Britons urged to ‘lock in a rate now’ ahead of major inflation announcement

Mortgage brokers are urging homeowners to secure their rates before Wednesday’s release of inflation figures, cautioning that market conditions can shift with little warning.

The Office for National Statistics (ONS) is set to publish the consumer price index (CPI) rate for the 12 months to January 2026, with many analysts pricing in a fall in inflation.

Industry experts have advised borrowers not to hold off in anticipation of the CPI, instead recommending they lock in deals immediately as mortgage rates are expected to drop later this year.

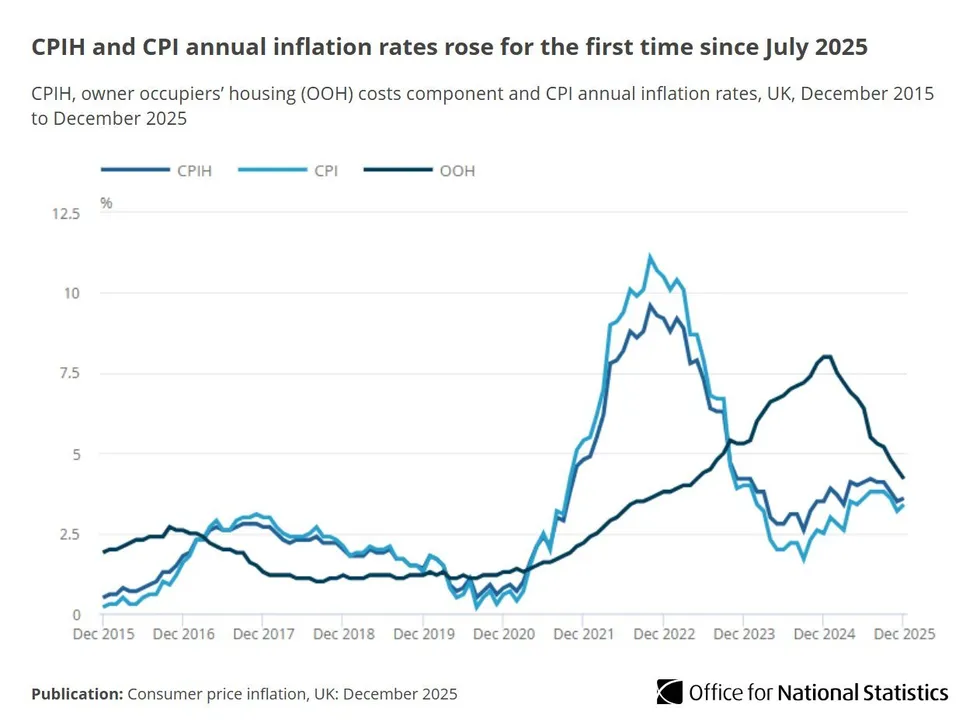

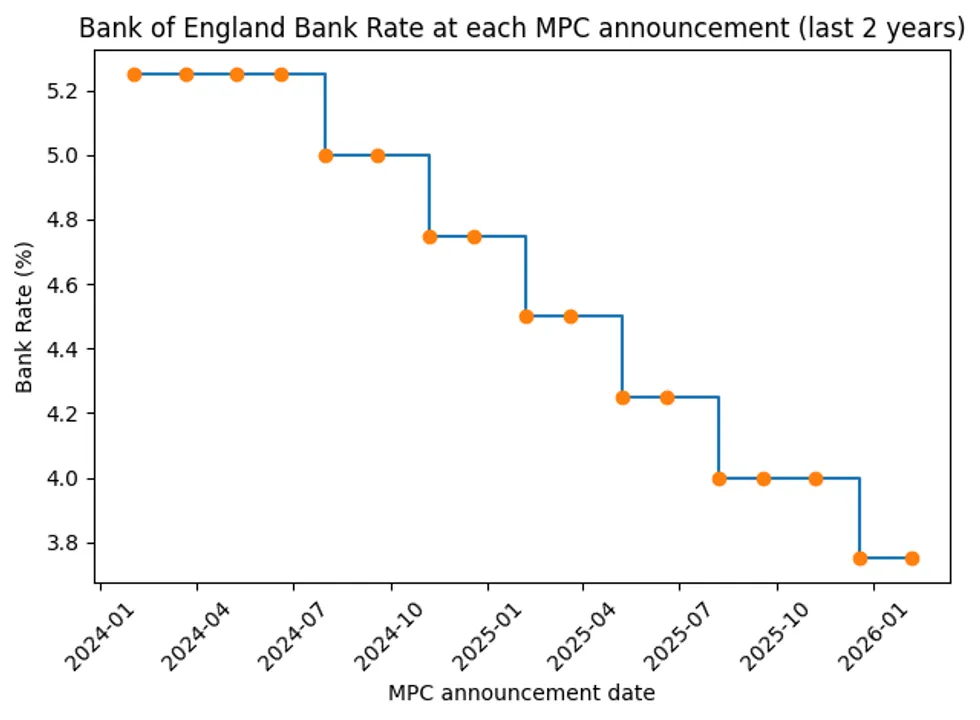

In recent years, the Bank of England’s Monetary Policy Committee (MPC) has opted to raise the UK’s base rate to as high as 5.25 per cent in an effort to bring inflation down.

Britons are being urged to ‘lock in a rate now’ when mortgage shopping

|

GETTY

This hike has been passed on to consumers through high street banks, building societies, and lenders, which has been beneficial for savers, but has hiked the cost of borrowing for those looking to get on the property ladder.

Should inflation ease as predicted on Wednesday and begin its descent towards the Bank of England’s two per cent target, mortgage rates are likely to follow a downward trajectory.

Based on the latest ONS data, the CPI inflation rate for the 12 months to December 2025 came to 3.4 per cent. Nationwide and Santander reduced their rates towards the end of last week, with NatWest and Barclays making similar moves today.

Louis Mason, the content and communications director at London-based Oportfolio Mortgages, told Newspage: “If Wednesday’s CPI figures come in as expected, we’ll likely see more lenders shuffling their rates around, but let’s not get carried away just yet.

How has inflation changed in recent years? | ONS

How has inflation changed in recent years? | ONS How has the base rate changed in recent years? | CHAT GPT

How has the base rate changed in recent years? | CHAT GPT “What we’re likely to see is a slightly less boring version of the usual cautious tweaking. Nationwide and Santander’s moves last week were more like testing the water with their toes than diving in headfirst.”

He urged those approaching the end of their fixed terms to abandon hopes of timing the market perfectly. “Stop waiting for the perfect moment because it doesn’t exist. Lock in a rate now,” Mr Mason advised.

Richard Davidson, a mortgage advisor at onlinemortgageadvisor.co.uk, emphasised the importance of prospective homebuyers acting promptly based on recent experience.

He shared: “The best advice for borrowers, based on recent years’ experience, is to always lock in rates when possible. While rate predictions are abundant in the current landscape, we’ve seen that unexpected events can easily disrupt them.”

Borrowers able to secure more competitive deals could see even bigger gains | GETTY

Borrowers able to secure more competitive deals could see even bigger gains | GETTYMr Davidson noted that economic data tends to be priced into markets ahead of time, meaning inflation figures, gross domestic product (GDP) or Bank of England decisions rarely cause immediate rate movements unless results prove surprising.

Rohit Kohli, the director at Romsey-based The Mortgage Stop, highlighted that many borrowers remain unaware of their options.

He explained: “Most lenders will let you lock in a rate and switch to a lower one before completion if pricing improves.

“Many borrowers still don’t realise that flexibility existed.”