HMRC warning after 600,000 taxpayers hit by £325m in fines and interest for missing key deadline

Taxpayers now have just five days left to file their self‑assessment returns and settle their bills before the January 31 deadline, with those who miss it risking the same penalties that hit 600,000 people last year.

HM Revenue and Customs (HMRC) issued £325million in fines and interest charges against late filers following the previous deadline, according to analysis by national accountancy firm UHY Hacker Young.

The figures underline the consequences facing anyone who fails to act in time, with advisers urging taxpayers who have not yet submitted their return or arranged payment to do so immediately.

Missing the deadline triggers an automatic £100 fine, while interest of 7.75 per cent begins accruing on any unpaid tax.

If the bill remains outstanding beyond February 28, a further five per cent surcharge is added.

Neela Chauhan, partner at UHY Hacker Young, said the cost of delay can escalate rapidly.

“Initial penalties may be relatively small, but interest and further charges add up and can really start hurting quite quickly,” she said.

The firm warned that HMRC shows no sign of easing its enforcement approach, given the scale of unpaid tax.

Last year, £8.7billion in self‑assessment liabilities went uncollected — 12.5 per cent of the £69.6billion HMRC expected to receive.

Over 600,000 taxpayers hit with penalties after missing deadline

|

GETTY

Across the wider tax system, overdue business and personal taxes now total £44billion, with £37.8billion already in the debt‑collection pipeline.

Ms Chauhan said the Government’s fiscal pressures mean tougher action is likely.

“The Government is facing a fiscal black hole, so they should expect HMRC to become even tougher on tax debt collection,” she said.

Taxpayers who believe they have been wrongly penalised are urged not to simply accept the charges.

HMRC’s self-assessment deadline can be stressful for taxpayers

|

GETTYUHY Hacker Young said many fines are cancelled or reduced to zero on review.

“Penalties are applied automatically, so it is worth checking they are correct,” Ms Chauhan explained.

“Many penalties are overturned when challenged, so it is important to dispute those you believe have been issued in error.”

Those unable to pay in full are encouraged to contact HMRC early to arrange an instalment plan, which allows liabilities to be spread over time.

Such agreements are typically easier to secure before penalties begin to mount, making swift action essential.

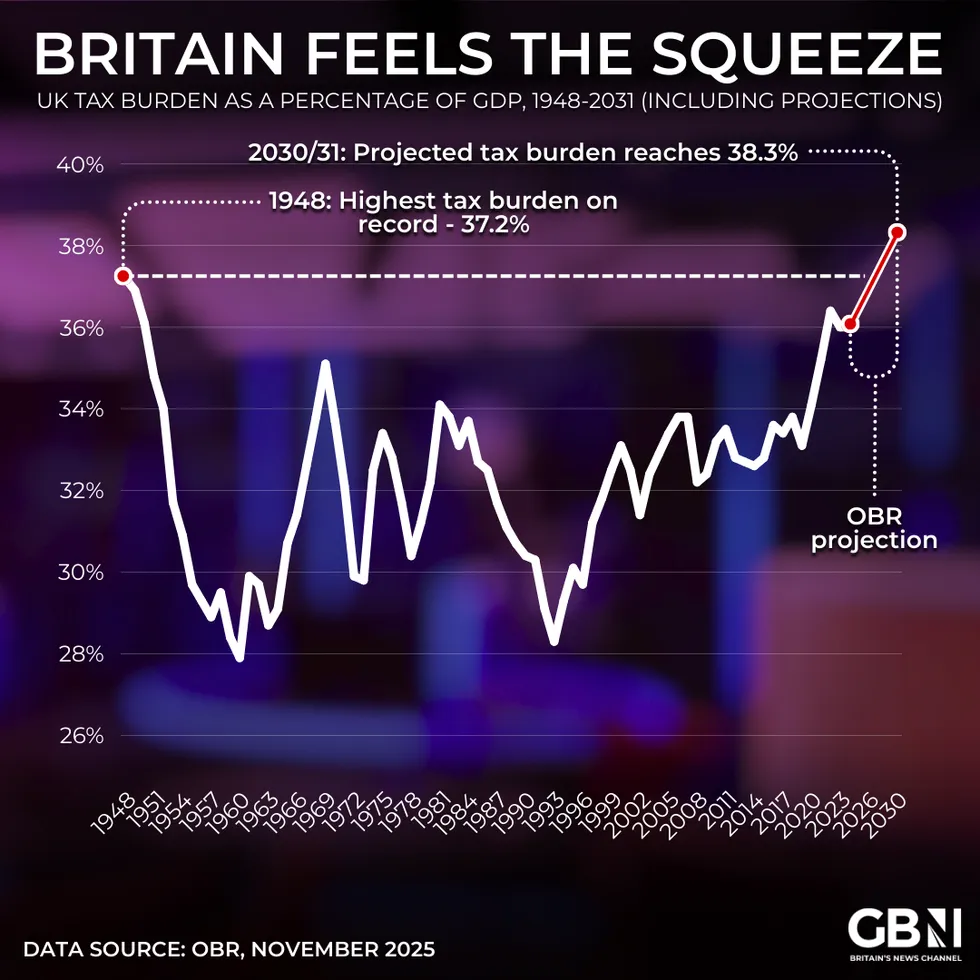

£26billion in tax raids has seen the UK’s tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR

£26billion in tax raids has seen the UK’s tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR

HMRC has issued a warning to taxpayers as new late‑filing rules come into force this month, with missed deadlines now potentially triggering a £200 penalty instead of the long‑standing £100 fine.

The revenue authority is overhauling how it penalises late self‑assessment returns, replacing automatic fines with a points‑based system designed to clamp down on repeat offenders while giving more flexibility to those who miss the occasional deadline.

The new regime is being rolled out initially as a pilot involving 100 taxpayers taking part in the Making Tax Digital programme, but HMRC said it will eventually apply to everyone who files a tax return.

Under the current system, taxpayers receive an immediate £100 fine if they miss the deadline.

Under the new rules, each missed filing date earns a penalty point, with financial penalties only applied once a taxpayer reaches a set threshold.

HMRC said the changes are intended to make the system fairer and more proportionate, while still ensuring that persistent late‑filers face tougher consequences.

While the process can feel daunting, many of the problems people face come down to a handful of avoidable mistakes.

Here, Sophie Graham, a Personal Finance Expert at Sunny, shares seven mistakes to avoid when submitting your Self Assessment.

Self Assessment Tax Mistakes To Avoid

Sophie Graham says: “Self-assessment can feel overwhelming, especially if you only deal with it once a year.

“Most mistakes aren’t about doing anything wrong on purpose, but about missing details or leaving things too late.

“Taking a bit of time to prepare and double-check your return can make the whole process far less stressful.”

1. Leaving your tax return until the last minute

“Procrastination increases the risk of errors, missing information or technical issues. Filing earlier gives you time to gather documents, ask questions and make corrections. Submitting early brings peace of mind.”

2. Forgetting to declare all sources of income

“It’s easy to forget smaller or irregular amounts. Side hustles, freelance work or rental income all need to be declared. Missing income can lead to unexpected tax bills or penalties. Keeping a simple record throughout the year helps.”

3. Missing out on allowable expenses

“Many people pay more tax by not claiming legitimate expenses. Professional fees, office supplies or a portion of household bills may be allowable. Understanding what you can claim makes a real difference. Checking HMRC guidance or seeking advice can be worthwhile.”

4. Making simple calculations or data entry errors

“Wrong figures, incorrect dates or mixing up gross and net amounts are common. These errors can delay processing or trigger queries. Reviewing your return carefully prevents problems. Using accounting software or HMRC’s online checks can help.”

5. Forgetting to budget for the tax bill

“Submitting your return doesn’t mean the cost is taken care of. Many underestimate what they’ll need to pay or forget to set money aside. Planning in advance avoids a last-minute scramble. Spreading savings across the year makes payments manageable.”

6. Overlooking payments on account

“Payments on account often catch people out. These advance payments can significantly increase what’s due in January. Understanding whether they apply prevents surprises. Reviewing previous tax bills helps anticipate them.”

7. Missing the deadline altogether

“Failing to submit or pay on time leads to automatic penalties. Even if you can’t pay straight away, submitting by the deadline is crucial. HMRC offers payment plans. Acting early gives more options and peace of mind.”