Pressure on BP chief executive Murray Auchincloss to speedily deliver returns to investors may finally be easing after a recovery in the group’s dismal share price and an epoch-changing oil discovery in Brazil.

The British oil company has been under intense pressure from activist investor Elliott Management for a step up in performance, and has been the subject of intense takeover speculation, with UK-based rival Shell seen as the most likely bidder.

But with its third-quarter figures due on Tuesday, there is growing confidence that Auchincloss and the group’s newly selected chairman Albert Manifold, who took the helm on October 1, are finally managing to get the energy giant back on an even keel.

The results are expected to show production will be higher than in the second quarter but down on a year ago. Broker estimates point to revenue of £47.8 billion for the three months to September.

While Auchincloss’s job appears to be safe for the moment, he still needs to convince the new chairman that BP can deliver on pledged cost savings, bring down its debt pile of £19.8 billion and continue to make share buybacks.

If he doesn’t succeed, it is often the job of a new chairman to deliver the head of an underperforming chief executive.

New dawn: Chief executive Murray Auchincloss has been under pressure from activist investors to turn the FTSE 100 company’s fortunes around

Manifold had a reputation for a steely focus on the bottom line and shareholder returns in his previous job as chief executive of construction and building materials group CRH, so he is unlikely to have any qualms about executive defenestration should the need arise.

BP has been through a torrid time following the departure of former chief executive Bernard Looney in 2023 and the replacement of chairman Helge Lund this year. Both men were key architects of the oil group’s overzealous switch to green energy which it is now scrambling to reverse.

The combination of changes at the top, a rapid reversal of the climate change agenda and aggressive demands from Elliott, which still owns 5 per cent of the group, led to intense takeover speculation earlier this year and a blunt denial from Shell that it had any interest in a merger deal.

The Shell statement in June stopped it from tabling any bid for six months under UK takeover rules, so it is still possible that it could come back when the lock-up expires on Boxing Day.

Comments from Shell boss Wael Sawan last week that the firm was interested in potential deals may have raised eyebrows in this regard, although he ruled out any ‘big-scale’ takeovers.

It is known, however, that BP did seek a joint venture with Shell’s exploration bosses on a discovery off Brazil in an effort to lower its costs developing the oilfield.

Shell declined the offer – a decision it may now be regretting given the extent of the Brazilian find.

In an update last week Gordon Birrell, BP’s vice president of production, was effusive about its scale, which was twice as large as previously thought.

The Brazil find is the biggest by BP in a quarter of a century and underpins the group’s reputation for being among the world’s leaders in oil exploration.

Criticism of BP’s strategy by Elliott has also calmed for the moment, with the activist currently focusing instead on shaking up drinks giant Pepsi-Cola.

But Elliott and Auchincloss are still out of step on BP’s spending programme. The chief executive is sticking with plans to spend £12 billion to £13.7 billion a year.

Elliott wants to see the outlays trimmed to £10.7 billion to £11.4 billion. But for now, the activists may have been satiated by a bounce in BP’s stock price.

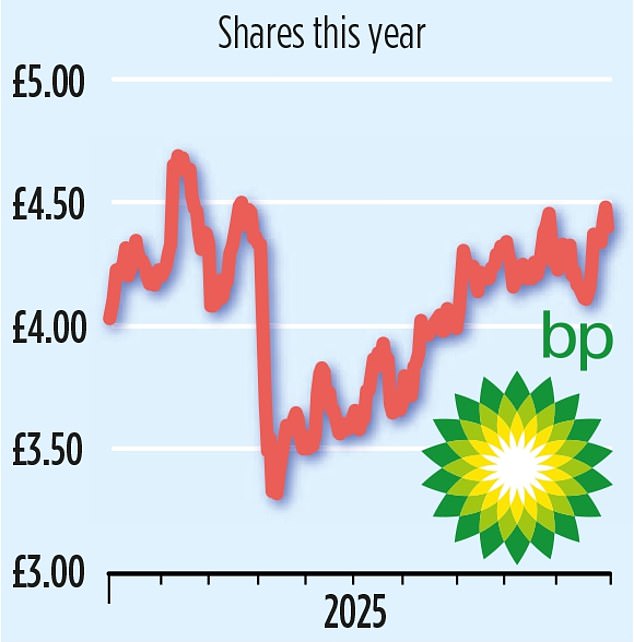

The shares have climbed nearly 20 per cent over the past 12 months and the company’s market value has improved by almost £10 billion since a nadir in April.

BP is also able to show that a fatter spending programme can bring rich rewards. In addition to the Brazil discovery, 2025 has been a strong year for the oil and gas divisions with six major project start-ups and an improvement in the reliability of its plants and refineries.

One potential snag, however, is Auchincloss’s commitment to delivering some £2.3 billion to £3 billion of asset sales this year as part of the effort to reduce debt. An overall decline in oil prices this year and a lack of enthusiasm for green energy amid a backlash against net-zero policies mean BP may struggle to achieve the hoped-for returns.

The group’s balance sheet has been under strain since 2010 when the Deepwater Horizon explosion in the Gulf of Mexico gobbled up £50 billion.

It also had to absorb an expensive write-down of £18 billion in its stake in Russian oil group Rosneft following the war in Ukraine, which had previously been a cash gusher for the group.

So while the share price may have recovered and some immediate threats have receded, it won’t take much for the pressure on BP’s bosses to ratchet back up.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.