Chancellor Rachel Reeves is exploring proposals to double council tax rates for properties in the highest bands, a move that could impact more than one million households across England.

The potential measure would see annual bills surge to as much as £10,000 for some homeowners.

Treasury officials are examining the policy as they seek to address a £30billion gap in public finances ahead of the November Budget. The proposal has emerged as one of several revenue-raising options under consideration.

Critics have expressed alarm at the plans, warning that many residents, particularly pensioners living on fixed incomes, could struggle to meet such steep increases. The measure would predominantly affect homeowners in areas with higher property values.

Under the proposals, households in Band G would see their annual charges increase from approximately £3,800 to £7,600. Those in Band H properties would face even steeper rises, with bills jumping from around £4,560 to £9,120 per year.

The most substantial charges would be in Rutland, where Band H residents could face annual bills of £10,800. This represents the highest council tax level in the country under the proposed changes.

The Institute for Fiscal Studies has suggested this approach could generate £4.2billion annually by the end of the decade. The think tank’s proposal would affect roughly 4.1 per cent of households across England, making it a targeted measure aimed at higher-value properties.

The geographical impact of these proposals would be heavily concentrated in southern England. Official data indicates that two-thirds of Band H properties are located in London and surrounding counties, where property values have risen substantially over recent decades.

Taxpayers are struggling with the unsustainable burden of council tax | PA

Taxpayers are struggling with the unsustainable burden of council tax | PAThe disparity across regions is stark. The North East contains just 1,560 Band H properties, whilst the South East has nearly 100 times that number. This regional imbalance means the policy would disproportionately affect homeowners in areas where property prices are highest.

Property experts have raised concerns about the market implications. Richard Donnell of Zoopla suggested the changes could prompt some homeowners to sell to reduce costs, potentially increasing housing supply and affecting prices. Lucian Cook of Savills warned that households with valuable assets but limited cash flow would bear the brunt of such measures.

Conservative leader Kemi Badenoch has condemned the proposals, stating: “Creating new higher council tax bands will hammer people who have lived in the same house for decades, particularly pensioners, some of whom will be unable to pay this new tax and be forced out of their home.”

LATEST DEVELOPMENTS:

Chancellor Rachel Reeves is exploring proposals to double council tax rates for properties in the highest bands

|

PAShe argued that rather than imposing new levies on family homes, the government should eliminate them, referencing her pledge to abolish stamp duty. Badenoch highlighted the Conservatives’ alternative approach, citing a “serious, costed plan to cut spending by £47bn.”

Reform UK leader Nigel Farage described the potential changes as an “attack on aspiration” and “an assault on assets.” He warned the measures would cause “huge consternation amongst older people living in properties they bought many years ago.”

The Treasury has declined to comment on the specific proposals, stating only that it does not discuss tax changes outside fiscal events. Sources suggest the Chancellor views council tax increases as among the more straightforward methods to generate revenue.

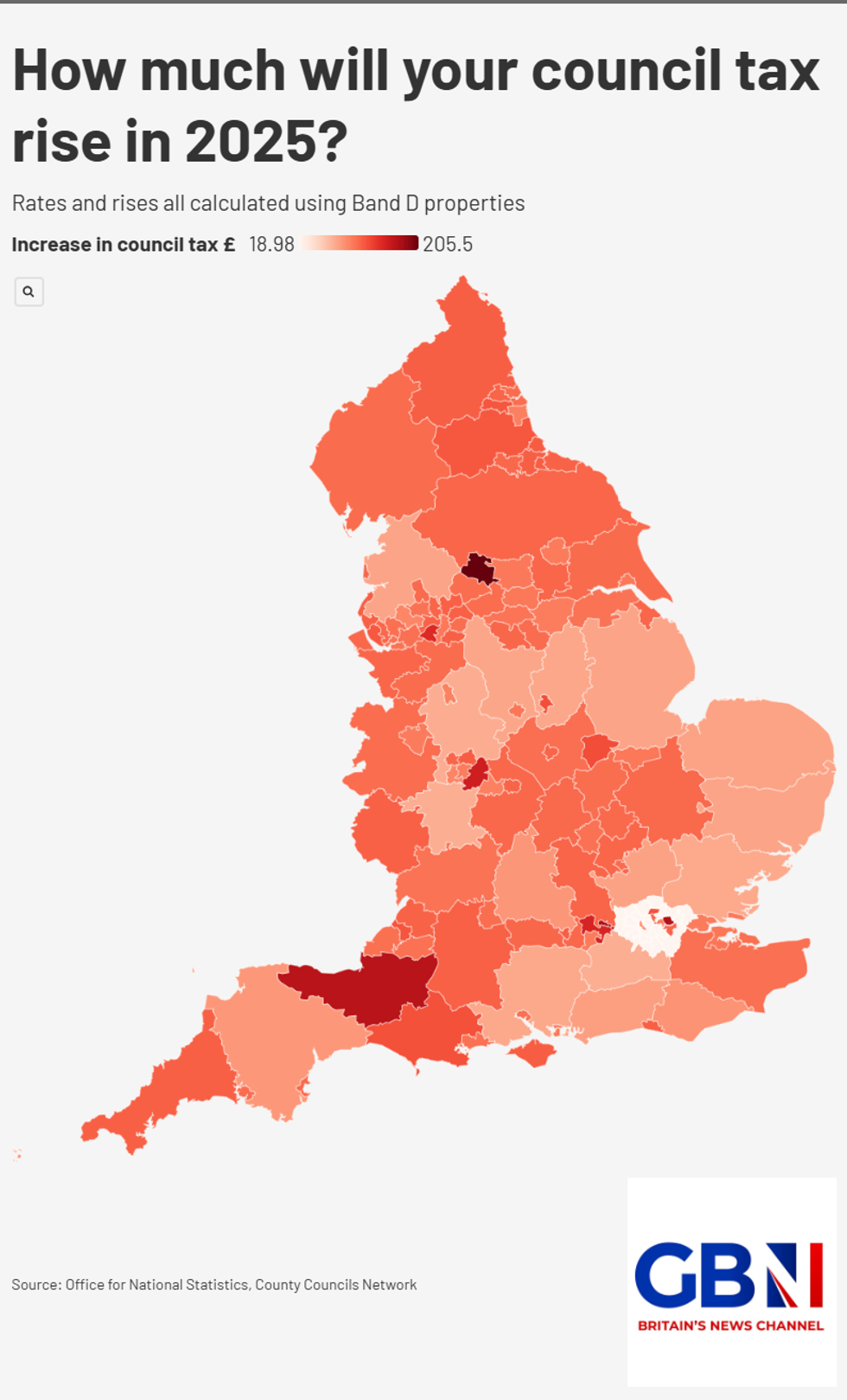

Council tax rises 2025/2026 | GBN

Council tax rises 2025/2026 | GBN

The timing remains uncertain, with final decisions on tax measures not expected until after 21 November, when the Office for Budget Responsibility delivers its latest economic forecast. The Budget is scheduled for 26 November.

The proposals form part of broader efforts to address fiscal challenges, with Treasury officials reportedly instructed to identify revenue from those earning above £45,000 annually.

This threshold effectively defines the top third of earners as targets for increased taxation, encompassing professions such as HGV drivers, teachers and restaurant managers.