Experts are sounding the alarm over a potential financial crisis as millions are “opting to save in cash for retirement” instead of using private pension pots and salary sacrifice initiatives.

Research from interactive investor has found that more than half of working adults in the UK are building retirement savings beyond their current workplace pension schemes.

Despite this growing trend, analysts are reminding Britons that cash savings are being “eroded”, and better returns could be accrued with a stocks and shares ISA.

Camilla Esmund, the senior manager at interactive investor, said pension policy has dominated headlines throughout the past year, particularly ahead of last month’s Autumn Budget.

Britons are urged not to ‘opt to use cash for retirement’

|

GETTY

“Speculated reforms to the retirement landscape raised concerns over the future of pensions, potentially undermining them as an important tool for long-term financial resilience,” she explained.

Notably, Ms Esmund pointed to ongoing changes to pension regulations as a key factor eroding confidence among savers.

“It’s clear from our research that the constant tinkering of the pension rules is harming public trust in pensions, disincentivising retirement saving, and risks widening the glaring pension engagement gap we have in the UK,” she said.

“Without urgent action to support savers, millions may reach later life without enough money to live comfortably.”

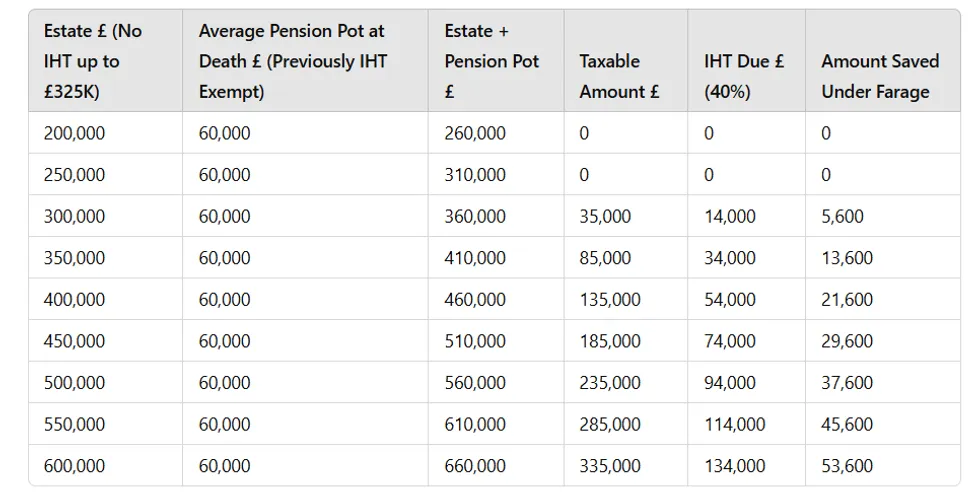

How much could you save? Pension pot | GBN

Ms Esmund acknowledged that pensions remain fundamental to securing one’s financial future, offering unique benefits including employer contributions, upfront tax relief, and a 25 per cent tax-free lump sum.

“However, it’s concerning that so many are opting to save in cash for retirement,” she said.

“Higher interest rates give the impression that cash savings are a good long-term option, but interest historically lags behind investment growth.

“This means the value of cash typically erodes over time. While it makes sense to have an adequate cash buffer, people risk missing out on years of investment compounding and could materially damage their retirement prospects.”

She warned that the real value of cash tends to diminish over time which means Britons should go out their way to make their money go further. Those who favour cash accounts risk forfeiting years of compound investment returns, which could “materially damage their retirement prospects,” Ms Esmund added.

Stocks and shares ISAs offer distinct advantages for those willing to accept greater risk in pursuit of stronger long-term returns, according to Ms Esmund.

Investors using these accounts benefit from tax-free growth and dividends, accelerating the expansion of their savings pot.

Unlike pensions, ISAs provide immediate access to funds, giving savers valuable flexibility. The tax-free nature of withdrawals also helps stretch retirement income further.

Ms Esmund noted that bringing multiple investments together on a single platform can improve oversight and cost management.

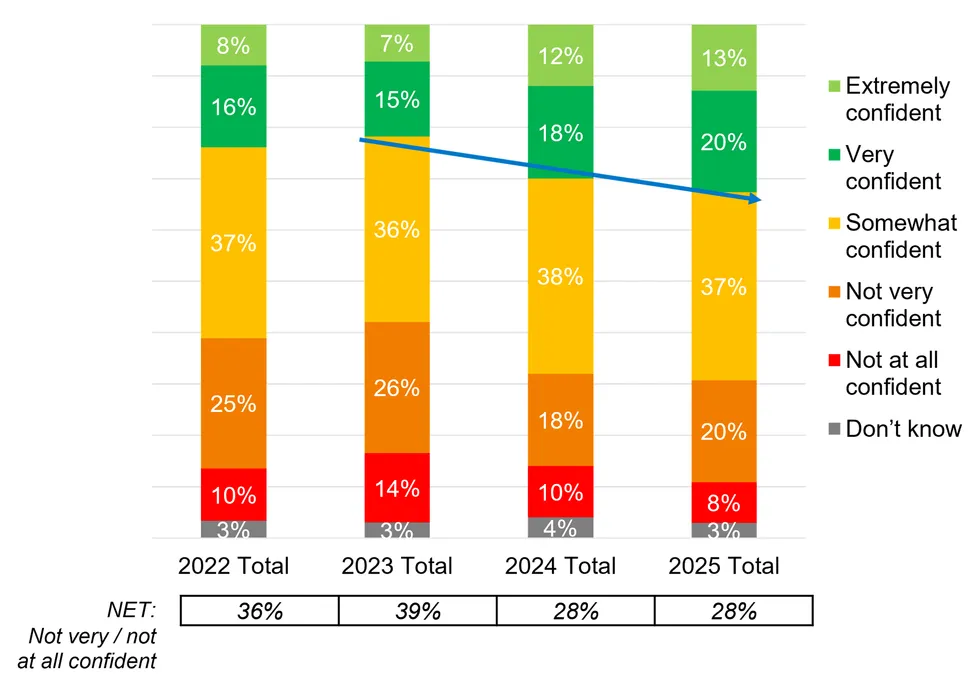

How confident are Britons about their pension savings? | AEGON

Carina Chambers, a pensions technical expert at Moneyfarm, added: “Taking control of your pension is one of the most valuable gifts you can give your future self. The end of the year is the perfect time to reflect on your goals and make sure your pension is working hard for you.

“By making pension reviews a regular part of your routine, alongside consistent contributions and thoughtful planning, you can set yourself up for a secure and enjoyable retirement. The earlier you start, the more you can benefit from the power of compounding growth, turning today’s decisions into tomorrow’s opportunities.

“As we wrap up another year, adding a pension review to your list of priorities could be the best present you give yourself. Like good planning for Christmas throughout the year, your pension works best when you check in regularly, make consistent contributions, and adjust your strategy as life evolves.

“Every pound you invest today could multiply many times over by the time you retire, making your pension the gift that truly keeps on giving.”