MPs urged to ‘examine’ triple lock payment hike due to ‘intergenerational fairness’

State pensions will be awarded a payment rate boost later this year; however, MPs are being called to “examine” whether the triple lock is the “best mechanism for delivering intergenerational fairness”.

New analysis from wealth manager Quilter reveals that typical workers effectively turn a profit on their state pension from the Department for Work and Pensions (DWP) within seven years of stopping work.

The research indicates that someone retiring at the expected future pension age would recoup all their lifetime National Insurance payments by the time they reach 76.

Office for National Statistics (ONS) data shows that men aged 30 today can anticipate living until 85 on average, while women of the same age have a life expectancy of 88.

MPs are being called to ‘examine’ the state pension triple lock

|

GETTY

This means most retirees stand to receive substantially more from the state pension than they ever contributed through National Insurance during their careers.

The findings have reignited debate over whether the triple lock guarantee remains financially viable for future generations.

According to Quilter’s calculations, a 30-year-old currently earning the national average salary of £39,000 will pay approximately £274,000 in National Insurance over their working life once inflation adjustments are applied.

Those on median earnings would reach the break-even point within seven years of claiming their pension. Higher earners face a longer wait, with those on £50,000 taking eight years to recoup their contributions, while £100,000 earners require 11 years.

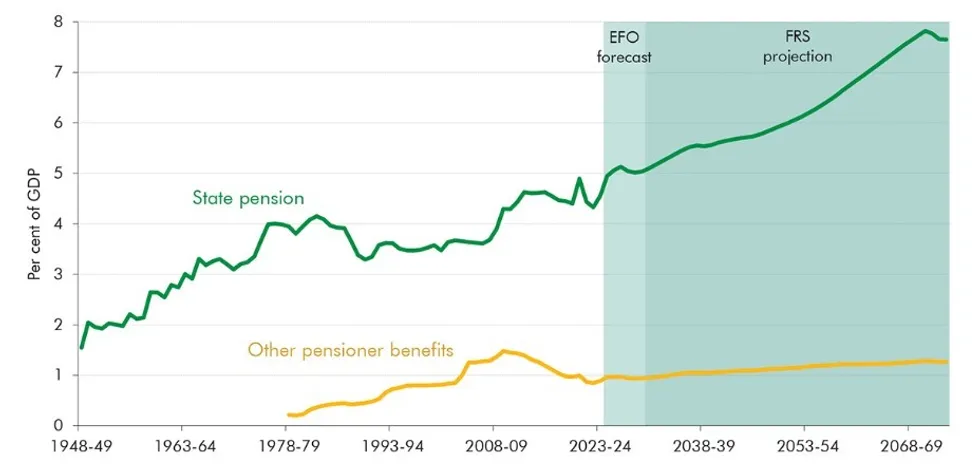

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR The analysis assumes the state pension age will have risen to 69 by the time today’s 30-year-olds retire. It also factors in annual wage growth of three per cent and inflation running at 2.5 per cent. Currently, the pension age stands at 66 and is scheduled to increase to 68 by 2046.

State pension expenditure reached £146billion this year, accounting for roughly 45 per cent of total benefit spending. Costs are projected to climb a further 18 per cent to £172billion by 2029-30.

Adam Cole, a retirement specialist at Quilter, said: “The triple lock has delivered sizeable cash increases in recent years, yet its rigid design means the state pension continues to rise faster than earnings in certain economic conditions.”

He warned this “risks eroding confidence in the system’s long-term affordability” and called on policymakers to assess whether the mechanism still delivers fairness between generations.

Mr Cole shared: “Now is the moment for policymakers to examine whether the triple lock remains the best mechanism for delivering intergenerational fairness.”

Sir Steve Webb, a former pensions minister now at consultancy LCP, argued the triple lock was never intended as a permanent fixture.

He suggested it should continue until the state pension reaches one third of average earnings, then be locked at that level.

The DWP dismissed Quilter’s analysis, with a spokesman stating: “We do not recognise these figures. It is not possible to calculate a single figure as each individual’s contributions are different.”

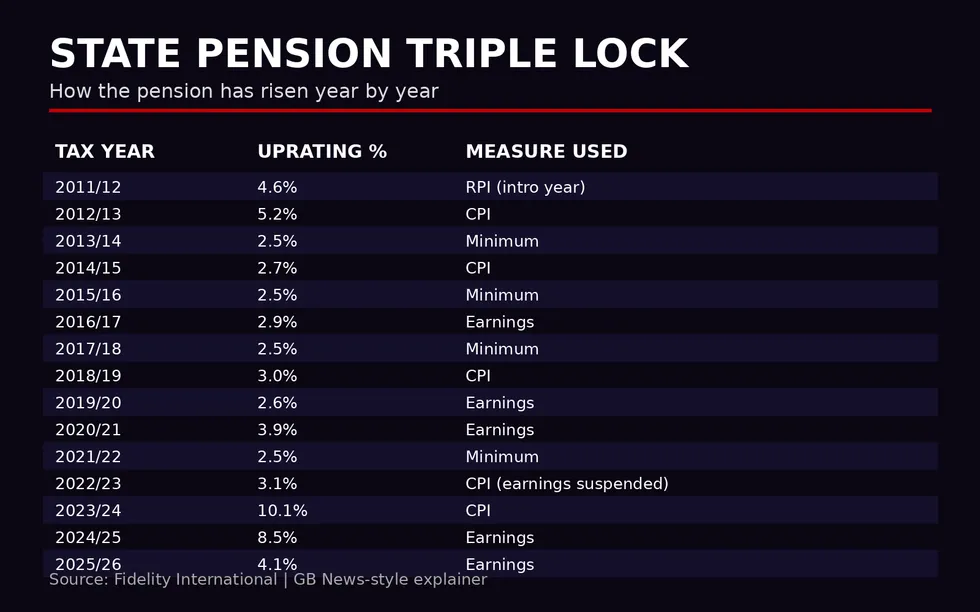

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL The spokesman reaffirmed that the triple lock remains a manifesto commitment for this Parliament, adding: “We remain committed to giving pensioners the security they deserve in retirement.”

Under the triple lock mechanism, state pension payment rates increase annually by either the rate of inflation, average wage growth, or 2.5 per cent; whichever is the highest.

Labour pledged to maintain the triple lock in its election manifesto and is not thought to be contemplating any alterations while in office.

Reform UK leader Nigel Farage indicated his party would determine its stance on the policy ahead of the next general election, leaving open the possibility of a different approach to pension guarantees.