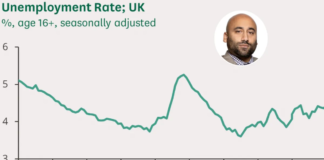

HMRC is issuing updated tax codes to millions of state pensioners as part of plans to recover winter fuel payments from those whose income exceeded £35,000 during the 2025 to 2026 tax year.

The changes mark the first winter under a new threshold based system introduced by the UK Government, which replaced the previous arrangement linked to Pension Credit eligibility.

Around two million pensioners are expected to repay their winter fuel payment through the tax system under the revised rules.

Under the current structure, all eligible state pension recipients initially receive the winter fuel payment automatically regardless of income level.

Pensioners whose total income from all sources, including employment income, private pensions or savings interest, exceeds £35,000 will have their tax codes adjusted to recover the payment.

The amount recovered depends on age bands used for winter fuel payments during the relevant tax year.

Pensioners aged under 80 received £200, while those aged 80 or over received £300.

For pensioners repaying £200, the recovery will typically be spread across the full tax year through PAYE adjustments, meaning roughly £17 additional tax deducted each month.

HMRC has confirmed pensioners cannot choose to repay the money in a single payment and must wait for recovery to take place through tax code adjustments.

Pensioners will see tax codes adjusted after new income threshold system replaced Pension Credit link

|

GETTY

A HMRC spokesman said: “We’ll take your payment for the 2025 to 2026 tax year by changing your PAYE tax code for the 2026 to 2027 tax year.”

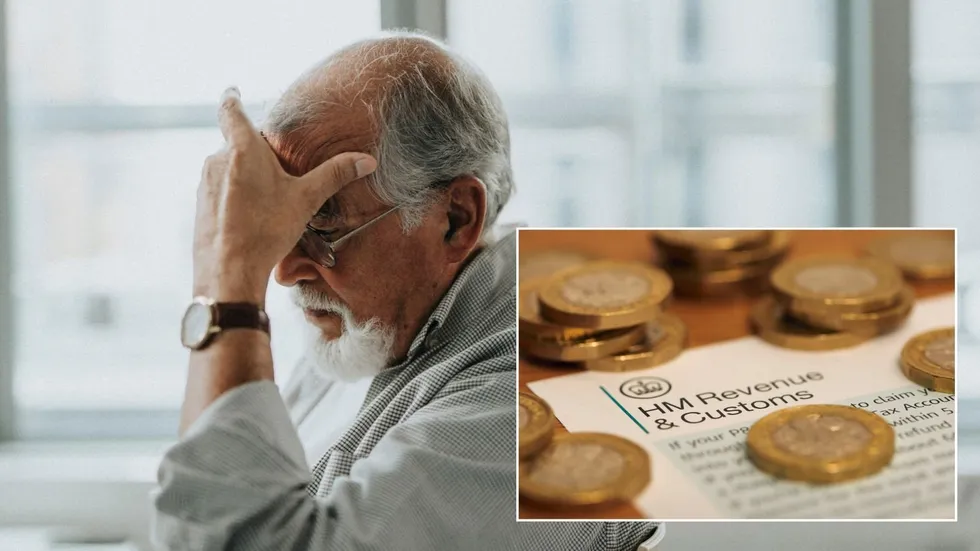

Pensioners affected by the changes will receive notification either by letter or through the official HMRC mobile application confirming their revised tax code.

The recovery process will operate by adjusting PAYE codes during the 2026 to 2027 tax year, meaning the additional tax will be collected gradually through regular income payments.

HMRC guidance states that once the tax year concludes, the authority will compare the total amount collected against the amount owed to ensure accuracy.

If insufficient tax has been collected through PAYE adjustments, pensioners may receive a tax calculation outlining any remaining balance.

There is one exception to the automatic recovery process covering individuals already completing self assessment tax returns.

Pensioners may receive a calculation outlining any remaining balance if insufficient tax has been collected

|

GETTYPensioners already registered for self assessment, or those later asked to complete returns by HMRC, will repay the winter fuel payment through that system instead.

The spokesman added: “The majority of people who need to pay back a Winter Fuel Payment will do so automatically via their tax code.

“For those already registered for Self Assessment, it will be collected via their tax return.

“We’ve provided online guidance clearly explaining how recovery of payments works and a calculator so people can see if they’ll need to pay back the payment.”

The new income threshold based system replaced the previous winter fuel payment structure, which had been linked directly to Pension Credit eligibility rules.

Pensioners affected by the changes will receive notification either by letter or through the official HMRC mobile application confirming their revised tax code

|

GETTY

The previous system had faced criticism from some groups who argued it created complexity around eligibility and payment entitlement.

The Government has said the updated system is designed to better target payments while maintaining automatic upfront support for pensioners.

Those who want to check whether they are likely to repay winter fuel payments can use an online calculator published by HMRC.

Detailed guidance explaining how repayment works is also available through official Government online services.

HMRC has said it will continue issuing tax code updates and notifications to ensure pensioners understand how repayments will be collected across the relevant tax year.