- Stocks inched higher following trade deal and base rate cut, but caution remains

London-listed stocks inched higher on Friday as investors were encouraged by a new US-UK trade deal and a Bank of England base rate cut in the previous session.

But investors remain cautious as economists warn the limited nature of the agreement and the continuation of enormous US tariffs on other important global economies will still weigh heavily on Britain’s open trading economy.

The FTSE 100 was up 0.4 per cent by late afternoon, while the FTSE 250 added 0.3 per cent.

Some 280 London-listed companies have issued warnings over tariff related risks since Donald Trump’s ‘Liberation Day’ announcement on 2 April, according to Bowmore Wealth Group.

UK exporters of cars, aluminium and steel, and aerospace are key beneficiaries of the agreement as it stands.

But there is limited detail about what it will mean for important sectors like pharmaceuticals and an across-the-board 10 per cent duty in place.

Shake on it: Trump agreed the trade deal with a UK negotiating team that included ambassador to the US Peter Mandelson

Lale Akoner, global market analyst at eToro, highlighted Jaguar Land Rover Bentley, and McLaren as ‘breathing easier’ on Friday, with tariffs on their US exports down from as high as 27.5 per cent to just 10 per cent on practically all current volumes..

Akoner added: ‘Not all are celebrating. UK food and drink exporters still face 10 per cent tariffs, and domestic farmers fear a flood of subsidised US ethanol and beef.

‘The macroeconomic uplift will be modest, but sector-specific clarity matters- particularly in capital-intensive industries.’

Little relief for UK’s lacklustre economy

The Bank of England moved to relieve pressure on economic output yesterday by cutting base rate from 4.5 to 4.25 per cent.

It thinks UK-specific tariffs and global trade tensions more generally will knock as much as 0.3 percentage points off UK growth this year but stresses that the outcome is highly unpredictable.

UK GDP smashed forecasts with 0.5 per cent growth in February, thanks to a surprise boost from manufacturing, but the Office for Budget Responsibility expects the British economy to muster just 1 per cent growth overall this year.

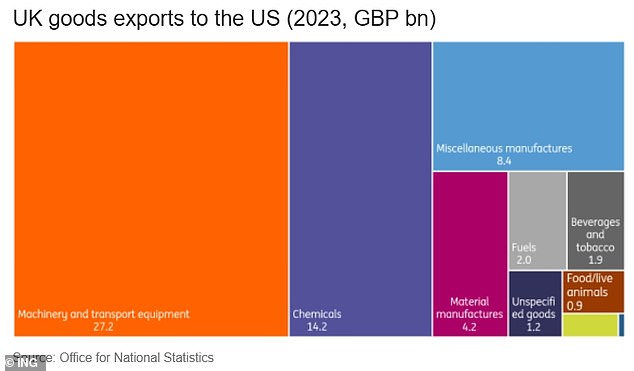

Machinery and transport equipment make up the largest proportion of UK exports to the US

Governor of the BoE Andrew Bailey warned on Friday that the global economic environment ‘is likely to continue to be challenging and less predictable than it was in the past’.

The bank is expected to cut interest rates as low as 3.5 per cent by March next year to help build momentum.

Thomas Pugh, economist at RSM UK, said if the US-UK trade deal ‘turns out to be the start of a series of US trade deals’ that prompt a ‘reduction in uncertainty and the damaging impacts of US tariffs’ then ‘there may be cause for more hope’.

‘But, for now, we see no reason to upgrade our forecast of just 1 per cent [UK GDP] growth this year,’ he added.

Analysts at ING are ‘sceptical that the UK’s deal will herald a much broader climbdown from the US administration,’ the bank wrote in a note on Friday.

It said: ‘Even the UK hasn’t succeeded in negotiating away the 10 per cent baseline tariff.

‘Our base case is that this remains in place, for all countries, throughout President Trump’s term.’

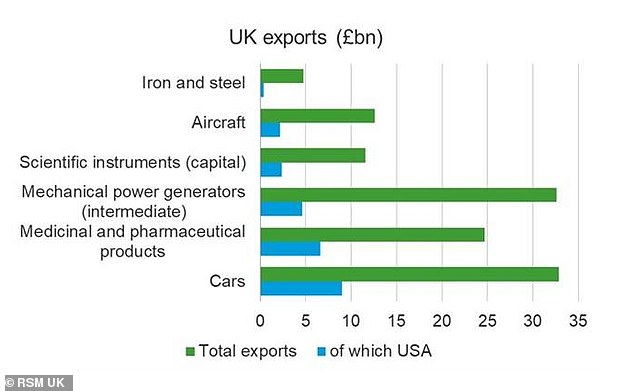

The US makes up a larger proportion of car and pharma exports than areas like aircraft

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.