Retirees face a “double whammy” hit due to the state pension age increasing and a stealth tax raid on retirement savings, experts warn.

Pension sector organisations have issued stark warnings about the potential consequences of simultaneously increasing the state pension Age while reducing tax benefits for private retirement savings.

The Investing and Saving Alliance has cautioned that such a dual approach could expose millions of future pensioners to significant financial hardship in their later years.

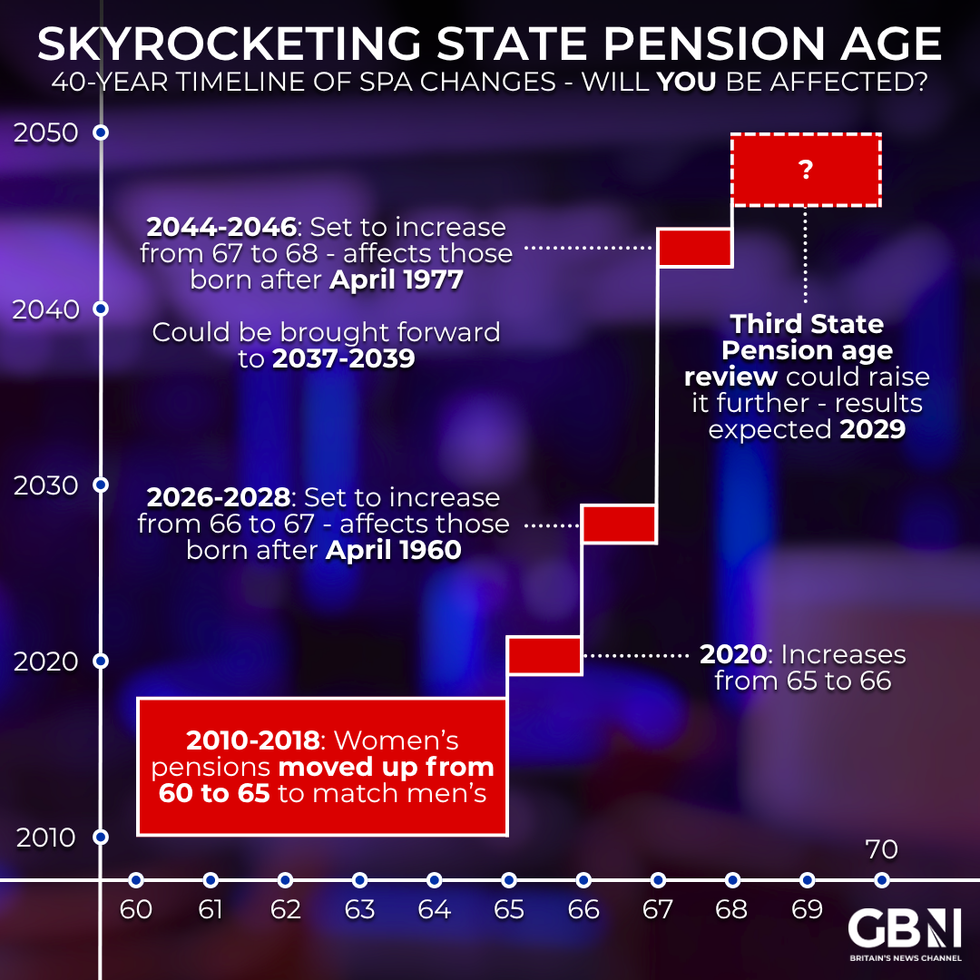

In its submission to the “Third State Pension Age Review,” the organisation emphasised that while longevity remains an important factor, it should not be the only consideration driving policy decisions.

Retirees slapped with ‘double whammy’ as the state pension age rises while retirement savings face a tax raid

|

GETTY

The warning comes as questions mount over the long-term viability and affordability of state retirement provision with the organisation putting forward several key proposals to safeguard retirement security.

These include implementing a minimum twelve-year notice period before any State Pension Age adjustments take effect, matching the interval between Normal Minimum Pension Age and State Pension Age to enable proper financial planning.

Additionally, they advocate introducing flexibility for earlier access, particularly benefiting individuals facing shorter life expectancies, while incorporating protections to prevent this becoming a default option that could disadvantage those already experiencing poverty.

The proposals also emphasise reinforcing Auto Enrolment schemes to ensure that combined state and workplace pensions can meet appropriate retirement income standards.

Skyrocketing state pension age – will you be affected? | GB News

Skyrocketing state pension age – will you be affected? | GB NewsIndustry voices have raised alarms about fairness between generations and retirement income sufficiency.

Current workers face the prospect of supporting an expanding retired population whilst potentially waiting longer to receive their own state benefits.

Renny Biggins, the head of Retirement at TISA, stated: “Raising the state pension age while simultaneously scaling back tax incentives for private pension saving risks creating a double whammy for future retirees.”

Research indicates present savings levels fall short of securing sufficient retirement funds.

Particularly concerning is data showing that one in four people aged between 60 and 65 currently experience poverty, highlighting existing vulnerabilities even before proposed changes.

The pension industry is advocating for comprehensive retirement strategies that account for workplace savings, health disparities and wider economic factors.

Experts stress that state pension forms part of a distinctive social agreement where working-age taxpayers support older generations.

Mr Biggins added: “The state pension is a cornerstone of retirement income for millions, and we welcome the Government’s intention to ensure its long-term sustainability.

LATEST DEVELOPMENTS:

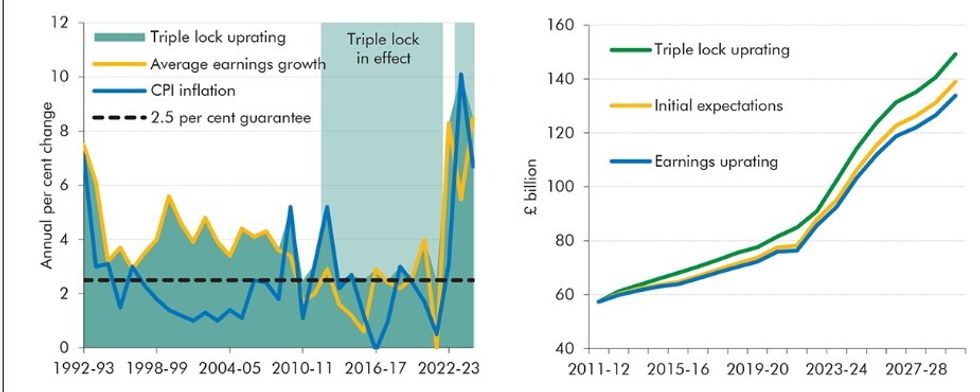

What has the impact of the state pension triple lock been on the public’s finances | OBR

What has the impact of the state pension triple lock been on the public’s finances | OBR “But any changes must be part of a joined-up strategy that considers private pensions, health inequalities, and the broader economic landscape.”

Catherine Foot, the director of the Standard Life Centre for the Future of Retirement, added: “A review of the state pension age should also note that it is intrinsically linked to typical levels of private savings. While the state pension provides the bedrock of most people’s retirement incomes, private savings are the other part of the equation.

“The Pensions Commission is currently looking at people’s projected retirement outcomes and our modelling points to issues in the coming decades with current rates of saving insufficient to secure people adequate retirement incomes.

“To ensure the Commission’s recommended solutions will be thoroughly implemented, we believe a statutory requirement for the Government to review retirement adequacy every five years, alongside the state pension age will be necessary.”