A stealth tax on savings accounts would be one of the “least popular” policy proposals Chancellor Rachel Reeves could announce in next week’s Budget statement on November 26.

Reports suggest the Treasury is considering slashing the tax-free allowance attached to ISAs in a move which would make savers liable to pay more to HM Revenue and Customs (HRMC).

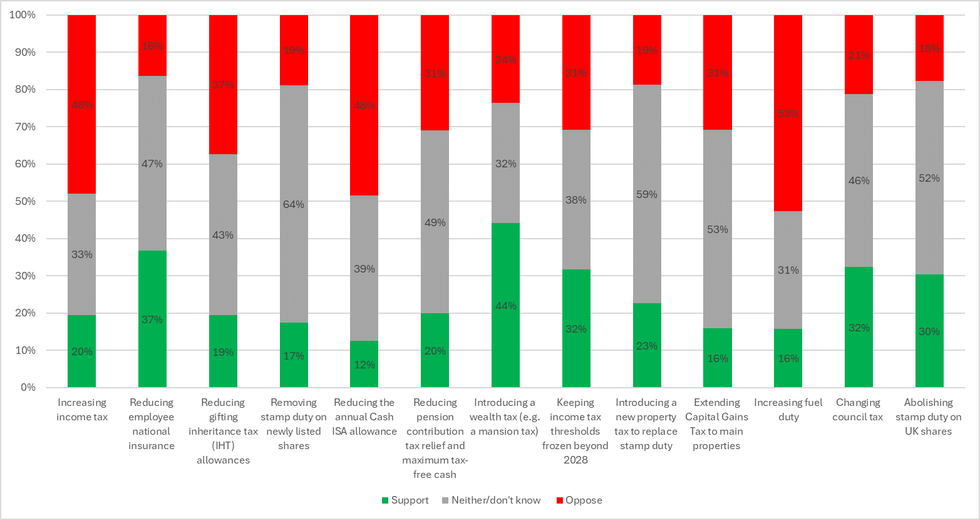

Polling from AJ Bell has identified cutting the cash ISA allowance as the most unpopular potential Budget measure amongst British voters, with merely 12 per cent backing such a move.

Nearly half of those surveyed, 48 per cent, actively oppose any reduction to the current £20,000 annual limit, making it the least favoured option amongst various tax proposals being considered for the 26 November Budget.

Britons are not keen on the tax-free allowance attached to ISAs being cut

|

GETTY

The findings come as the Chancellor weighs up different revenue-raising options, with the Treasury Committee having previously cautioned that reducing the allowance would introduce unnecessary friction and complexity whilst failing to encourage investment behaviour.

Proposals to raise income tax rates face similarly strong resistance, with 48 per cent of respondents opposing such measures whilst only 20 per cent express support.

The prospect of prolonging the current freeze on tax thresholds garners backing from fewer than one in three Britons at 32 per cent, despite mounting speculation that the government may pursue this approach to generate additional revenue through fiscal drag.

Additional unpopular proposals identified in the research include potential increases to fuel duty and reductions in inheritance tax (IHT) gifting allowances, suggesting voters remain broadly resistant to various tax-raising measures being considered by the Treasury.

The ISA limit is £20,000 each tax year | PA

The ISA limit is £20,000 each tax year | PATom Selby, director of public policy at AJ Bell, warned that “Brits clearly do not want to see further restrictions placed on how they save and invest their money”.

He highlighted that AJ Bell’s research indicates over half of Britons would simply transfer their funds to alternative savings accounts if faced with a cash ISA reduction, rendering the policy ineffective at encouraging investment.

“A reduction to the cash ISA allowance would hardwire the barriers that currently exist between cash ISAs and stocks and shares ISAs,” Mr Selby stated, adding that it could foster a “use it or lose it” mentality amongst savers.

The introduction of a wealth tax stands alone as the sole proposal attracting net public backing, with 44 per cent of Britons favouring such a measure in some form.

Mr Selby noted that this support likely stems from most people not viewing themselves as potential targets of such a tax, believing it would not affect their own finances.

However, he cautioned that implementing a wealth tax presents significant practical challenges, particularly around valuing assets like “family homes, pensions and private businesses” which “aren’t always simple to value, and can’t easily be turned into cash to pay taxes”.

He also warned that such a policy might prove “counter-productive by encouraging rich individuals to relocate outside the UK, taking their tax revenues and economic contribution with them.”

According to HMRC figures, cash ISAs remain the most widely used type of ISA, with 66 per cent of all adult ISA subscriptions directed to them in the 2023–24 tax year.

Which taxes are most unpopular with the British people?

|

AJ BELL

During this period, a record £103billion was subscribed to adult ISAs, a significant increase from previous years, driven largely by rising interest rates making cash savings more attractive.

However, despite this high general awareness of ISAs, a significant knowledge gap exists regarding specific rules, such as the annual allowance and the features of different ISA types.

Prior to next week’s fiscal statement, the UK Government has been actively exploring options for ISA reforms to encourage more retail investment into the stock market and support economic growth.

This has included the potential introduction of a “British ISA” with an additional £5,000 allowance for UK-focused investments.