Chancellor Rachel Reeves’s proposed reforms to the ISA regime have come under fire as rumoured tax penalties could result in million of Britons opting to “delay investing” in the years ahead.

Investment experts are cautioning that proposed modifications to ISA rules risk compounding the effects of the cash ISA allowance reduction by introducing unnecessary complexity for those new to saving and investing.

Last year’s Budget from the Chancellor confirmed a cut in the cash ISA limit from £20,000 to £12,000 for under-65s, with stocks and shares ISAs also set to be overhauled by the Treasury.

This prompted discussions last week between HM Revenue and Customs (HMRC), savings providers and City representatives about the future direction of these tax-efficient accounts.

The Chancellor’s ISA reforms are being criticised

|

GETTY

Justin White, the chief operating officer at investment app Kaldi, has raised concerns that a series of regulatory changes could leave inexperienced investors bewildered rather than empowered.

He contends that policymakers’ intentions to boost investment participation are sound, but the execution may prove counterproductive down the line once reforms are implemented.

Mr White specifically highlights concerns about plans to reassess whether money market funds and similar products are too “cash-like” for inclusion in stocks and shares ISAs.

He argues that such restrictions could undermine savers who use lower-risk investments as a gateway into markets after exhausting their reduced cash ISA allowance.

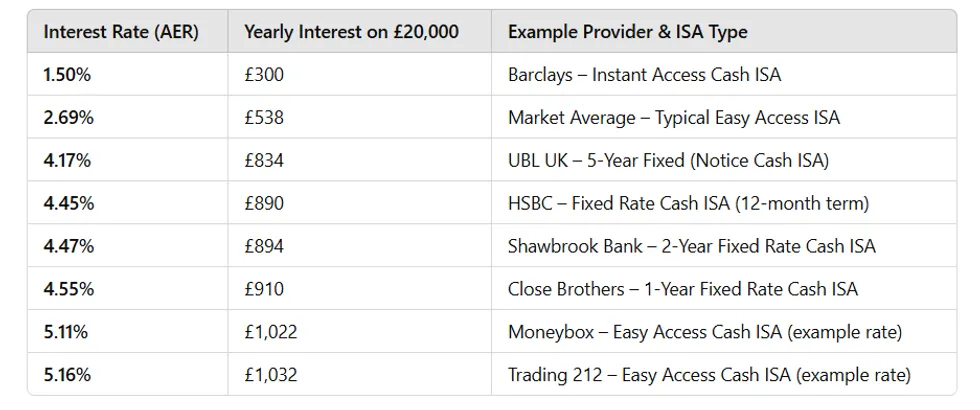

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBN

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBNHe maintains that closing the investment gap requires the Government to prioritise education, clarity and flexibility to accompany any incentives rather than being undermined by them.

Mr White added: “People need to be incentivized or given a catalyst to invest, which this proposal addresses.

“But, introducing complexity and reducing flexibility around movements from stocks and shares ISAs to cash ISAs, removing cash like investments and applying penalties to parking cash in stocks and shares ISA it increases confusion for novice investors rather than empowering them and creates another reason to delay the start of their investing journey.

“This proposal, in order to prevent parking of cash, risks defeating its larger purpose of encouraging investment, particularly early investment, which is so vital. If we want to close the investment gap, education, clarity, flexibility and confidence need to sit alongside incentives; not be undermined by them.”

Is the Bank of England cutting interest rates fast enough? | GETTY

Is the Bank of England cutting interest rates fast enough? | GETTY The looming reforms to ISA come amid wider changes to the savings market, with interest rates likely to plummet in response to the Bank of England’s base rate decisions.

Caitlyn Eastell, a personal finance analyst at Moneyfacts, notes that December’s base rate cut has already triggered falls across all average savings rates for the first time in more than six months

.”The number of accounts paying above base rate saw its biggest rise on record to 877, accounting for just under 40 per cent of the market. However, this means that over 60 per cent still don’t match base rate, leaving savers’ cash languishing and making it harder to build financial security,” Ms Eastell explained.

She anticipates interest rates settling between 3.25 per cent% and 3.50 per cent, levels last seen in December 2022, which will affect the deals offered to savers from high street banks.

Britons are looking for the best savings deals | GETTY

Britons are looking for the best savings deals | GETTYAt the start of this year, the Moneyfacts Average Savings Rate stood at 3.35 per cent, compared to approximately 2.80 per cent when rates were last at similar levels in late 2022.

The approaching new tax year represents the final opportunity for savers under 65 to take full advantage of the £20,000 cash ISA allowance before the reduction takes effect.

However, Ms Eastell cautions against adopting a wait-and-see strategy during ISA season.

Major banks currently offer just 1.53% on easy access cash ISAs, potentially leaving savers £450 worse off compared to placing their full allowance in an average one-year fixed cash ISA.