Pension returns are beating ISAs despite Chancellor Rachel Reeves’s looming tax raid on retirement savings, as Britons are earning close to £7,400 more from their pots.

Despite forthcoming inheritance tax (IHT) reforms set to take effect in April 2027, pensions continue to offer superior outcomes for those saving towards retirement compared to ISAs, according to new analysis from Standard Life.

The research reveals that tax relief on contributions remains a powerful advantage, potentially helping to counterbalance any additional inheritance tax liabilities under the new rules.

However, concerns about the changes are prompting some savers to reconsider their approach. Standard Life-backed research found that 16 per cent of defined contribution pension holders intend to access their funds sooner than originally planned, while 11 per cent are contemplating reducing their contributions.

Pension returns are beating ISA savings despite Rachel Reeves’s inheritance tax raid

|

GETTY

Shifting retirement savings away from pensions or cutting back on contributions could ultimately prove detrimental, the analysis warns.

A £20,000 ISA investment would reach approximately £29,605 after a decade, assuming four per cent annual returns after charges.

By contrast, a pension contribution costing the same £20,000 net amount would grow substantially larger thanks to tax relief.

Basic-rate taxpayers could see their pot reach around £37,006, while higher-rate taxpayers could accumulate up to £49,341 over the same period.

The Chancellor is rumorued to be considering further ISA reform | GETTY

The Chancellor is rumorued to be considering further ISA reform | GETTY Pensions also benefit from higher annual allowance limits than ISAs, enabling greater savings capacity.

Workplace scheme members gain further from employer contributions.

For the majority of estates, unused pension funds will still pass to beneficiaries without attracting inheritance tax after April 2027, as most fall beneath the nil-rate band.

Surviving spouses who own property can access a combined threshold reaching £1million.

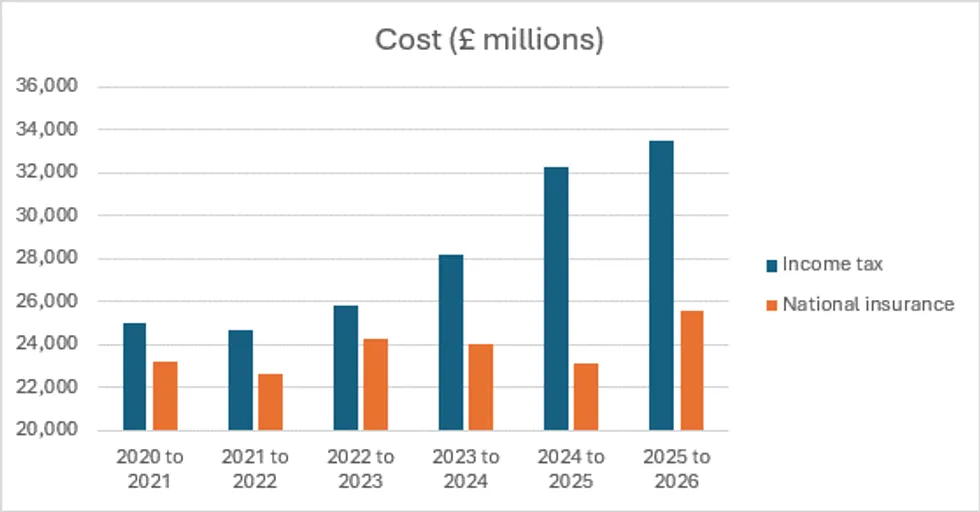

How much pension tax relief you can get depends on your earnings | AJ Bell analysis of HMRC data

How much pension tax relief you can get depends on your earnings | AJ Bell analysis of HMRC dataEstates valued above these limits will see unused pension assets taxed at 40 per cent, matching the treatment of other inherited wealth..

It should be noted that beneficiaries may also face income tax on withdrawals at their marginal rate when the pension holder dies after turning 75.

Nevertheless, the initial tax relief received on pension contributions represents a considerable benefit that can offset these additional charges, meaning inherited pensions are unlikely to leave recipients worse off than other assets.

Neil Jones, tax and estate planning specialist at Standard Life, cautioned against abandoning pensions in response to the changes,

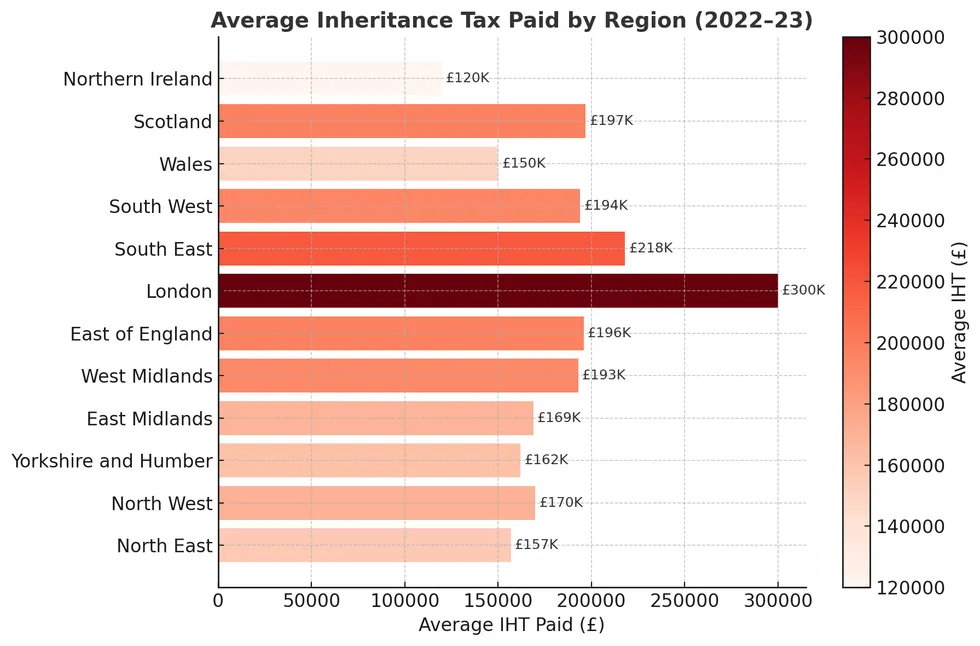

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONS“Including pensions within the scope of inheritance tax represents one of the most significant changes to estate planning in decades,” he said.

“While the impact will primarily be felt by the wealthiest estates, there is a risk that pensions begin to be viewed less favourably by the wider saving population who are unlikely to be affected.”

Mr Jones emphasised that redirecting savings into alternative products could harm long-term financial security.

He recommended consulting a professional financial adviser to navigate estate planning decisions effectively.