More than half of adults, equating to some 28.8million people, have used AI tools to help manage their money over the past 12 months, research reveals.

Personal finance is now the number one usage of AI in the UK, research from Lloyds Bank claims, as people head to chatbots for help with budgeting, saving and financial education.

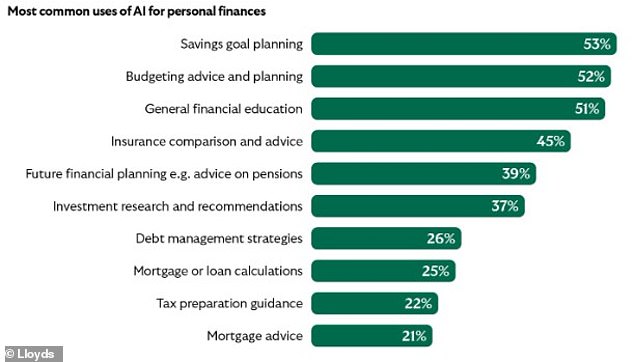

The most common use of AI for personal finance is to help plan savings goals, it said, with 53 per cent using the tech for this purpose. Some 52 per cent use AI to plan budgets, and 51 per cent for financial education.

However, AI is also being used for future financial planning, investment research, debt management and tax preparation.

Some 45 per cent said they have used AI for insurance comparisons and advice, while 39 per cent and 37 per cent used it for future planning and investment research, respectively.

The figures come after research from Checkout.com indicated that two out of five households would let AI spend their money for them if it meant they could save time on menial tasks like paying bills.

Go-to: Nicola, 34, from Brighton, says AI is her first port of call for financial help

Lloyds says as many as 87 per cent of people are now confident using the internet, an increase of four million people over the past five years. With this, the number of those using mobile banking apps has tripled to 21million.

Jas Singh, chief executive of consumer relationships at Lloyds said: ‘AI is rapidly transforming how people manage their money, with the potential for millions of consumers to feel more confident and in control of their personal finances.

‘From everyday budgeting to planning for the future, we’re already seeing people use the technology to make smarter choices and build financial resilience.’

The main barrier with AI, Lloyds says, is a lack of trust, with 83 per cent concerned about their data privacy and eight in 10 worried about receiving outdated information.

Some 70 per cent say they are concerned about a lack of tailoring to their personal circumstances.

Singh added: ‘As AI becomes a bigger part of our financial lives, trust is the next frontier. People want to be sure the information they receive is accurate, secure and truly tailored to their needs.

‘That’s why banks have a vital role – not just in providing cutting-edge technology, but in combining it with trusted expertise and a deep understanding of our customers.’

‘Our focus is on building tools people can genuinely rely on – helping everyone to benefit from the confidence and clarity that digital solutions bring.’

Help: Some 45% said they have used AI for insurance comparisons and advice

‘ChatGPT is my first port of call’

For 34-year-old Nicola, a data analyst from Brighton, AI has become the first place she goes for help with her finances.

She said: ‘Apps are a way of life for me. I use them all day, every day to manage everything from planning our home renovation to managing my banking.’

Nicola says ChatGPT has helped to to find a reward credit card that fits her needs, with AI explaining to her the benefits and application process of various options.

‘It was so quick. If I’d tried to do that research myself, it would’ve taken ages,’ she said.

Finances can be a bit overwhelming, but I feel like it’s educating me

‘I can find more competitively priced flights, plan holidays, access fitness plans and recipes. ChatGPT is now my first port of call.

‘Friends and colleagues were talking about it, and I was a bit sceptical at first. I thought: “Is it safe? What data are they storing?” But once I started using it, I realised – this is amazing. You can literally type anything into it.’

Nicola added: ‘I’m really keen on tech that helps with budgeting and tracking spending. It’s useful to see: “These are your bills, this is what you spent on petrol, this is what you spent on clothes last month”.

‘When you’ve got loads of transactions, it can be difficult to keep track, but these tools can make sense of it.

‘I’ve also used AI when remortgaging to find out the best time to look for a new deal, and to understand some of the terminology. Finances can be a bit overwhelming, but I feel like it’s educating me.’

SAVE MONEY, MAKE MONEY

Sipp cashback

Sipp cashback

£200 when you deposit or transfer £15,000

4.53% cash Isa

4.53% cash Isa

Trading 212: 0.68% fixed 12-month bonus

£20 off motoring

£20 off motoring

This is Money Motoring Club voucher

Free shares bundle

Free shares bundle

Get free UK shares worth up to £200

4.45% Isa with bonus

4.45% Isa with bonus

Now with no penalty for withdrawals

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence. Terms and conditions apply on all offers.