody needs to explain to Rachel Reeves that her words really can hurt people. Her words have really had an impact on the market.”

The executive described how speculation caught the public off-guard.

“It was a tough market anyway… but as soon as she started flying some kites, everybody was taken by surprise, like a rabbit in headlights, and everybody just stopped,” Mr Payne said.

He said the uncertainties had created an atmosphere where buyers and sellers alike have adopted a wait-and-see approach.

Mansion sales plunge

|

LonRes/CoPilot

The market’s underlying fragility extends beyond headline transaction figures, according to industry specialists.

Nick Gregori, LonRes’s head of research, highlighted a troubling disconnect between buyer interest and completed sales.

Mr Gregori said: “Under-offer levels continue to look robust but stubbornly refuse to translate into actual sales, with the existing lack of confidence in the market exacerbated by fears of significant tax changes in the upcoming Budget.”

He noted that uncertainty has begun affecting vendors as well.

Mr Gregori warned anticipated income tax increases combined with elevated borrowing costs have further undermined purchaser confidence.

“These factors will erode buying power from consumers, putting further pressure on the property market,” he said.

While exceptional transactions still occur, including Star Wars creator George Lucas’s September acquisition of a £40million St John’s Wood property, Mr Payne emphasised these represent outliers.

“People are waiting to see what comes out of the Budget and whether they can afford what they thought they could afford a few weeks ago,” he said.

The luxury market’s difficulties follow last year’s non-domicile tax reforms, which had already dampened international buyer interest in London’s prime properties.

Knight Frank research indicates that mansion tax concerns have driven high-end values down at their swiftest pace in more than four years.

Beyond the capital, Britain’s broader housing market displayed similar weakness during October.

London has been the most searched-for area among Britain’s home buyers in 2022

|

PAThe Royal Institution of Chartered Surveyors reported deteriorating conditions across multiple metrics, with buyer demand, transaction volumes and new property instructions all declining further into negative territory.

The confluence of fiscal uncertainty, persistent borrowing costs and potential income tax rises has created what industry observers describe as a perfect storm for property values.

Market participants remain in limbo, awaiting Budget clarity before committing to transactions they might have pursued mere weeks earlier.

The Treasury has been contacted for comment.