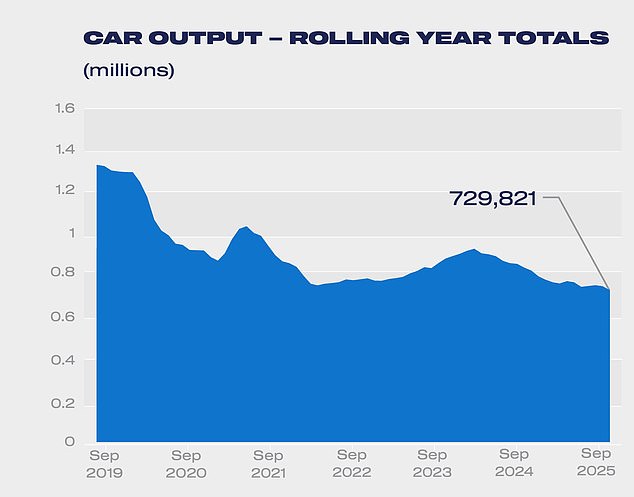

Car production plummeted by more than a quarter in September as the crippling impact of Jaguar Land Rover’s cyber attack hit the brakes on the UK’s motor manufacturing industry.

Britain’s biggest car maker was forced to suspend production across all vehicle plants in the UK – as well as overseas – throughout September after shutting down its IT systems to mitigate the impact a cyber breach carried out by hackers on 30 August.

JLR assembly lines were downed on 1 September and the first workers returned to factory floors only on 7 October as part of a ‘phased restart’ to production that has yet to return to full capacity.

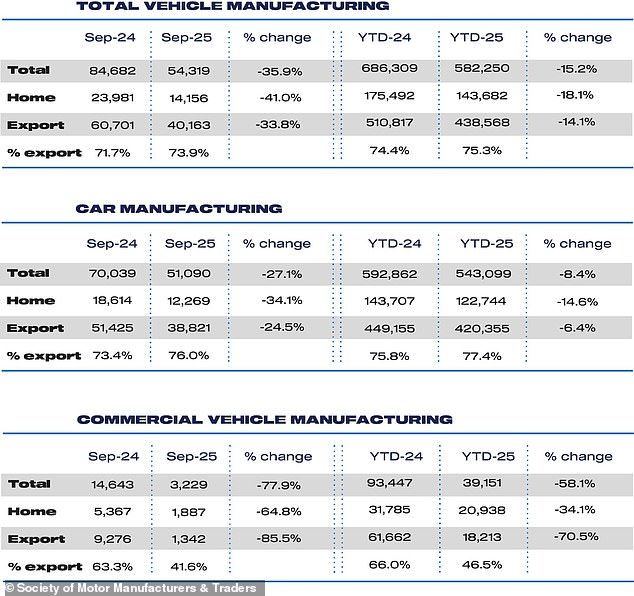

New industry figures published this morning show the dramatic impact the JLR production suspension had on passenger car outputs, which plunged by 27.1 per cent last month.

Just 51,090 vehicles left factory gates compared to 70,039 in September 2024 – down 19,000 units.

With the shortfall almost entirely JLR products with an average sale price of £70,000, the estimated value loss is around £1.33billion.

Mike Hawes, chief executive at the Society of Motor Manufacturers and Traders (SMMT) said on Friday that JLR’s unscheduled production stoppage has put the sector under ‘immense pressure’.

A spokesperson for JLR told the Daily Mail: ‘We are still undertaking a phased restart of vehicle production and have a launched a new supplier financing scheme to support cashflow during the recovery.’

Just 51,090 vehicles left UK car factory gates compared to 70,039 in September 2024 with the majority of the shortfall being Jaguar Land Rover products following its five-week production shutdown in the wake of its cyber breach

SMMT chief executive Mike Hawes said on Friday that JLR’s unscheduled production stoppage has put the sector under ‘immense pressure’

With its car plants shuttered for almost six weeks and running at limited pace, the incident has cost JLR – which typically produces 1,000 vehicles per day – a reported £2billion in lost revenue, while the knock-on effect to suppliers has left some facing collapse.

On 28 September, the Government stepped in with a £1.5billion loan guarantee to support its supply chain to keep smaller businesses tied to JLR output afloat until the car maker could fully restart its assembly lines.

According to the Cyber Monitoring Centre (CMC) – an independent think tank – the attack on JLR’s systems is the ‘single more financially damaging’ instance of a cyber breach to ever hit Britain.

Marks & Spencer, the Co-op and Harrods have all suffered cyber breaches this year, though CMC says the financial ramifications of these pales in comparison to the attack on the Tata-owned car maker.

With the manufacturing shutdown affecting over 5,000 companies, it is estimated to have cost at least £1.9billion, according to the CMC’s calculations.

The non-profit organisation, which ranks the severity of cyber events in the UK, said the cost could be even higher if operational technology has been ‘significantly impacted’ or there are unexpected delays in bringing production back to pre-attack levels.

‘With a cost of nearly £2billion, this incident looks to have been by some distance, the single most financially damaging cyber event ever to hit the UK,’ said Ciaran Martin, chairman of CMC’s technical committee.

‘That should make us all pause and think. Every organisation needs to identify the networks that matter to them, and how to protect them better, and then plan for how they’d cope if the network gets disrupted.’

JLR refused to comment on the CMC’s report.

With its car plants shuttered for almost six weeks and running at limited pace, the incident has cost JLR – which typically produces 1,000 vehicles per day – a reported £2billion in lost revenue, while the knock-on effect to suppliers has left some facing collapse

According to the Cyber Monitoring Centre (CMC) – an independent think tank – the attack on JLR’s systems is the ‘single more financially damaging’ instance of a cyber breach to ever hit Britain

JLR assembly lines were downed on 1 September and the first workers returned to factory floors only on 7 October as part of a ‘phased restart’ to production that has yet to return to full capacity

Half of UK-made cars are ‘electrified’

The September figures also showed the dramatic change in type of vehicles being produced by UK factories.

Almost half (47.8 per cent) of all passenger cars made in the month were either battery electric, plug-in hybrid or hybrid, with volumes up 14.7 per cent to 24,445 units.

Commercial vehicle (CV) production, meanwhile, declined for a sixth consecutive month as falling van outputs continue to weigh heavy on the UK manufacturing industry.

Assembly lines recorded 77.9 per cent fewer units last month compared to September 2024, with just 3,229 CVs rolling off assembly lines.

The SMMT pointed to Vauxhall’s ‘consolidation of operations’ for the decline, following the decision by the brand’s parent group Stellantis to close the 100-year-old Luton van factory in April and shift all production to its EV-only site in Ellesmere Port, Merseyside.

Combined car and van production, therefore, was down by 35.9 per cent in September to just 54,319 vehicles.

Reeves could batter motor industry workers in next month’s Budget

The SMMT has also sounded the alarm on concerns that the Chancellor will push ahead with plans to end Employee Car Ownership Schemes (ECOS) as part of her cost-saving measures announced in next month’s Autumn Budget.

These schemes are an ‘important part of manufacturer remuneration packages’ allowing employees to ‘access the products they make and sell affordably,’ the trade body said.

However, Rachel Reeves is expected to reclassify ECOS vehicles to make them liable for company car tax, putting them out of reach for most automotive workers.

New analysis by SMMT showed that 60,000 automotive manufacturing workers could be affected by the decision, cutting the value of their remuneration and leaving them without personal transport.

‘The impact will be especially severe for factory employees in regions lacking adequate public transport, making it more difficult to work flexible shift patterns and more challenging to recruit people into a sector already suffering a skills shortage,’ the SMMT said.

And the move will have wider ramifications for the UK’s motor sector, with some 80,000 fewer new car sales per annum predicted as a result.

This will create ‘irrevocable damage to the nearly new and used markets, and an equally significant reduction in UK production volumes of up to 20,000 cars,’ the SMMT warned.

‘Such a reduction would amount to a loss of more than £1 billion in revenue, putting some 5,000 manufacturing jobs at risk, and a near half billion-pound hit to government finances from lost VAT and Vehicle Excise Duty receipts.’

Hawes added: ‘The move to scrap ECOS immediately puts that ambition in doubt and must be reversed given the damage it will inflict on the sector and exchequer revenues.’