HM Revenue and Customs (HMRC) is bringing on board 1,000 valuation specialists as the Government gears up to enforce its new “mansion tax” on high-value residential properties exceeding £2million.

Chancellor Rachel Reeves unveiled plans for this council tax surcharge targeting expensive homes in England during last year’s Budget, with the levy scheduled to come into effect from April 2028.

The Valuation Office Agency (VAO), the Government body responsible for determining council tax bands across England and Wales, will be merged into HMRC from April this year.

Approximately 200,000 properties face reassessment under the incoming policy, with the valuation process anticipated to commence from later this year.

HMRC is understood to have hired 1,000 valuation officers ahead of the ‘mansion tax’ introduction

|

GETTY

Owners of properties valued at £2million or above will face an annual charge added to their council tax bills once the policy takes effect.

The surcharge begins at £2,500 per year for homes at the threshold, with the amount increasing based on property value.

Those with residences worth £5million or more will pay the highest rate of £7,500 annually.

The VOA has indicated it will deploy professional valuers to assess homes potentially subject to the new charge, alongside additional support staff.

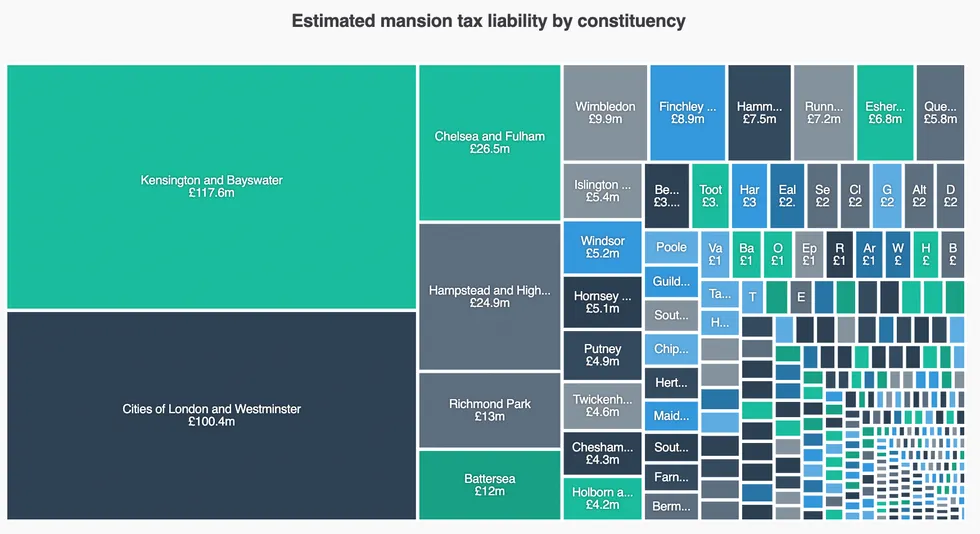

Estimated mansion tax liability by constituency | Tax Policy Associates

Estimated mansion tax liability by constituency | Tax Policy Associates Are you worried about a ‘mansion tax’ from Labour? | GETTY

Are you worried about a ‘mansion tax’ from Labour? | GETTYFurthermore, the VOA has confirmed that properties worth £1.5million will also undergo assessment to ensure no homes are overlooked, according to its chief executive Jonathan Russell.

Speaking at a Treasury select committee hearing last month, Russell stated that between 150,000 and 200,000 houses could fall within scope, with all properties previously valued up to £5million being rechecked.

Shadow local government secretary Sir James Cleverly questioned the government on staffing allocation, asking how many of the 1,000 new recruits would work specifically on the council tax surcharge.

Labour MP Dan Tomlinson responded on Monday that the VOA is still developing its resourcing plans and cannot yet confirm specific numbers.

HMRC is understood to be ‘working’ to ensure no tax is paid on state pensions for certain Britons | GETTY

HMRC is understood to be ‘working’ to ensure no tax is paid on state pensions for certain Britons | GETTY Property experts have cautioned that the mansion tax could spark a flood of valuation disputes, including Craig Hughes, the head of Private Client Services at Menzies LLP.

He shared: “Introducing a mansion tax adds further complexity into the property market and could have unintended consequences for homeowners and the wider economy.

“High-value properties often form part of long-term financial planning, and repeated changes to tax regimes create uncertainty for both current owners and prospective buyers. This uncertainty risks discouraging investment, which could slow activity in the upper tiers of the housing market.

“The revenue generated is modest relative to the overall tax base, and yet the broader economic effects – reduced mobility, increased transactional friction, and potential downward pressure on property values – may ultimately outweigh fiscal benefit.”