Rachel Reeves under fire for ‘hiding £1.3trillion debt mountain’ in Budget

Chancellor Rachel Reeves faces accusations of concealing a £1.3trillion borrowing burden within her Budget, despite publicly insisting she is reducing the nation’s debt.

A new report explains the Chancellor has hidden an additional tranche of borrowing that will burden Britain with a massive “debt mountain” throughout this parliamentary term.

Speaking in the House of Commons last Wednesday, Ms Reeves declared: “My fiscal rules will get borrowing down while supporting investment … I said we would cut the debt and we are.”

She added: “Those are my choices. Not austerity, not reckless borrowing, but cutting the debt.”

However, fresh analysis challenges these assertions directly.

Sir John Redwood, who served as Margaret Thatcher’s senior economics adviser, has produced analysis suggesting the Budget fails to reveal the true scale of future borrowing.

According to his findings, an additional £675billion will be required to refinance existing government bonds, known as gilts, as they mature.

This sum comes on top of £628billion in extra state expenditure planned over the coming five years.

Combined, these obligations create what Mr Redwood describes as a £1.3trillion “debt mountain” that the Chancellor has not made transparent.

Rachel Reeves under fire for ‘hiding £1.3trillion debt mountain’ in Budget

|

PAThe cumulative borrowing would push Britain’s national debt to £3.53trillion, representing approximately £50,840 for every individual in the country.

The Chancellor’s confident declarations to Parliament stand in stark contrast to Redwood’s findings, which indicate both debt and borrowing will continue their upward trajectory under Labour’s stewardship.

In a report co-authored with Brexit Facts4EU, the former Thatcher adviser states: “Rachel Reeves is building a debt mountain whilst claiming to bring the debt down.

LATEST DEVELOPMENTS:

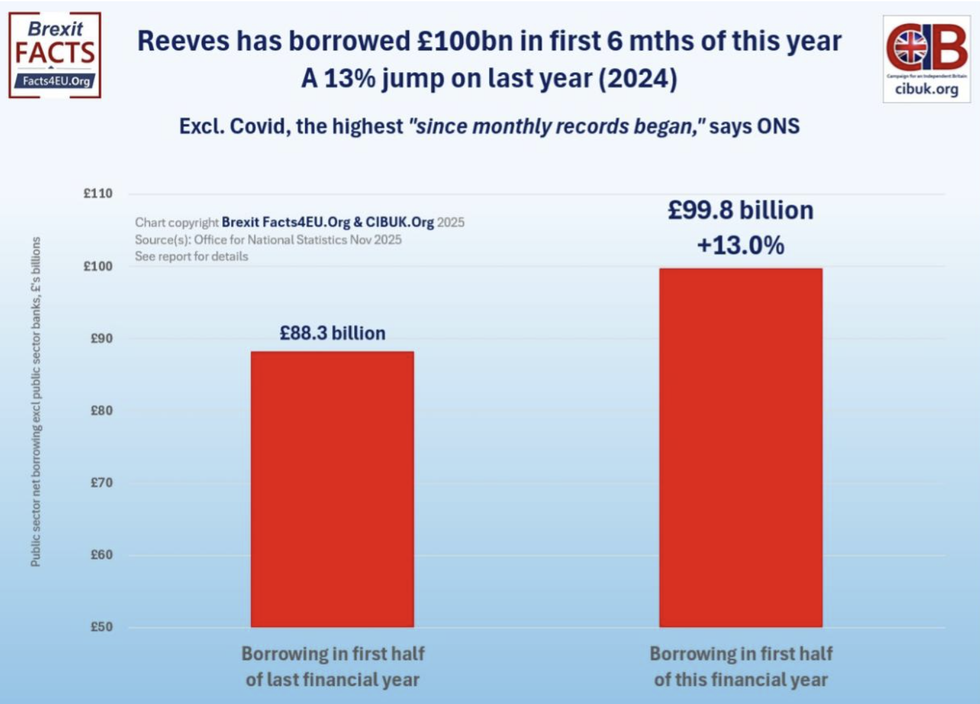

The chart highlights the increase in borrowing | FACTS4EU

The chart highlights the increase in borrowing | FACTS4EU“She wants to add a staggering £628bn to the state debt over the next five years, as if the £3tn the Government has already borrowed was not enough.”

Mr Redwood further criticises the timing of proposed tax increases. He told The Telegraph: “She only brings in some tax rises at the end of the period to pretend late in the day to be doing something about her borrowing habits.”

Mr Redwood warns that financial markets may struggle to absorb such enormous borrowing requirements, with the Bank of England now actively selling bonds rather than purchasing them.

The scale of borrowing amounts to an equivalent burden of about £50,840 per person

|

GETTYHe compares the Chancellor’s predicament to “watching someone who wants to go on a spending spree aim to take out a large overdraft, only to find they also need a pile of cash to repay the mortgage they already have when it expires.”

The former adviser also questions whether bond markets will “find another £1.3tn”.

He said Ms Reeves “is unlikely to be in charge” when the planned tax rises eventually take effect following the next general election.