A 71-year-old man with no private retirement savings has been slapped with a £800 tax bill despite Chancellor Rachel Reeves previously promising those who are reliant on the benefit “will not have to pay”.

Alan Perkins, who worked multiple jobs for five decades prior to retiring, assumed he would be able to depend on his state pension in later life but now faces a hefty charge from HM Revenue and Customs (HMRC).

The septuagenarian has been affected by the decision to freeze personal tax thresholds, which was introduced by the previous Conservative Government in 2021 but has since been extended until 2031.

Critics note frozen tax thresholds have been a politically easy way to generate revenue for the Treasury while not actually raising tax rates, however it has contributed towards fiscal drag.

A state pensioner has been hit with a £800 tax bill due to frozen HMRC thresholds

|

GETTY

This is the phenomenon used to describe when HMRC thresholds are frozen during a period of time when incomes or inflation are on the rise, resulting in Britons being pulled into higher brackets of tax.

Mr Perkins is one of thousands who paid into the state earnings-related pension scheme, otherwise known as Serps, which ran from 1978 until 2002 to help employees bolster their retirement income.

The scheme was replaced by the state second pension before being weeded out in favour of the new state pension in 2016. Thanks to the regular top-ups from his wages, the retiree got an extra £90 a week from his state pension amount.

As a result, Mr Perkins accrued an annual income of around £16,500, which is notably higher than the £11,973 claimants of the full new, state pension receive. Despite this, the 71-year-old’s income is £4,000 higher than the £12,570 personal allowance, which is the amount someone begins to pay tax on their income.

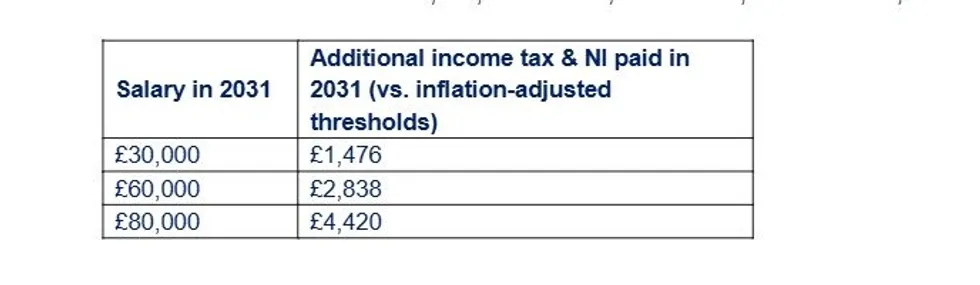

How much more will you pay by 2031 due to fiscal drag? | STANDARD LIFE

How much more will you pay by 2031 due to fiscal drag? | STANDARD LIFEBased on the Pensions and Lifetime Association methodology, the retiree’s yearly income places him just above the £13,400 “minimum” required to pay for basic needs.

Speaking to The Telegraph, Mr Perkins said: “I’ve worked like a dog for all of my life. I worked stupid amounts of overtime to provide for my family. I would leave home at 6.30am in the morning and get in at 10.30pm at night, and that was five days a week.

“On weekends I would work until about six o’clock and then I would do an evening as a minicab driver as well.“Although we were all living in the same house, it meant I didn’t really see my children grow up much.

“And now I’m retired, they take tax out of it. I never thought anyone on a state pension would pay tax. I can’t get my head around it.”

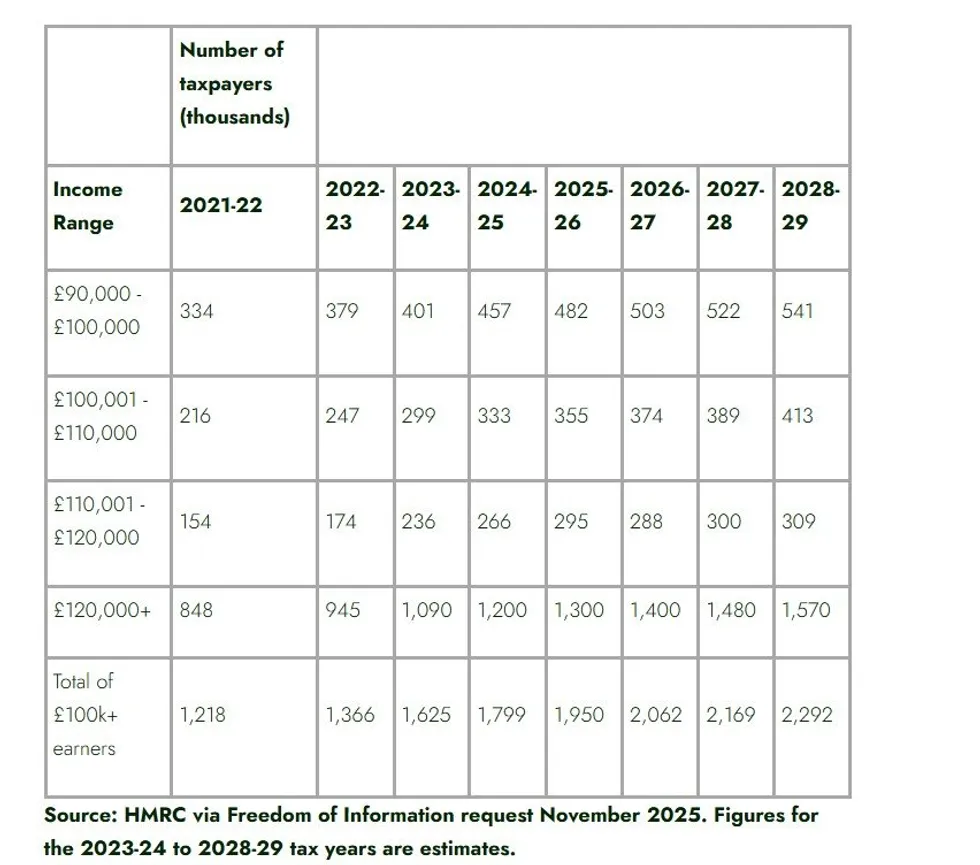

How many people will be pulled into higher tax brackets? | RATHBONDES / HMRC

How many people will be pulled into higher tax brackets? | RATHBONDES / HMRC Much of his professional career was spent working as a commercial heating engineer, which led him to choose Serps over instead of his company’s workplace retirement plan.

During her Budget statement on November 26, Ms Reeves confirmed her intention to extend the existing freeze on personal HMRC thresholds to 2031 in what is widely considered a stealth tax.

Despite the Chancellor decision, Mr Perkins also blamed the Conservative Party under former Prime Minister, an ex-Chancellor, Rishi Sunak who oversaw the initial freeze.

He added: “The tax thresholds should have gone up for everybody, and this is the consequence. But when I saw Rachel Reeves announce that people only on the state pension would be exempt, I thought big deal, I’m already paying it. Does she not realise there are people like me?”

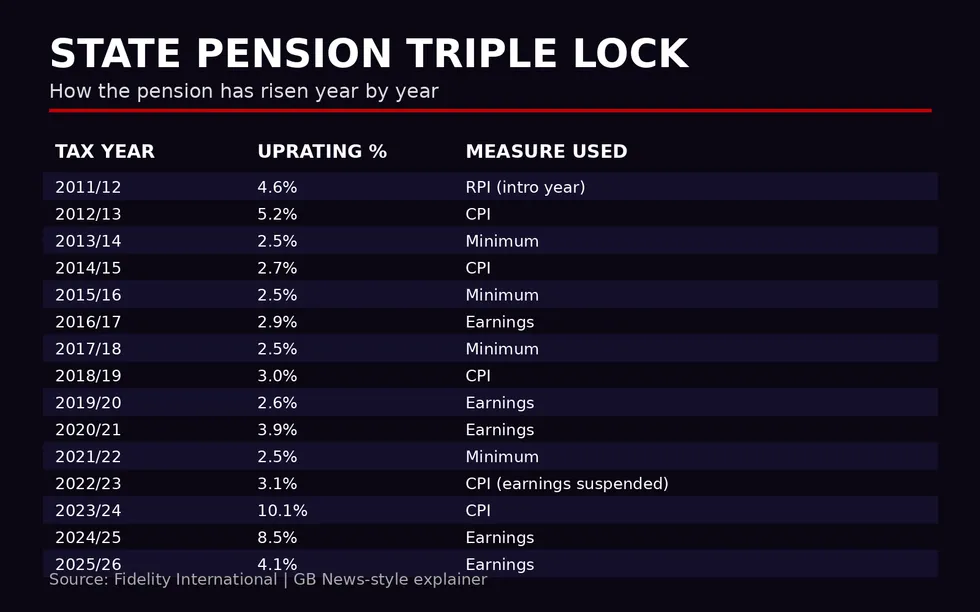

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL Ms Reeves’s stealth tax will not only just impact Serps claimants as millions of regular state pension recipients will be pulled into paying more to HMRC due to frozen thresholds and the triple lock.

The triple lock guarantees state pension payment rates rise every year by at least 2.5 per cent. While this has policy has been praised by anti-poverty campaigners, analysts are warning state pensions will cross the personal allowance threshold by 2027.

In April 2026, the new state pension will jump to £241.30 per week or £12,547 annually, just below the £12,570 threshold. Once crosses, Britons will have to pay tax on their state pension payments alone for the first time ever.

When approached for comment, the Treasury cited the Government’s plan to ease the administrative burden for pensioners whose sole income is the basic or new State Pension without any increments so that they do not have to pay small amounts of tax via Simple Assessment from 2027/28.