Millions of workers across Britain are set to see a boost to their pension savings under a change announced by Rachel Reeves ahead of the Budget.

The hidden pension boost has become apparent after the Government confirmed the National Living Wage (NLW) for people aged 21 and over is set to rise to £12.71 from April 2026.

The Chancellor announced plans to raise the National Living Wage and National Minimum Wage to ensure low-paid workers are “properly rewarded for their hard work”.

From April, the changes will lift pay for around 2.7 million workers, with a full-time worker on the National Living Wage set to gain £900 a year, while someone on the National Minimum Wage could see their pay rise by £1,500.

Kate Smith, Head of Pensions at Aegon said: “There’s also a hidden pensions benefit to increasing the National Living Wage, as it’ll have a positive impact on pensions contributions and enable employees to build up larger pension pots.”

The rise will also make it significantly easier for part-time and low-income employees to qualify for workplace pension schemes.

Now, workers putting in fewer hours each week can now meet the qualifying criteria, potentially adding tens of thousands of pounds to their retirement savings over a working lifetime.

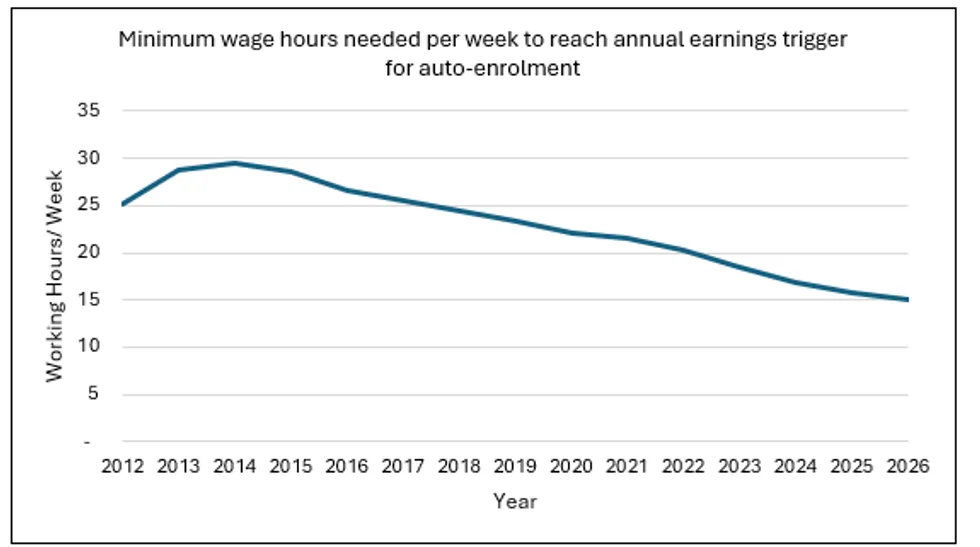

The shift represents a dramatic change from when auto-enrolment was first launched in 2012, when employees needed to work approximately 25 hours weekly to hit the qualifying threshold.

The change means those working a 15-hour working week (around two working days) will now meet the £10,000 annual earnings trigger for pensions auto-enrolment. This is ten hours per week fewer than when auto-enrolment was introduced.

According to Standard Life’s calculations, a worker putting in just 16 hours weekly on minimum wage could accumulate a pension pot worth approximately £84,100 by the time they reach state pension age.

So employees aged 22 and over now qualify for auto-enrolment working just 15 hours per week (around two working days) across the year

|

STANDARD LIFE

Those employed full-time on the new rate stand to build even more impressive retirement funds, with projections suggesting a 22-year-old starting work today could amass around £208,000 by retirement.

In the first year alone, full-time minimum wage employees could see roughly £2,030 added to their pension through auto-enrolment contributions.

Catherine Foot, Director of the Standard Life Centre for the Future of Retirement said: “A rising minimum wage not only boosts pension savings through higher contributions on increased salaries, but it also makes auto-enrolment more accessible.

Rachel Reeves announced plans to raise the National Living Wage and National Minimum Wage In her Budget on November 26

|

GETTY“With the new National Living Wage from April, working just 15 hours a week will be enough to meet the £10,000 annual earnings threshold, enabling more people to qualify for workplace pensions and start building their retirement savings.

“Although cost-of-living pressures and immediate financial concerns remain a priority for low-income and part-time workers, even a small amount saved to a workplace pension, which is boosted by valuable employer contributions, can make a meaningful difference to future retirement incomes.”

The NLW has continued to increase each year, giving workers a sizeable boost. In April 2025, the rate increased by 6.7 per cent, giving those 21 and over £12.21 per hour.

Ms Smith said: “From April, all workers aged 21 and over, and on the lowest incomes, will benefit from a salary increase, as the National Living Wage rises, boosting their spending power and going some way to alleviate the ongoing burden of rising living costs.”

One of the key objectives of the recently reinstated Pension Commission is to tackle retirement savings adequacy among vulnerable groups, particularly low earners who are among the least likely to contribute to a pension.

Currently, only one in four low-income private sector workers are saving for retirement.

From April, the changes will lift pay for around 2.7 million workers, with a full-time worker on the National Living Wage set to gain £900 a year

|

GETTYTo address this, the Commission is expected to consider reforms to auto-enrolment, including lowering the age threshold for eligibility and removing minimum earning limits.

These changes should broaden the accessibility of auto-enrolment and offer some additional boost to pension pots

Ms Foot concluded: “The Pension Commission will need to strike the right balance between addressing undersaving among the most vulnerable groups with the pressures facing employers with the rising cost of employment.”