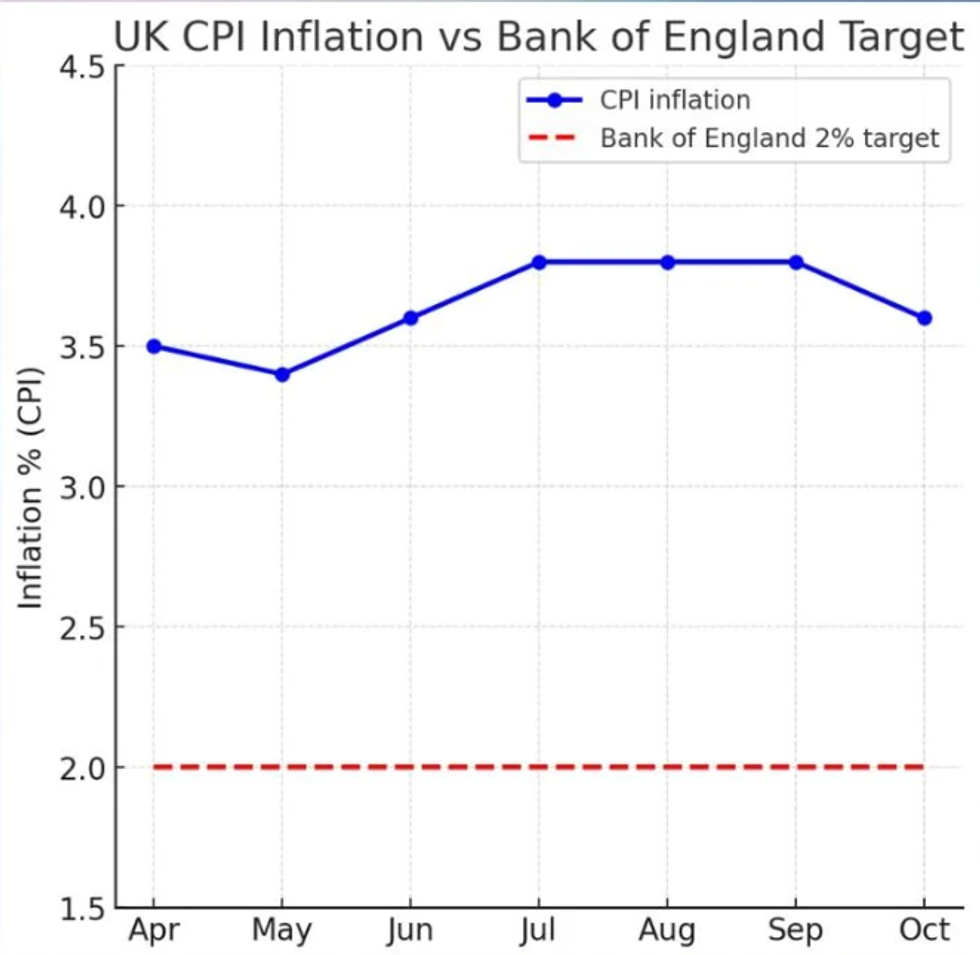

UK inflation eased to 3.6 per cent in October after hitting 3.8 per cent the previous month, according to new figures from the Office for National Statistics (ONS).

The slowdown is offering mixed fortunes for British households.

GB News looks at the implications for mortgages and food prices as consumers attempt to navigate the winter months.

Food costs

The strain continues to be felt as supermarket checkouts – even as the overall rate of price rises cools.

Essential food items remain stubbornly expensive, pushing the weekly shop higher for millions of people.

Food shopping remains a particular pressure point for households.

Key staples are rising sharply in price, leaving families facing higher bills on everyday essentials.

Danni Hewson from investment platform AJ Bell said: “Staples like bread, meat and potatoes all cost more than they did even a month ago.”

Fruit prices edged down slightly, but the fall offers limited reassurance for households facing persistent rises across most of their basket.

Grocery inflation is continuing to outpace the headline rate.

The Bank of England’s research has found that families are still buying similar quantities of food despite the higher costs.

In a statement, the central bank said: “Concerns about rising food costs and utility bills still dominate conversations.”

Supermarket shopping still feels expensive despite inflation cut

|

GETTY

“Households continue to change their shopping habits to reduce spending, such as buying more vegetables and reducing meat consumption.”

Its research indicates shoppers are becoming increasingly resourceful as they try to stretch budgets.

People appear to be purchasing broadly the same volume of food but paying much more for it.

The shift towards more vegetables and less meat reflects efforts to limit the impact of rising costs on household finances.

The fall will feel like a small boost to the Chancellor

|

ChatGPT

Mortgage rates

Homeowners and prospective buyers however, are experiencing a different picture.

Cooling inflation has encouraged major mortgage lenders to cut rates as many anticipate the Bank of England could lower interest rates in December.

Alice Haine from Bestinvest said: “Inflation remains well above the Bank of England’s happy place of two per cent.”

She added that the new inflation figure could pave the way for a sixth rate reduction since August last year.

The Bank uses its benchmark rate to steer inflation towards its two per cent target.

With inflation at three point six per cent, analysts expect the Bank to have more room to ease policy.

David Hollingworth from mortgage brokers L&C said: “There has been particular emphasis placed on rates for home movers with some of the best rates available for purchases.”

Financial information service Moneyfacts reports that the average two-year fixed mortgage is now at four point eight eight per cent. Five-year fixed deals average 4.3 per cent.

Mortgages are becoming cheaper for consumers

|

GETTYFirst-time buyers are also benefiting. Those with five per cent or 10 per cent deposits are seeing some of the most favourable rates in two to three years.

Lenders typically experience quieter business in the run-up to Christmas and have been cutting rates to attract customers during the slower period.

Market activity is additionally being shaped by the upcoming Budget on November 26.

Many buyers and sellers are waiting to see what Chancellor Rachel Reeves announces before making major financial decisions.