Up to 800,000 workers could face an unwelcome shock upon reaching retirement age after the Government’s state pension calculator provided them with figures that were far too generous.

HM Revenue and Customs’ (HMRC) online forecasting tool, launched a decade ago to help individuals plan for their later years, has been displaying projected pension amounts that painted an overly rosy picture for hundreds of thousands of users.

Many of those affected were led to believe they would qualify for the full new state pension, but in reality, they fell short. The flawed forecasts mean numerous workers now face potential gaps in their retirement income that they had not anticipated.

Conservative Government ministers first became aware of the issue in 2017, yet it took a full four years before thorough repairs were implemented.

Britons are at risk of a state pension shortfall

|

GETTY

The scale of the problem had already become apparent by 2019, when figures showed that roughly 360,000 incorrect forecasts had been produced during the tool’s initial three years of operation.

Furthermore, the system’s flaw meant it failed to show certain manual adjustments, giving users false assurance that they had accumulated enough contributions to secure the maximum pension.

This left many workers unaware they needed to make additional National Insurance contributions, with 35 years of payments being required to claim the full, new state pension.

The issue has been resolved for individuals reaching state pension age prior to April 2029, but HMRC has confirmed that those retiring after this date may still be receiving inaccurate information.

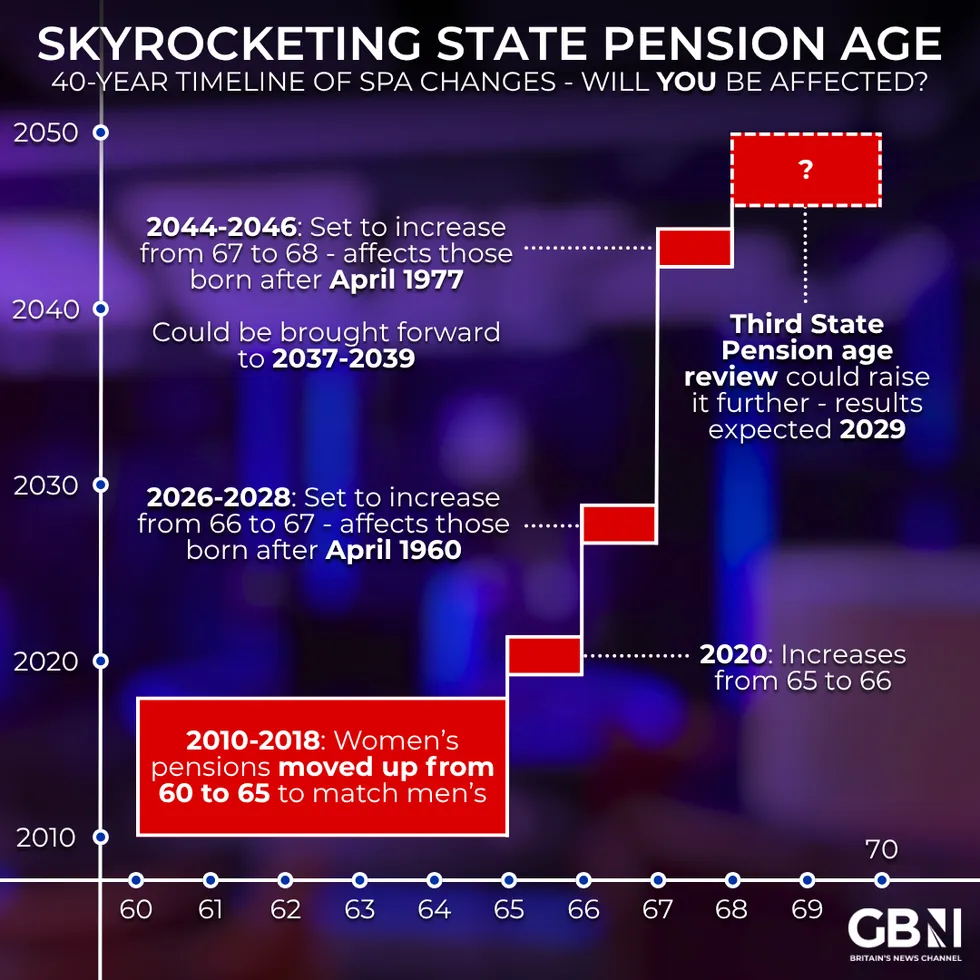

Are you affected by state pension age changes? | GETTY

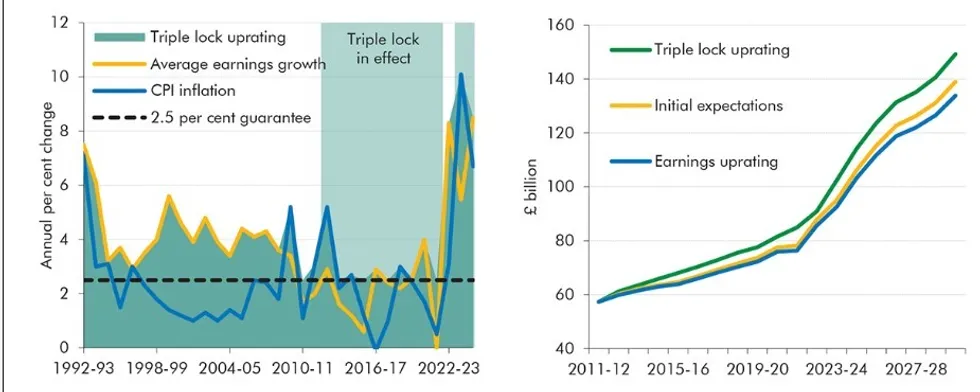

What has the impact of the state pension triple lock been on the public’s finances | OBR

Some workers were wrongly told they would receive the full amount and had no need to pay further National Insurance contributions.

Those who have been misled can now make lump-sum payments of up to £907 annually to fill gaps in their record, with the option to backdate contributions as far as 2006 . Normally, voluntary payments are restricted to the previous six years.

Sir Steve Webb, the former pensions minister who now works as a partner at consultants LCP, warned that not all affected individuals would have the financial means to address the shortfall.

He said: “When people request a state pension forecast to use as the basis for their retirement planning, they should be in a position to be confident that the information they have received is accurate. But in too many cases, it seems that this was not so.”

HMRC is understood to be ‘working’ to ensure no tax is paid on state pensions for certain Britons | GETTY

Speaking to The Telegraph, pensions expert Tom McPhail described the lengthy delay in addressing the fault as indefensible.

Mr McPhail said: “Forecasting and planning your retirement income is absolutely critical for most people. If the state is providing misleading information, then it’s impossible to make an accurate plan.

“Some of this is pretty complex, so things can go wrong and systems can be amended. But if they’ve known about it for years, people need accurate information. There’s no justification or excuse for not having fixed the problem yet.”

HMRC stated it cannot determine precisely how many people remain affected but confirmed it would permit those given misleading forecasts to make voluntary top-ups from the date they received incorrect information.