‘Star performer asset of 21st century!’

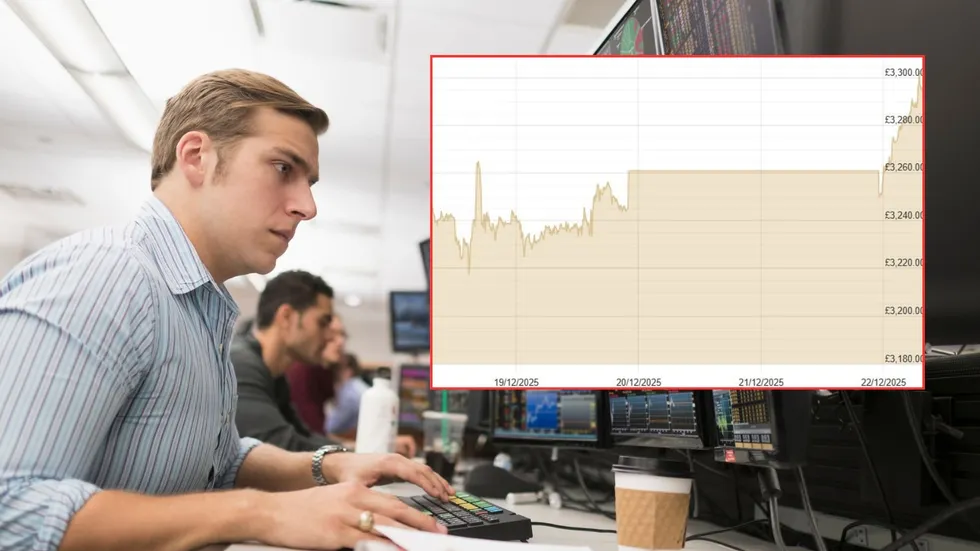

The price of gold broke $4,440 (£3,279.06) per ounce earlier today, propelled by anticipation of additional interest rate reductions from the US Federal Reserve following this month’s quarter-point cut.

The precious metal has climbed 67 per cent this year, significantly outpacing other major asset classes. A weakening dollar has made bullion more affordable for international purchasers, further fuelling demand.

Geopolitical tensions and trade disputes, resulting from US President Donald Trump’s sweeping tariffs, have reinforced gold’s traditional role as a refuge for nervous investors.

Strong purchasing activity from central banks worldwide has provided additional support, while markets are now factoring in two further American rate cuts during 2026.

Gold price is skyrocketing as 2025 comes to an end

|

GETTY / GOLD

Chris Rudden, the head of Investment Consultants UK at digital wealth manager Moneyfarm, said: “AI may dominate headlines, but gold has quietly been the 21st century’s star performer.

“Since 1999, gold’s value has risen more than elevenfold, compared to a 6.8-times increase for the S&P 500. Just this year gold has risen more than 50 percent.”

Economists note the comparison underscores how the yellow metal has dramatically outperformed equities over the past quarter century, but other metal assets have also performed well as of late.

Silver has likewise enjoyed remarkable gains, with prices surging by 117 per cent at certain points during the current year, and is being considered a safe asset amid trade

Analysts predict gold could be valued as high as $5,000 in 2026 | GOLDCORE

Analysts predict gold could be valued as high as $5,000 in 2026 | GOLDCORE David Morrison, a senior market analyst at Trade Nation, noted that the precious metal’s advance has been gradual but consistent, with technical indicators suggesting further upside potential.

“While gold continues to hover just south of all-time highs, the MACD is around a third of the level it hit when gold was last up here two months ago,” the analyst observed.

However, Mr Morrison urged caution among investors during the festive period, warning that reduced trading volumes could amplify price swings over the holiday season.

A resurgent dollar or wave of profit-taking over Christmas could fundamentally alter the technical picture, he cautioned, advising investors to maintain disciplined risk management.

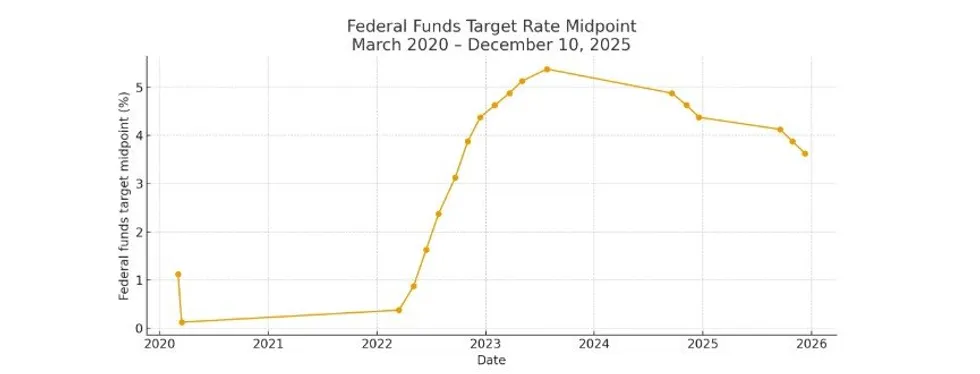

The Federal Reserve’s Federal Open Market Committee (FOMRC) reduced borrowing costs by a quarter percentage point earlier this month, marking its third such cut this year.

The decision proved contentious, with the rate-setting committee voting nine to three in favour of lowering interest rates to between 3.5 and 3.75 per cent. Such division is unusual for a body that typically reaches unanimous agreement.

Fed officials face mounting challenges as the economy contends with tariffs, workforce changes stemming from immigration enforcement, and substantial government spending reductions.

The central bank’s task has been complicated further by gaps in economic data collection caused by the government shutdown, while President Trump considers his options for the next Fed chair.

How has the Federal Funds Rate changed? | Federal Reserve / Chat GPT

How has the Federal Funds Rate changed? | Federal Reserve / Chat GPT Reacting to the Fed’s decision, Rathbones’ head of market analysis John Wyn-Evans said: “One of the few remaining uncertainties for investors to negotiate before the end of the year was the final Federal Reserve FOMC meeting of 2025.

“Although, after much indecision, market expectations were pitched at a 90 per cent probability of a cut, voting members were still going to have tread carefully between concerns about a slowing labour market on the one side and persistently above-target inflation on the other.”

On whether 2026 will see similar stock rallies to past years, Fidelity International’s investment director Tom Stevenson said: “After three years of rising prices, stock markets may struggle to hold onto their gains in 2026. That is despite a still positive outlook for corporate earnings.

“These have staged an impressive bounce back from the tariff announcements of eight months ago when investors feared that Donald Trump’s reshaping of global trade would hit company profits.”