The headteacher of a Dudley school, forced to close after Labour’s Budget last year, has told GB News the removal of VAT exemption for private schools has been “devastating”.

Chancellor Rachel Reeves said the introduction of VAT on private school fees and removal of their business rates relief would raise £1.5 billion to provide the “highest quality of support and teaching” to children who attend state schools.

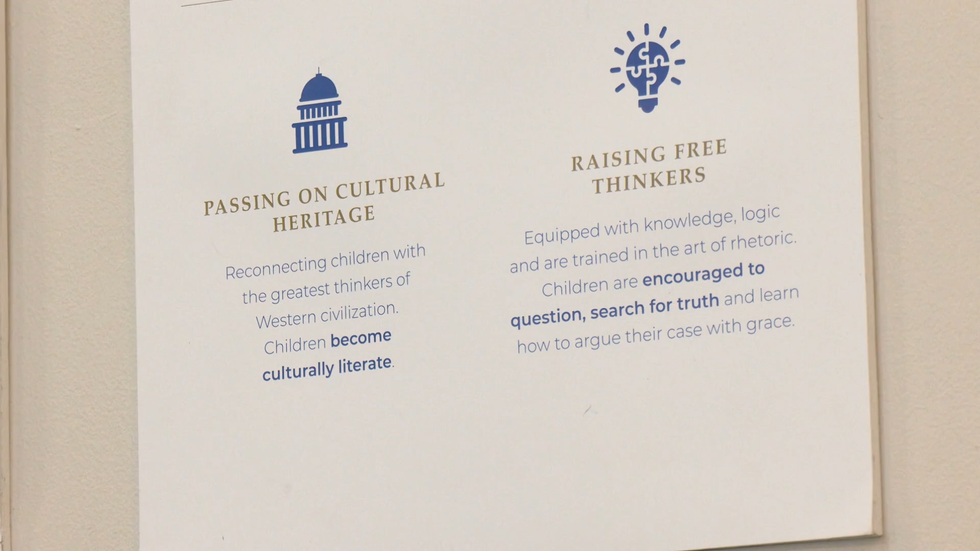

The King Alfred School was said to be “the flagship for classical education in the UK” at a price “affordable for working parents”.

Back in January, GB News visited the school to see how children were taught a curriculum which celebrated British history, philosophy and Christianity from an early age.

Former Headteacher, Hayley Bowen, says the changes saw 50 per cent of students leave in their last year.

She said: “It was completely and utterly devastating because we were just about to purchase a bigger building for our school and expand into secondary education.

“To go from that kind of momentum to then VAT coming in, we lost 50 per cent of our children in that final year. It just wasn’t feasible.

“They’re families who just want the best for their children and that’s who it’s really hit the hardest and it’s just so sad.”

Ms Bowen told GB News the decision to close the school was not taken lightly

|

PARLIAMENT / GB NEWS

Named after the ninth-century King of Wessex, who brought in a number of educational reforms during his reign, the school was part of the Classical British Education group.

Ms Bowen told GB News she believes the traditional teaching methods which the school were built on are not a priority for the Government.

She said: “It seems to be that they are providing more and more of what I would call the basic parenting aspects of school, rather than really striving for robust and strong academics.

“Our school was quite different in the fact that it was pens and paper, and the teacher teaching at the front, and I think that a lot of people wanted that.

The school prided itself on raising free thinkers

|

GB NEWS

“I think they’re sick of their children being glued to devices.”

Labour says the change to VAT on fees will help fund 6,500 new teachers and boost state education. For the former Dudley school headteacher, there’s still hope the school will open again in the future.

She told GB News: “We never wanted to close the school, it took us the best part of ten years in trying to develop this and piloting the return to a traditional type of education.

“The way the systems are with the Department for Education and Ofsted, and all the hoops that you have to jump through to comply, they almost make it like it’s not worth doing.”

Ms Bowen sat down with GB News’s Jack Carson

|

GB NEWS

In August, it was revealed that over 50 private schools have closed since Labour imposed VAT on private school fees.

The move was promised in Labour’s election-winning manifesto with the party saying it was a “revenue-raising” measure.

The Government expects to raise around £1.6 billion a year as a result, which it plans to pump back into state education.

In January, the number of pupils in independent schools in England fell for the first time since the Covid-19 pandemic, according to Government figures.

Over 11,000 pupils left independent schools in England, with the total dropping from 593,486 in 2023 to 582,477 in January this year, marking a 1.9 per cent fall.

Despite the introduction of VAT on school fees, the number of independent schools rose slightly from 2,421 in January last year to 2,456 in January this year.

A Department for Education spokesman said: “Ending tax breaks for private schools will raise £1.8billion a year by 2029-30 to help fund public services, including supporting the 94 per cent of children in state schools to achieve and thrive.”

“The number of children in independent schools has remained steady, while the most recent data shows the rate of families getting a place at their preferred secondary school is at its highest in almost ten years.”