Reform UK leader Nigel Farage has asserted the state pension triple lock’s future remains “open for debate” despite his party’s new Treasury spokesperson signaling his support for the policy.

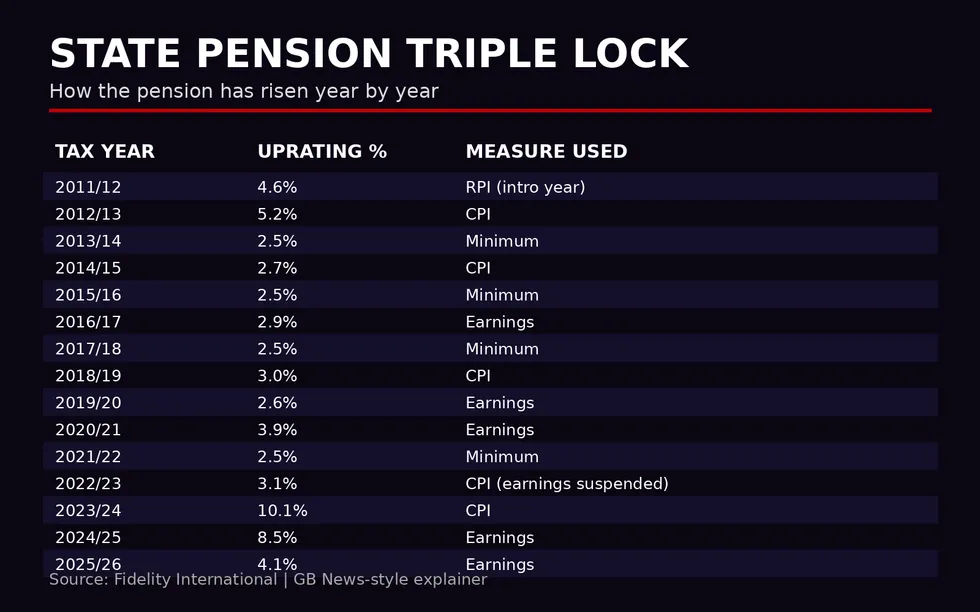

Under the triple lock mechanism, state pension payment rates are raised annually every year by either the rate of inflation, average wage growth or 2.5 per cent; whichever is the highest.

During a press conference this afternoon, Robert Jenrick outlined Reform’s fiscal vision for Britain if the party were to win the keys to Number 10 Downing Street, promising to maintain Bank of England independence and the Office for Budget Responsibility (OBR).

The insurgent party’s Treasury spokesperson said: “I’ve always been a supporter of the triple lock. It’s incredibly important to provide dignity and security to older people on fixed incomes in the last decades of their life, particularly at a time like this where there’s such challenging circumstances with the cost of living.”

State pension triple lock ‘open for debate’, Nigel Farage claims

|

GETTY

However, when asked by journalists about whether the triple lock will be included in the party’s next election manifesto, Mr Farage said the policy continues to be “open for debate”.

Over the years, the Reform leader has refused to commit to keeping the state pension payment uprate mechanism in place if he were to become Prime Minister.

When asked if he had changed his mind, Mr Farage said: “No, I haven’t changed my mind. It’s open for debate. Everything is open for debate.”

This apparent policy dispute between the Reform leader and Mr Jenrick comes after the latter affirmed the party’s plan to reimpose the two-child benefit cap on payments from the Department for Work and Pensions (DWP).

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL

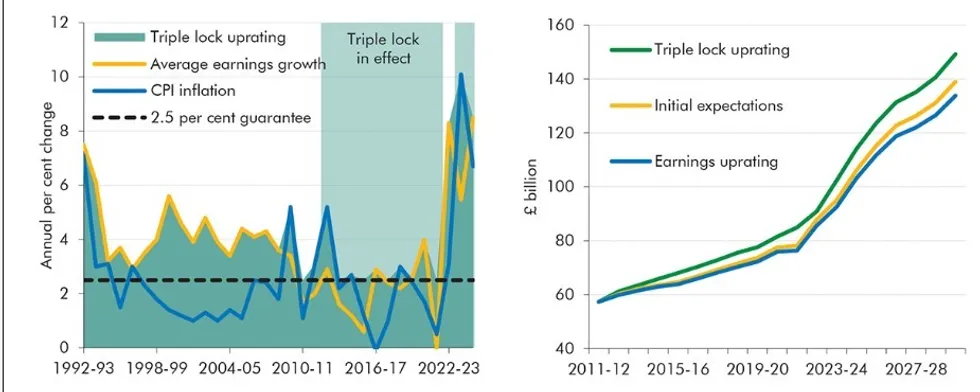

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL  What has the impact of the state pension triple lock been on the public’s finances | OBR

What has the impact of the state pension triple lock been on the public’s finances | OBR Mr Jenrick’s also promised to defuse the “benefits bomb” with the Labour Government having come under fire from an increase in welfare expenditure since returning to power.

However, critics have signaled pension benefit spending as making up a large proportion of the DWP’s outgoing costs and inflating the existing bill.

A recent report from the OBR projected the state pension triple lock will cost the Government £10billion more a year than initially forecast by the end of the decade without reform.

Catherine Foot, the director at the Standard Life Centre for the Future of Retirement, said: “In all but its least optimistic life expectancy scenarios, the OBR projects significant increases in public spending.

Robert Jenrick, who was unveiled as Reform UK’s Shadow Chancellor yesterday, made the pitch during a keynote speech in the City of London | GB NEWS

Robert Jenrick, who was unveiled as Reform UK’s Shadow Chancellor yesterday, made the pitch during a keynote speech in the City of London | GB NEWS“A sizeable portion of this increase will be driven by more people receiving the State Pension for longer, as well as the triple lock driving up the state pension amount people receive. At the same time, rates of individual retirement saving are falling far behind what our longer lifespans now require.

“This poses serious questions about the UK’s future retirement adequacy. Our research shows the UK is on track to face a retirement crisis by 2040 if current trends persist, with the majority of retirees expected to have insufficient savings.

“That isn’t a reality the Government or pensioners want to face. We urge Government to commit to begin the adequacy review at the earliest opportunity and set out a roadmap to improving retirement adequacy.”

The Labour Government has committed to keep the triple lock in place until at least the end of this Parliament. GB News has contacted Reform UK for comment.