‘Loyalty to big banks’ could leave YOU nearly £300 worse-off due to low interest rates

British savers who remain loyal to major high street banks are losing out on hundreds of pounds each year, according to fresh analysis from a leading financial comparison service.

Research from Moneyfactscompare reveals that the largest banks pay a mere 1.17 per cent to 1.19 per cent on flexible easy access accounts, while challenger banks offer rates reaching 4.12 per cent.

For someone holding £10,000, this leads to a nearly £300 loss as it translates to earning just £119 annually with a traditional bank versus £412 with a top challenger provider.

Those with the average savings pot of £17,365 face an even starker difference, potentially missing out on £565 in interest by sticking with established lenders.

Savers are being warned to avoid ‘loyalty to big banks’

|

GETTY

Caitlyn Eastell, a personal finance analyst at Moneyfactscompare, said: “Loyalty to big banks can leave savers hundreds of pounds worse off, an amount that many may struggle to spare.

“With savings rates expected to drop further from the peaks seen over the past few years, staying in a low-paying account may amplify the cost, making it harder for savers to reach their financial goals.

“Switching to a lesser-known challenger bank could help offset this, as they often offer more attractive rates. By operating digitally with lower overhead costs, challenger banks can pass on cost savings to customers, giving them the opportunity to improve their returns.

“Savers don’t have to take on additional risk by switching to a smaller or digital provider because many challenger banks are also covered by the Financial Services Compensation Scheme (FSCS), which protects deposits up to £120,000.”

Britons are switching current accounts to take advantage of savings deals | GETTY

Britons are switching current accounts to take advantage of savings deals | GETTY She added: “However, savers should remain alert. Challenger banks often lead the market with headline rates that include limited-time bonuses, sometimes exceeding two per cent.

“Bonus rates reward active switchers, allowing them to access the best rates and boosted returns in the short-term, but they also drive competition between providers, pushing banks to offer better deals all-round.

“Once bonuses expire, rates can fall sharply, so passive savers risk being left behind, and those seeking stability may find these less suitable for long-term planning.”

Earlier this month, TotallyMoney published research conducted by Moneycomms that found that the Big Five Banks are offering an average rate of just 1.17 per cent on their easy access accounts.

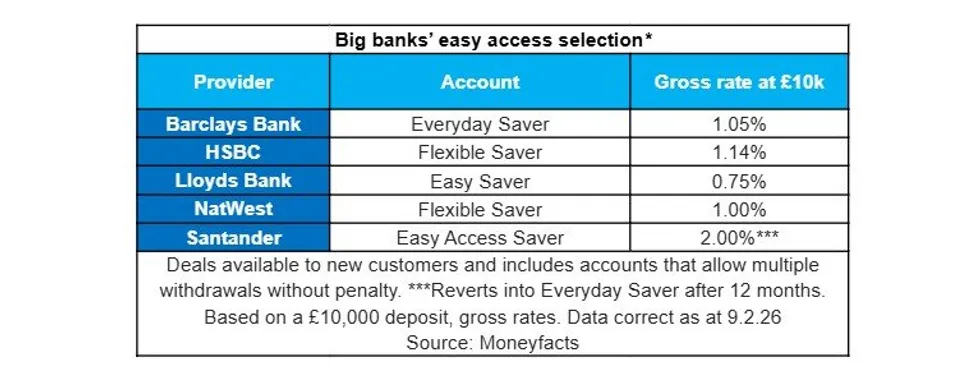

What are big banks offering savers?

|

MONEYFACTSCOMPARE

This is despite the fact savers could get up to 4.11 per cent if they shopped around for better deals with other high street banks and building societies, as well as challenger financial institutions.

Those with the average savings pot of £17,365 face an even starker difference, potentially missing out on £565 in interest by sticking with established lenders.

Alastair Douglas, the CEO of TotallyMoney, added: “Many savings accounts might have the words ‘bonus’, ‘reward’ in them, but the truth is, there’s a high chance that your money will effectively be losing its value due to inflation outstripping the poor interest rate offered by your bank.

“To find out what rate your bank is paying, open your banking app, or check your latest statement – it’ll only take a few minutes, but could make a real difference. Some banks are currently offering more than 4%, and by switching, you can start making your money work for you.”

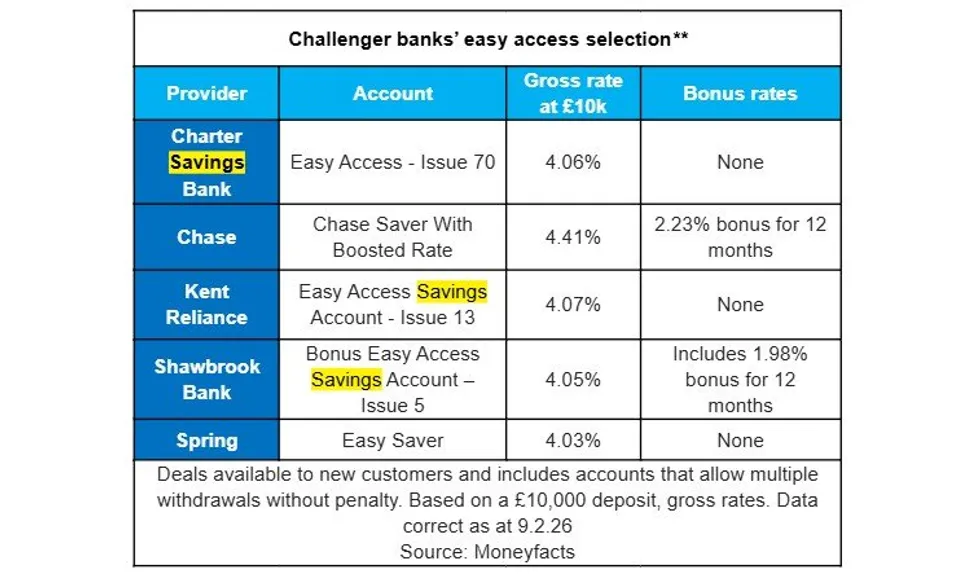

What are challenger banks offering customers?

|

MONEYFACTSCOMPARE

The Bank of England has hiked the UK’s base rate to as high as 5.25 per cent in recent years as part of efforts to ease inflation, however, this has since fallen to 3.75 per cent.

At least one more cut to interest rates from the central bank’s Monetary Policy Committee (MPC) is expected at some point this year, which could see savings deals removed from the market.

Andrew Hagger, a personal finance expert of Moneycomms, shared: “Base rate may be on the way down, but that doesn’t mean you should put up with a shoddy savings rate from your bank.

“Open a new account with a best buy no strings easy access account, and you can still bag a decent return, for example, the Spring Easy Saver is paying 4.11 per cent and can be opened in just a few minutes online, a quick and easy way to boost your savings interest income.”