Pensioners living in one of Britain’s wealthiest boroughs are set to receive more than £400,000 in state pension payments over their lifetime, according to official figures.

While anyone with 35 years of National Insurance contributions qualifies for the full new state pension, the total amount ultimately paid out varies widely depending on where people live and how long they live for.

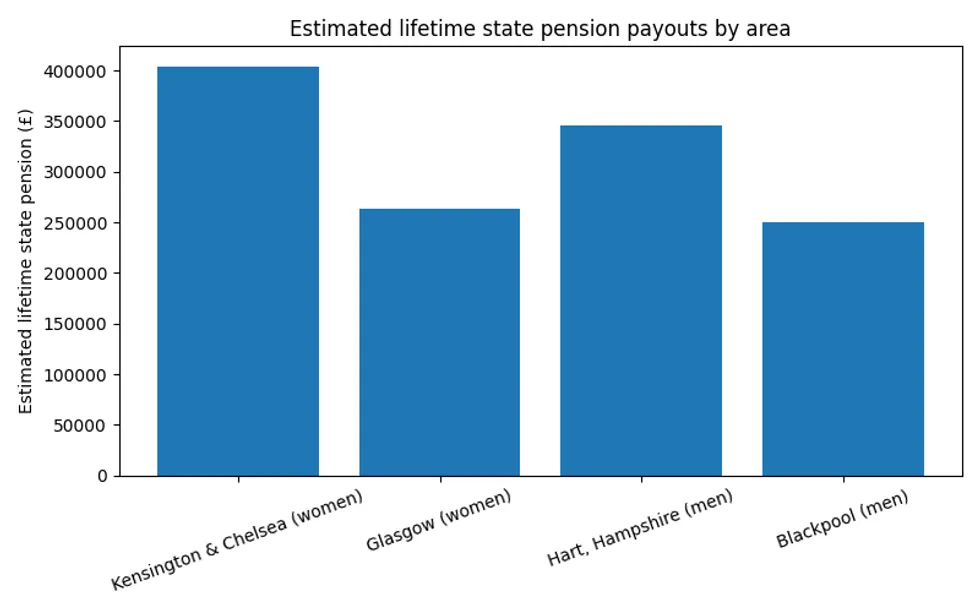

A woman retiring in Kensington, west London, stands to receive approximately £403,689 in state pension payments over her lifetime, according to fresh analysis of Office for National Statistics data.

Her counterpart in Glasgow, however, would collect roughly £140,000 less due to stark differences in life expectancy between the two areas.

The disparity emerges from ONS figures showing that a 65-year-old woman in the affluent London borough can expect to reach 88.9 years of age, whilst Glasgow records the UK’s lowest female life expectancy at just 83.1 years.

Times Money examined the recently published data in collaboration with wealth manager Quilter, calculating lifetime pension values based on annual increases of 2.5 per cent in line with the triple lock’s minimum guarantee.

The geographical divide extends to male pensioners as well, with Hart in Hampshire offering the greatest lifetime value at £345,300 for men expected to live until 86.2 years.

By contrast, a man in Blackpool reaching the local average age of 81.4 would receive just £250,626 – a gap of roughly £95,000.

Estimated lifetime state pension payouts by area

|

ONS/CHATGPT

Southern England dominates the longevity rankings for both sexes. Every local authority where women aged 65 can anticipate living at least another 23 years sits within London or the south.

Following Kensington & Chelsea, the areas with highest female life expectancy include Westminster, Camden, Richmond-upon-Thames, Winchester, Barnet, Harrow and South Hams in Devon.

For men, the top performers after Hart were Richmond-upon-Thames, Barnet, Harrow, Westminster, Wokingham, Winchester and Uttlesford. Only Ribble Valley in Lancashire broke into the top ten from outside the south.

The full new state pension currently stands at £230.25 weekly

|

GETTYThe full new state pension currently stands at £230.25 weekly, rising to £241.30 from April, which translates to an annual sum of £12,547.60.

While the pension age presently sits at 66, it will increase to 67 by 2028 and is scheduled to reach 68 by 2046, potentially sooner.

Adam Cole from Quilter said: “Regional differences in life expectancy could have a significant impact on the total value of state pension you get. When you factor in that the state pension age is typically the same for everyone, the financial disparity becomes clear.”

Many workers believe their national insurance contributions fund their pension directly, though in practice these payments also support maternity allowance, jobseeker’s allowance, universal credit and a portion of NHS funding.

LATEST DEVELOPMENTS:

The government launched a review of the state pension age in July, examining whether current thresholds remain appropriate given the latest life expectancy statistics

|

GettyThe government launched a review of the state pension age in July, examining whether current thresholds remain appropriate given the latest life expectancy statistics. Any increase to the pension age could further penalise those in areas where people already die younger.

Steve Webb, a former pensions minister, said: “Our national insurance system does pool risks, as those who sadly die early are in effect used to pay the pensions of those who live longer.

“If we turned everyone’s state pension rights into the same notional pot at retirement and then put them through an annuity-type formula, you would end up paying higher pensions to people in the north, who could expect to get them for a shorter period, and lower pensions to those in the south.”

The review arrives amid concerns over affordability, with the Office for Budget Responsibility projecting pensioner spending will climb from £161.2billion in 2025-26 to £195.4billion by 2030-31.