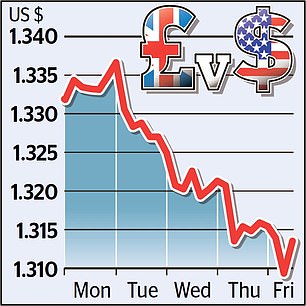

The pound suffered a Halloween horror show yesterday as it slumped to its worst week against the dollar since January.

Worries about the Budget as well as increased bets on a Bank of England interest rate cut next week have been weighing on the currency.

Sterling briefly sank below $1.31, its lowest level since April’s tariff-driven market turmoil. It ended down 1.3 per cent for the week – the worst since January – and has fallen 2.3 per cent over the course of October, marking its worst month since July.

It has also been on the back foot against the euro, hovering yesterday at close to €1.13, a two-and-a-half year low.

The pound’s fall, at a time when many families have been enjoying a half-term break, will have made life more expensive for those who have gone abroad.

Traders have increased bets on a rate cut when the Bank of England’s Monetary Policy Committee (MPC) meets next week.

Falling: The pound slumped to its worst week against the dollar since January

Experts at Goldman Sachs and Nomura expect a quarter-point cut, though others still believe officials will hold off. Financial markets see a one-in-three chance of a move, which would take Bank rate down from 4 per cent to 3.75 per cent. The chances of a pre-Christmas cut by December are seen as closer to 50/50.

It marks a significant change since a couple of weeks ago, when the chance of a November cut seemed small and it was viewed as being much more likely that there would be no move until the new year.

But since then, official figures have shown inflation coming in lower than expected – remaining at 3.8 per cent in September rather than rising to 4 per cent as feared.

Economists at Goldman Sachs also pointed to sluggish jobs, wage and growth data as making a cut more likely. And the deteriorating picture for the public finances has increased the likelihood of painful tax hikes and spending cuts at the Budget on November 26.

Signals from the Bank of England have been mixed, with governor Andrew Bailey recently underlining the weakness in the jobs market, but chief economist Huw Pill taking a more hawkish line by emphasising the need to keep inflation under control.

Matthew Ryan, at global financial services firm Ebury, said: ‘A combination of Budget jitters and rising bets in favour of a December rate cut from the Bank of England have kept sterling firmly on the back foot so far this week.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.