The Ftse 100 and other global stock markets plummeted this morning as US President Donald Trump ramped up his aggressive efforts to take over Greenland from Denmark.

Investors appear spooked by the Trump administration’s threats to levy tariffs on European countries, including the UK, in a move that could significantly damage British businesses.

Chancellor Rachel Reeves withdrew her scheduled appearance at the London Stock Exchange for when markets opened today, in order to appear at Prime Minister Keir Starmer’s address to the nation regarding the crisis.

The UK’s primary stock market index slipped nearly 50 points as Mr Starmer called for diplomacy between the White House and the European Union, with the French Cac 40 and German Dax falling around two per cent 1.35 per cent, respectively.

The Ftse 100 has fallen due to Trump’s actions

|

GETTY

Mr Trump has claimed the US will slap countries with an an initial 10 per cent tariff on nations which do not recognise his illegal annexation of Greenland. This would be raised to 25 per cent on June 1.

EU official are understood to be preparing to launch a large set of retaliatory tariffs worth €93billion ($107.71billion) following President Trump’s warnings over the weekend.

The International Monetary Fund (IMF) has sounded the alarm over escalating geopolitical tensions and the Trump administration’s continuing threats of tariffs on allied nations.

According to the IMF, trade tensions between the US and Europe could hurt growth forecasts for the global economy by “prolonging uncertainty and weighing more heavily on activity”.

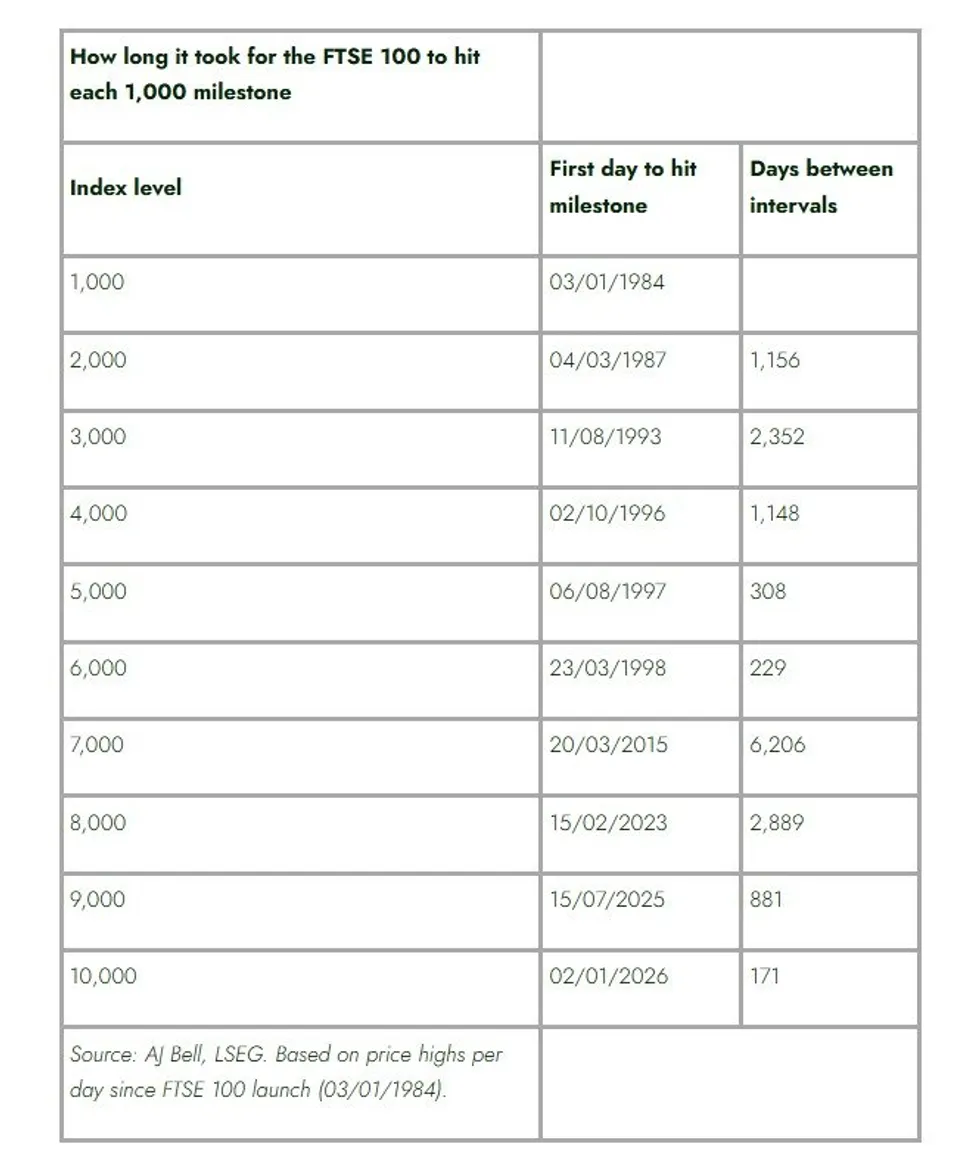

How long has it taken for the Ftse to reach every 1,000 mark? | AJ BELL

The international trade association claimed “introducing new layers of uncertainty and disrupting the global economy through their impact on financial markets, supply chains, and commodity prices”.

Susannah Streeter, Chief Investment Strategist, Wealth Club, said: “Just when there appeared to be a lull in the tariff storm, President Trump has whipped up fresh economic chaos.

“He’s meting out punishment to European countries opposing the administration’s demand that Greenland becomes part of the US, either through purchase or invasion. This is the President’s modus operandi – unleash uncertainty and threats of more onerous measures, to coerce nations to acquiesce to his demands.

“Given how entrenched both sides are in their positions regarding Greenland’s future, it looks likely that the 10 per cent tariff is here to stay for a considerable time, with an increase to 25 per cent highly possible in June.

“This is a migraine inducing development for politicians who have already had to go through tortuous negotiations to reach the first tranche of tariff deals, winning exemptions for certain sectors.

“For companies selling into the United States, and their customers this move creates another layer of difficult decision making. Already they’ve had to try and absorb the current tariffs, there will be little room to soak up any more, so this new tranche of duties is likely to end up being passed onto American customers.

“Many will baulk at paying higher prices, leading to lower sales, hurting exporters. Some importers of crucial goods may eye up the threat of a 25 per cent tariff from June, and bring forward sales, which could provide an initial bump, but then are likely to look elsewhere for a longer-term cheaper supplier.”

THIS IS A BREAKING NEWS STORY…MORE TO FOLLOW

The stock market has been volatile since Trump returned to office | Reuters