Britons are being reminded that “investing could help meet long-term goals” when it comes to finances ahead of a looming tax on savings from Chancellor Rachel Reeves next year.

During the 2025 Budget, the Chancellor confirmed the tax-free allowance attached to cash ISAs will be reduced from £20,000 to £12,0000 from April 2027 for under-65s, with reports suggesting the Treasury is exploring reform to the stocks and shares ISA regime.

As it stands, Britons can deposit up to £20,000 tax-free annually into ISA products, including cash ISAs with a set interest rate similar to a traditional savings account, and stocks and shares ISAs which see returns linked to market performance.

Savers can also place up to £4,000 into lifetime ISAs, which are considered savings vehicles for prospective first-time homebuyers. A 25 per cent bonus is added to the account

The Chancellor is rumorued to be considering further ISA reform

|

GETTY

It is understood that HM Revenue and Customs (HMRC) is floating a 22 percent flat-rate charge on any interest earned on cash holdings held in stocks and shares ISAs, Politico reports.

Investment platforms have criticised the Chancellor’s rumoured plans, asserting that it goes against her previous claims of wanting to improve retail investing in the UK.

Stephen McGee, the CEO at Scottish Friendly, claimed that the rumoured changes to the ISA regime could encourage Britons to adopt traditional investing options through funds and sector portfolios.

He explained: “We welcome the Government’s focus on encouraging more people to invest. While this proposal may not be popular with some savers who hold cash within their investment ISAs, it should be seen as part of a broader effort to prompt greater engagement with long term investing.

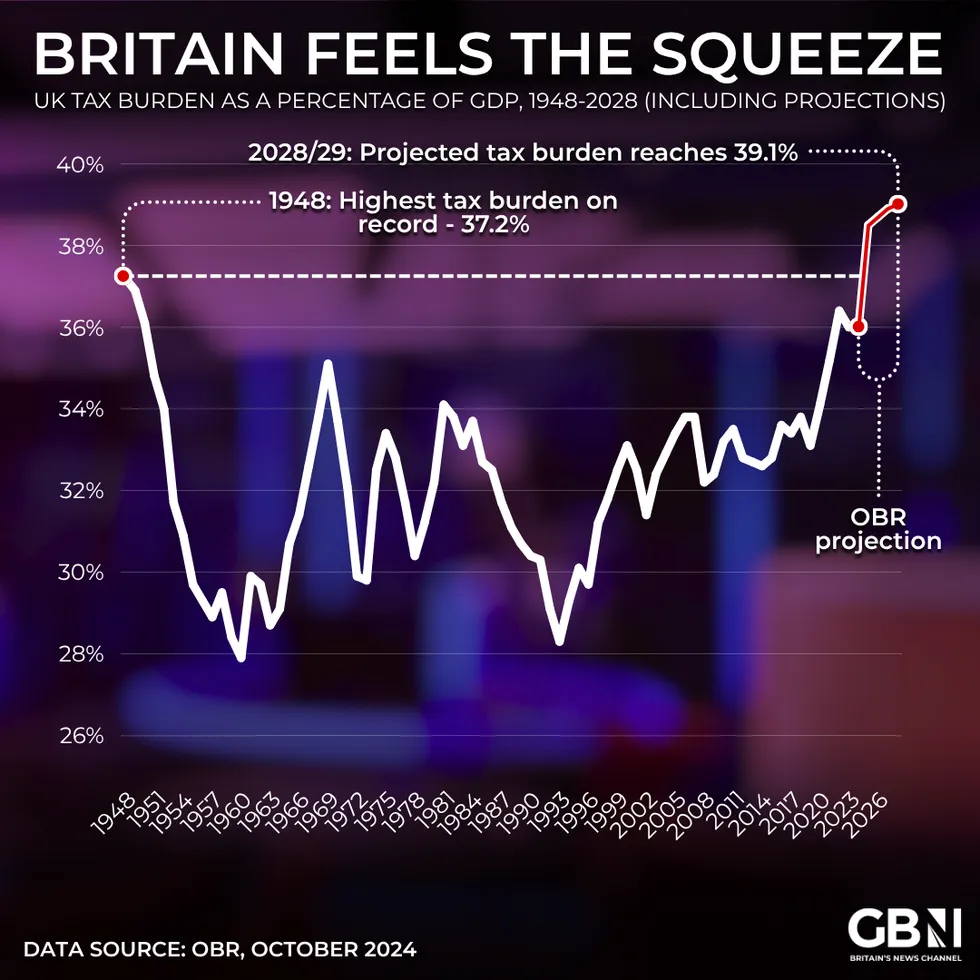

UK tax burden as a percentage of GDP | GB News

UK tax burden as a percentage of GDP | GB News“Too many savers remain heavily weighted towards cash by default, even within investment ISAs that are designed to support growth over time. Reforms like this can act as a prompt for people to review how their money is held and whether investing could play a greater role in helping them meet their long-term goals.”

The chief executive added: “Cash will always have an important part to play in a balanced financial picture, particularly for managing short-term needs, risk, and market volatility.

“That is why it is essential these changes are introduced with clear guidance, sensible carve-outs and enough time for savers to adapt, especially where cash is held temporarily as part of an investment strategy.

“That being said, if handled well, these proposals could provide a useful nudge that helps to normalise investing, increase engagement with savings decisions, and support better outcomes for savers over the long term. For those reasons, the direction of travel should be welcomed.”

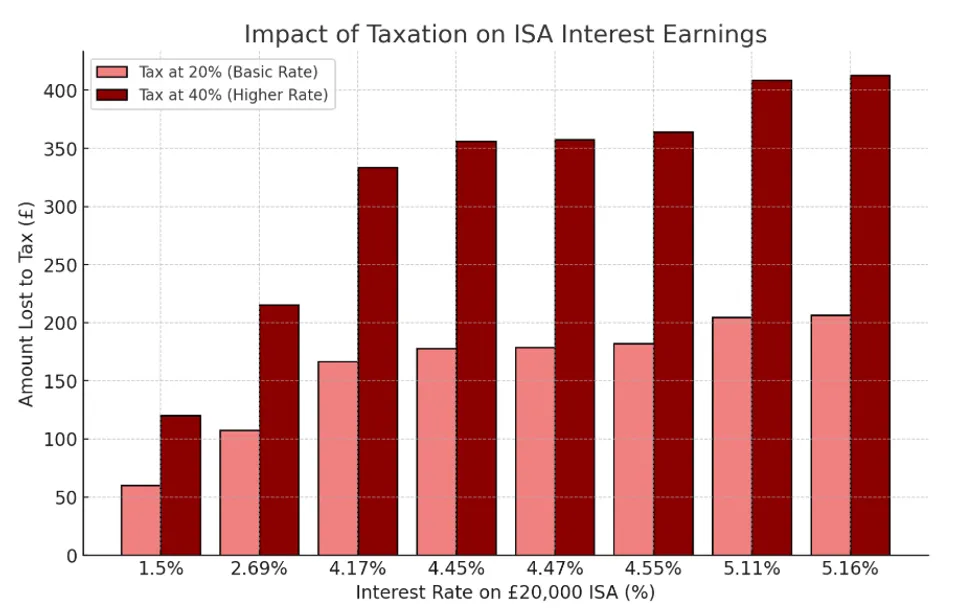

How much you could lose if Isa earnings were subject to income tax, broken down via interest rate and tax bracket | GBN

How much you could lose if Isa earnings were subject to income tax, broken down via interest rate and tax bracket | GBNSenior executives from Lloyds Banking Group and Hargreaves Lansdown gathered with Treasury and HMRC representatives last week to discuss the looming ISA overhaul.

Those present expressed concern that the reforms were being pushed forward too quickly, without adequate consideration of how ordinary investors actually manage their money.

Industry sources suggested the changes could backfire, potentially deterring savers from putting money into British businesses rather than stimulating domestic investment.

Ms Reeves has argued these measures are designed to channel more savings towards British companies and bolster economic growth. However, Treasury officials are simultaneously developing what they describe as anti-circumvention provisions aimed at stopping savers from sidestepping the new restrictions.

ISAs are popular savings tools

|

GETTYAmong the measures under consideration is a prohibition on moving funds from stocks and shares ISAs back into cash accounts. One attendee at Tuesday’s discussions offered a stark assessment of the Government’s approach to the reforms.

“It became abundantly clear at the meeting today that significant reforms to ISAs are being made on the hoof with little understanding of how retail investors behave or the extent of potential unintended consequences,” the source told Sky News.

A Government spokesperson said: “To encourage greater investment in stocks and shares, we’re developing changes to ISA rules which will prevent circumvention of the new lower cash ISA limit.

“We’re already working closely with industry and will publish clear guidance before the changes come into effect.”