Full list of major changes from Rachel Reeves YOU need to know about

Major changes to the pension system are coming in 2026 thanks to a series of reforms being rolled out by Chancellor Rachel Reeves and the Labour Government.

Ms Reeves has received criticism since taking over the Treasury due to her inheritance tax (IHT), which saw pension assets brought into the levy’s purview, and the extension to frozen tax thresholds.

These policies have been cited as indicative of the Government’s apathy towards the fiscal challenges faced by pensioners and future retirees.

However, the Chancellor has asserted 2026’s series of pension reforms will help improve the retirement prospects of millions .

The Chancellor is making major changes to pensions in 2026

|

GETTY

Here is a full list of the major pension changes taking next year:

- Implementation of the targeted support regime

- The Pension Schemes Bill

- Introduction of the pensions dashboard

- The Pensions Commission

- Salary sacrifice: NI cap from April 2029.

The Targeted Support regime, unveiled through an Financial Conduct Authority (FCA) consultation in June 2025, represents an attempt to close the gap between generic guidance and fully regulated financial advice.

Under the new framework, authorised firms will be permitted to offer tailored recommendations to groups of people sharing similar financial profiles, with the aim of making pension and investment support both more accessible and affordable.

Applications for firms wishing to participate will open from March, though the launch remains contingent on parliamentary approval of the necessary legislation.

Jonathan Watts-Lay, the director at WEALTH at work, said: “I welcome the initiative, albeit with some reservations. The new regime could help savers to get started and bridge the advice gap and may also encourage disengaged investors to make active choices and get better value from their investments.”

However, he cautioned that the approach is not comprehensive by design and will not account for an individual’s complete financial picture or personal circumstances, meaning regulated advice remains crucial for those with substantial assets.

Pension reforms are being rolled out by the FCA

|

PAThe Pension Schemes Bill, currently progressing through parliament, targets poorly performing retirement schemes and addresses the growing problem of fragmented retirement savings.

According to Department for Work and Pensions (DWP) estimates, approximately 13 million deferred defined contribution pots are valued at under £1,000, with this figure rising by roughly one million annually.

The legislation also mandates that defined contribution schemes provide default pension benefit solutions, termed “guided retirement” in the bill, to convert savings into retirement income.

Mr Watts-Lay expressed concern about this approach: “There is a real danger that this could lead to a repeat of the issues seen with annuities pre-Freedom and Choice, where individuals defaulted into their providers annuity without exploring better options elsewhere.”

He emphasised that retirement requirements vary enormously based on health, life expectancy, other assets and income preferences, meaning generic default options cannot adequately serve everyone’s needs.

A Targeted Support regime is scheduled to begin operating in April 2026, while the Pension Schemes Bill is making its way through parliament with an anticipated completion date around mid-2026.

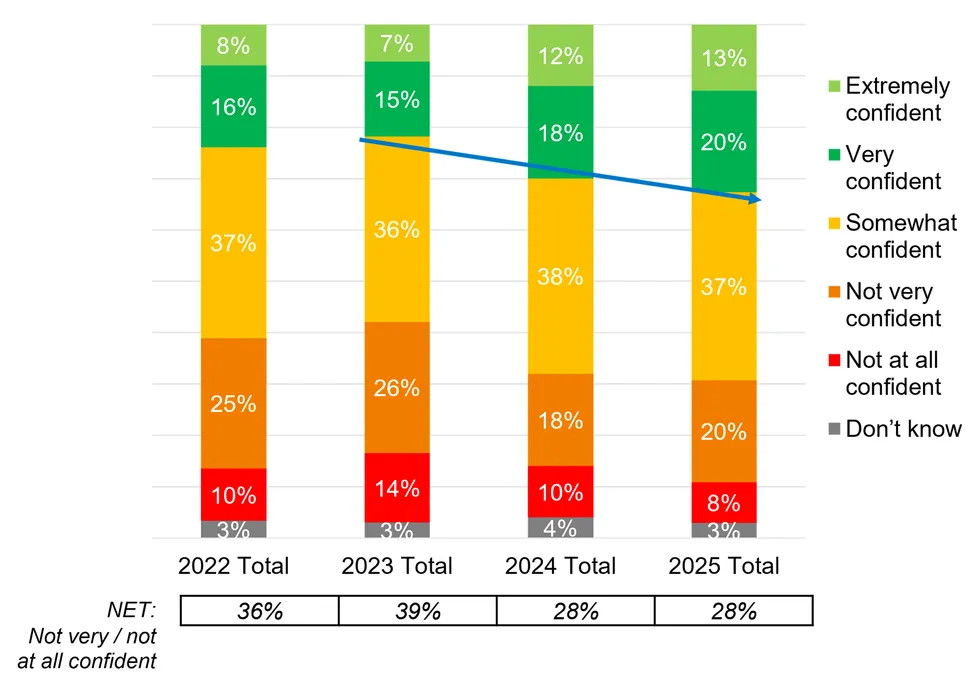

How confident are Britons about their pension savings? | AEGON

How confident are Britons about their pension savings? | AEGON Pensions dashboards will also become operational throughout next year, giving individuals unprecedented visibility of their accumulated savings.

Mr Watts-Lay added: “Dashboards will give people a view of all their pensions in one place. This can make it much easier to understand what they’ve built up, spot any gaps, and plan for the income they’ll need in retirement.”

The Government also reconvened the Pensions Commission in July 2025 to assess whether current savings levels are adequate, amid concerns that future generations of retirees may face worse outcomes than those retiring today.

From April 6 2029, salary sacrifice pension contributions will only benefit from National Insurance exemption on the first £2,000 annually, with amounts exceeding this threshold subject to standard NI rates for both employees and employers.

Those making modest contributions through salary sacrifice, particularly basic-rate taxpayers, will likely see minimal impact as their annual payments typically fall below the £2,000 threshold.

However, individuals contributing larger sums will experience reduced efficiency in their savings strategy and may need to boost their contributions to stay on track for retirement goals.

Mr Watts-Lay suggested it may be prudent to maximise pension contributions before the 2029 changes take effect.

For those looking to prepare now, he recommended engaging with employers or HR departments, as many workplaces provide financial education, guidance and investment advice.

Workers with multiple pension pots accumulated across different jobs should enquire about consolidation services to gain clearer oversight of their retirement savings.