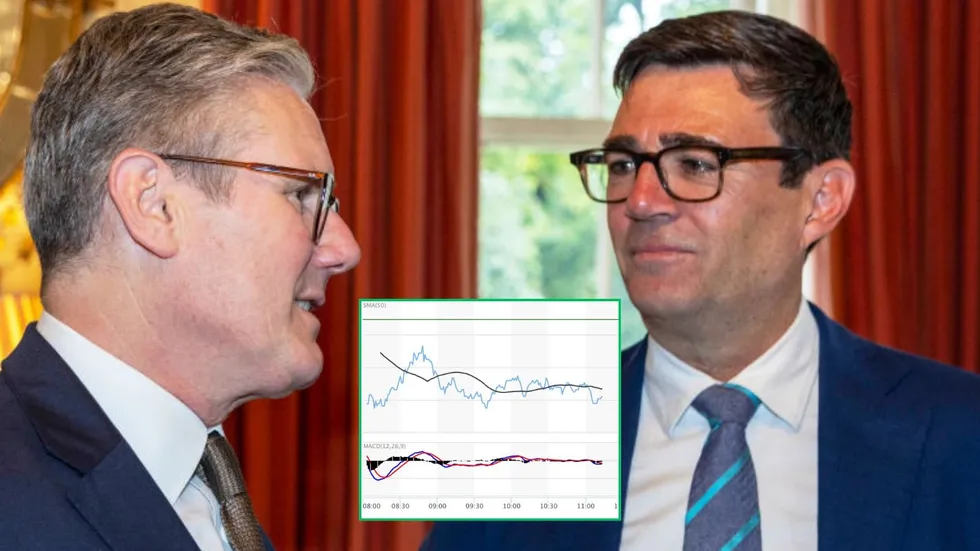

Government borrowing costs eased on Monday after Labour’s National Executive Committee blocked Andy Burnham from contesting a parliamentary by‑election, removing a source of political uncertainty that had unsettled gilt markets at the end of last week.

The yield on 10‑year UK government bonds fell to 4.47 per cent in early trading, down from Friday’s peak of 4.51 per cent.

Markets had viewed his potential candidacy as a possible stepping stone to a future leadership challenge against Sir Keir Starmer, prompting concerns about political instability at the top of Government.

British gilt yields rose faster than those of other major economies after news of Mr Burnham’s possible candidacy emerged.

Investors were unsettled by his previous comments that governments should not be “in hock” to the bond market — remarks interpreted by some as signalling a looser approach to fiscal discipline.

Fears that such a stance could lead to higher borrowing and increased public spending contributed to Friday’s sell‑off.

Gilt yields fall as Labour move reduces leadership uncertainty

|

GETTY

Andrew Wishart, senior UK economist at Berenberg, said political uncertainty had been the key driver of market moves.

He said: “A leadership challenge to Starmer would likely see investors demand a higher risk premium for holding UK bonds.

“It could result in a new leader who abandons the Government’s plan to reduce the budget deficit.”

He added that looser fiscal policy would raise concerns about inflation and long‑term sustainability.

Keir Starmer’s deputy Labour leader Lucy Powell reportedly voted to allow Mr Burnham to stand

|

PAJason Borbora‑Sheen, portfolio manager at Ninety One, said Monday’s market reaction reflected short‑term relief.

“The market is experiencing short‑term relief on the view that Burnham is less likely to be able to challenge Starmer,” he said.

Yields on newly issued government debt fell across maturities during Monday’s London session, with analysts saying the move reflected a partial unwinding of Friday’s political risk premium.

Mr Wishart said blocking Mr Burnham removed “one outcome that would make the bond market nervous”, though he stressed that Labour had limited room for manoeuvre regardless of leadership outcomes.

“Labour cannot afford a bond market accident,” he said, adding that any future leader would face resistance to higher borrowing unless matched by tax rises.

Jim Reid, analyst at Deutsche Bank, said gilts had seen “relative relief” but warned the issue was not resolved.

He said markets remained highly sensitive to political developments within Labour, with leadership speculation likely to continue ahead of local elections in May.

Mr Wishart said it was “more likely than not” that Sir Keir would be replaced after those elections, and that any transition would be closely scrutinised by investors.

Gilt yields jumped in a similar way last July after Rachel Reeves appeared in the Commons, triggering investor jitters over the Chancellor’s potential removal

|

GETTYThe episode underlined how sensitive UK borrowing costs remain to political uncertainty.

A similar reaction occurred last July when gilt yields rose sharply following a Commons appearance by Rachel Reeves, amid investor concern that the Chancellor could be removed.

Yields later retreated after Sir Keir publicly reaffirmed his support for her.

Market participants said the latest moves showed how quickly political headlines can feed into gilt pricing.