Britain’s stock market benchmark index surged to a new record earlier today, breaking through the 10,400-point barrier as money flowed out of technology and software shares into alternative sectors.

The Ftse 100’s gains came against a backdrop of turmoil in global tech markets, with European bourses posting mixed results following overnight losses that swept through Asian exchanges.

Wall Street’s software sector has borne the brunt of recent selling pressure, with the nine worst performers in the S&P 500 so far this year all coming from software and related services industries.

Each of these companies has shed at least 25 per cent of its value. The selloff was triggered by Anthropic, the artificial intelligence startup behind the Claude chatbot, unveiling new tools capable of performing legal work traditionally handled by paid database services.

The Ftse has risen to a new height once again

|

GETTY

Fears that artificial intelligence could rapidly consume the business models of established software firms sent shockwaves through markets worldwide.

Asian technology shares bore heavy losses, with Chinese software group Kingdee International plunging more than 12 per cent.

Indian IT giants were similarly hammered, as Tata Consultancy Services dropped 7 per cent while Infosys tumbled 7.5 per cent.

The rout reflected growing anxiety that data analytics providers serving lawyers, banks and corporate clients face an existential threat from accelerating AI capabilities.

Concerns have been raised over a potential stock market “bubble” | GETTY

The City of London is happy with the stock market’s peformance | PA

Accountancy software provider Sage saw its shares fall more than three per cent, while the London Stock Exchange Group dropped 4.6 per cent.

RELX, which maintains a substantial presence in the legal information sector, slipped one per cent after finding itself at the centre of Tuesday’s storm when it endured double-digit losses alongside other data firms.

Worryingly for these companies, Wednesday brought no respite. Bargain hunters showed no appetite to buy into the weakness, leaving shares of RELX, London Stock Exchange, Rightmove and Sage without any meaningful recovery.

Ipek Ozkardeskaya, senior analyst at Swissquote, broke down how the recent developments in the AI market have impacted the current trajectory of the Ftse 100.

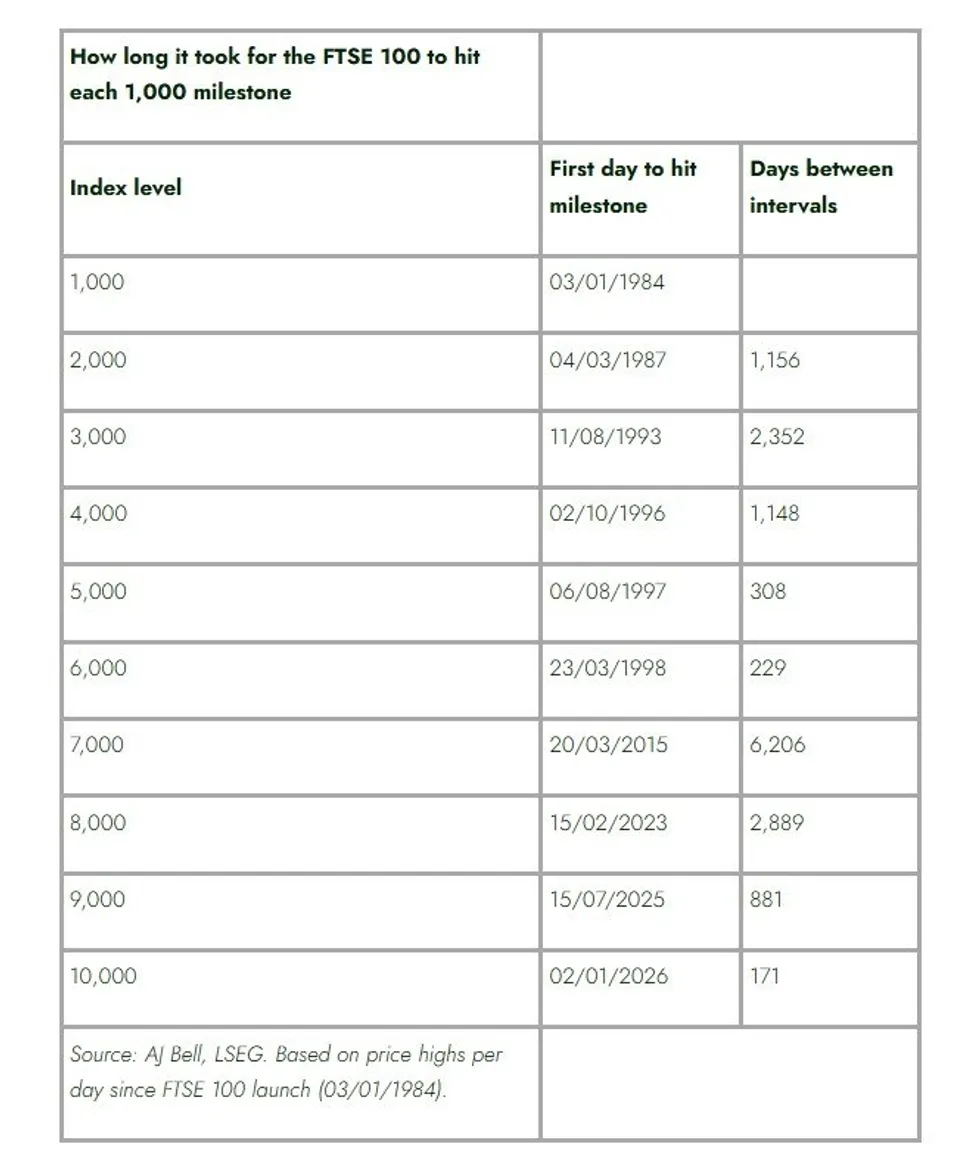

How long has it taken for the Ftse to reach every 1,000 mark? | AJ BELL

Ms Ozkardeskaya shared: “The relief that came with the easing selloff across the metals space lasted until news broke that Anthropic, an AI startup backed by Amazon and Google, had rolled out a new AI tool designed to handle legal and research work traditionally done using paid databases.”

She added: “The announcement spooked markets, triggering a sharp selloff in software companies that sell data analytics and decision-making tools to lawyers, banks, and corporates, on fears that AI and new players are coming for their lunch and at an accelerated pace.”

Dan Coatsworth, head of markets at AJ Bell, noted: “To what extent AI can disintermediate traditional data analytics and software firms is not yet clear, but a lot of investors weren’t sticking around to find out.

“The market wasn’t troubled by guidance for a dip in annual earnings at SSE, instead focusing on the more significant news that its massive multi-year investment programme is on track. Delivering on this programme and its associated growth potential is far more relevant than a single year’s earnings per share.”