Homeowners are already in line to receive “lower monthly repayments” on their mortgage following last week’s move by the Bank of England to slash the base rate to below four per cent, analysts claim.

A cut to interest rates by the central bank could mark a “turning point” for the UK housing market, a property expert has said, after new research showed more than half of would-be buyers are being put off by higher borrowing costs.

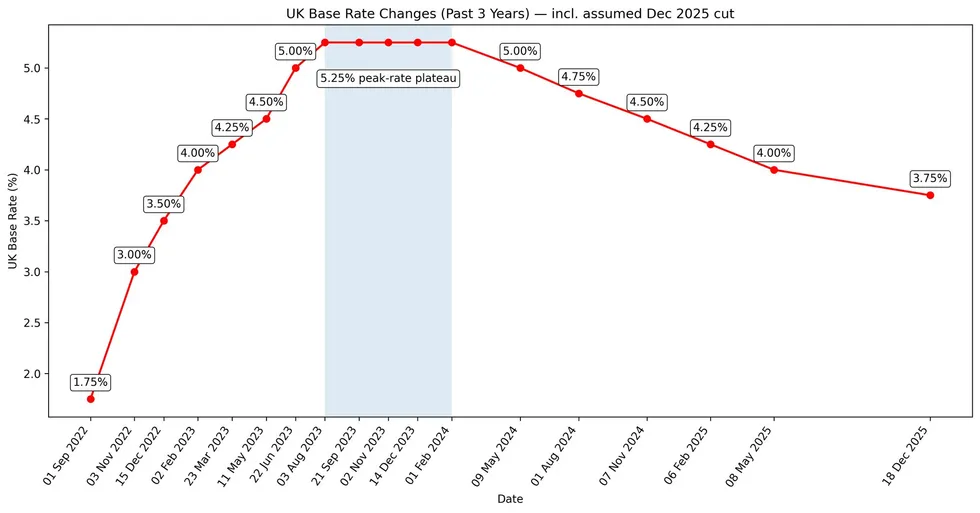

Threadneedle Street announced on Thursday that it is reducing the base rate from four per cent to 3.75 per cent, easing pressure on millions of households with mortgages and other loans.

Around 500,000 homeowners on tracker mortgages, which move in line with the base rate, are expected to see their monthly repayments fall by roughly £30, offering some immediate financial relief.

This week’s Bank of England announcement is expected to see a drop in mortgage rates

|

GETTY

The move comes after a prolonged period of elevated interest rates to as high as 5.25 per cent, introduced by the Bank’s Monetary Policy Committee (MPC) to tackle stubborn inflation.

While interest rates had already begun edging down in anticipation of cuts, economists note Thursday’s decision is the clearest signal yet that the era of ultra-tight monetary policy is easing.

Recent research commissioned by We Buy Any Home highlighted just how damaging higher interest rates have been for UK consumer confidence when it comes to the property market.

According to the survey, 53 per cent of people cited interest rates as the main reason they are unable to move home, with concern highest among 35 to 54 year-olds who are typically most active in the housing market.

The Bank of England has kept interest rates high due to stubborn inflation | GETTY

The Bank of England has kept interest rates high due to stubborn inflation | GETTY Elliot Castle, chief executive of We Buy Any Home, said the base rate cut from the Bank of England could unlock pent-up demand after months of hesitation from prospective homebuyers.

Mr Castle said: “This is genuinely positive news for the UK housing market. For many buyers this will mark the turning point they have been waiting for after a prolonged period of uncertainty.”

He said the most immediate impact would be seen in mortgage pricing, with lenders such as Nationwide Building Society already competing aggressively for business.

The mortgage expert added: “This rate cut gives them further scope to reduce fixed and variable deals. That means lower monthly repayments for homeowners and improved affordability for first-time buyers, who have been under intense pressure over the past two years.”

“Confidence is just as important as cost and this move sends a clear signal that the direction of travel for interest rates is now downward,” We Buy Any Home’s chief executive said.

“When homebuyers believe the worst is behind us, activity tends to pick up quickly, particularly among those who have been sitting on the sidelines waiting for stability.”

He added that property sellers are also likely to benefit as confidence improves in a double win for the market going into the New Year.

“For sellers, increased buyer confidence should translate into stronger demand and more completed transactions, rather than the stop-start market we’ve seen recently,” he shared.

“This is not about reigniting unsustainable house price growth but about restoring a healthier level of market activity.”

Mr Castle concluded that a base rate of 3.75 per cent creates a more balanced backdrop for the sector, supporting responsible borrowing while helping the housing market underpin wider consumer confidence and the UK economy.

However, analysts warn the markets are only pricing in one more interest rate cut from the Bank of England’s MPC in 2026 which may not happen until later in the year.

This means the base rate would not fall below 3.5 per cent next year, which remains considerably higher than pre

The Bank of England has made changes to the base rate in recent years | CHAT GPT

The Bank of England has made changes to the base rate in recent years | CHAT GPT Peter Stimson, the director of Mortgages at the lender MPowered, said: “In the end it was a slim margin rather than a slam dunk. With inflation falling away and Britain’s economy shrinking, the markets had convinced themselves that today’s decision would be a full-throttle cut, which would be swiftly followed by more in 2026.

“The narrowness of the vote suggests that the Bank’s ratesetting committee isn’t so sure. Nearly half of its members voted to leave rates unchanged, and the accompanying minutes were curiously ambivalent.

“While saying that the Base Rate is likely to continue on a ‘gradual downward path’, the text added that future judgments ‘will become a closer call’.

“I’m not sure how things can get any closer than today’s 5-4 split. In the coded language beloved of central bankers, the committee is saying that deep divisions remain between its members.”